263: Certain vs Uncertain, Constellation Software Capital Deployment 2015-2022, Netflix Ads?, Robots as a Service (RaaS), U.S. Nuclear Power, and Billie Eilish

"Not if they do it right."

To make something good, just do it.

To make something great, just re-do it, re-do it, re-do it.

The secret to making fine things is in remaking them.

—Kevin Kelly

👴🏻 💡 I was listening to Modest Mouse’s most recent album, and there’s a song where the chorus is:

It takes a lifetime to ever figure out that

There ain't no lifetime that's ever figured out

...

these are some places that we're lucky just to be between(the whole track is basically a slow buildup/crescendo — someone made a video for it with scenes from Miyazaki’s Totoro)

Let’s assume that certain realizations/insights/breakthroughs typically come to people around a certain age, after a certain amount of experience and/or historical perspective.

f.ex. Around 25 you figure certain things out, different ones around 50, others at 80...

Then what about those ‘ah-ha!’ moments at ages that we almost never reach, like at 110, or others that are still out of reach to humanity at 150 or 250? I can’t imgine that if someone lived that long — with a healthy mind & body — that they wouldn’t gain wisdom that is almost impossible to acquire in a much shorter period 🤔

🛀 Even if you're not better than anyone else at XYZ, if you improve at the same rate as everyone else and just do it 3-5x as long, it'll seem like you're “talented” at it ¯\_(ツ)_/¯

❓🙋♀️🙋♂️ Question for you:

Would you be interested in some type of channel (like on Slack or Discord) where readers of the newsletter could meet each other and chat?I’m constantly blown away by how smart and nice and generous and curious readers of this steamboat 🚢 are, but it’s very difficult for me to get readers to connect with each other.

I try to feature good feedback in the newsletter, which turns it somewhat into a 1-to-many conversation rather than a pure broadcast, but it’s still not a many-to-many exchange.

I feel like if some of you reading this got to know each other, you’d develop friendships, have great conversations, learn stuff, have fun, laugh, cry, get married, whatever (👰🏻♀️🤵🏼♂️).

There’s a bit of that going on in the comments, but most readers read via email and never see the comments…

So the idea has been swirling around my head for a while — and was recently rejuvenated by friend-of-the-show and supporter (💚 🥃) Nick Zaharias — that maybe it would be cool to create a little space where readers can find each other.

Some kind of virtual clubhouse (🍻🍸☕️ 🥃 🥂🥛🥤), if you will, except totally *not* the app Clubhouse.

Does that sound appealing to you? Any strong feelings one way or the other? Please let me know by replying to this email or in the comments here:

🪴 Sometimes you have to re-pot yourself, like a plant with roots that have grown too big for the pot it’s in.

It’s a scary, disruptive process, but you’ll be better off on the other side of it. 🌳

(h/t this is largely inspired by something Merlin Mann said)

💚 🥃 If you’re not a paid supporter yet, hopefully this is the edition that makes you go:

“Hey, I think I want to support what he’s doing here.”Thank you for that! 🤠

A Word From Our Sponsor: ⭐️ Tegus ⭐️

What makes a great investor isn’t pedigree or diplomas 🎓, it’s quality thinking and information 🧠

Tegus can’t provide the thinking for you, but on the information front, they’ve got you covered! 📚

With 25,000+ primary source expert calls covering almost any industry or company you may want to learn about, and the ability to conduct your own calls with experts, if you so choose, at a much lower cost than you’ll find elsewhere (70% lower than the average cost of ˜$400), this is the service to turbo-charge the depth and breadth of your knowledge 📈

⭐️ Get your FREE trial at Tegus.co/Liberty ⭐️

Investing & Business

🧠 Small-but-certain vs Large-but-uncertain victories 🤔

I’ve written about this a few times, but I don’t tire of examining this phenomenon.

I keep noticing how good small-but-certain victories feel for me, even versus much larger ones that are uncertain.

A good example of this is how much I enjoy buying a huge 4-gallon container of dishwashing soap, or a 1-gallon jug of shampoo. It must be because the math is simple and I can see that it’s 40% cheaper or whatever than if I bought the regular consumer size.

Same with this carbon steel pan from the Costco Business Center (which targets mostly SMBs, but any Costco member can go) for $23 CAD while most 12-inch carbon steel pans that I can find elsewhere are at least twice that, if not more.

It’s a small dollar amount saved, but the fact that I can be *certain* about it makes a difference vs buying a stock that I think is *probably* undervalued, and there’s never a single moment when you’re revealed to be correct, as you usually can’t know *for sure* what is causing price movements.

Constellation Software Capital Deployment: 2015-2022Q1

This is the part where I shamelessly plug the podcast I did with MBI on Constellation.

h/t friend-of-the-show C.J. Oppel

📺 📢 Should Netflix sell ads? 🤔

Ben Thompson (💚 🥃 🎩) has a good new piece where he makes a case for Netflix to offer an ad-supported tier to better monetize the attention it commands, which would allow it to better double-down on what it does best (rather than focus so much on all kinds of horizontal expansion ideas, like games — which may work, but are a tougher sell).

First, an advertising-supported or subsidized tier would expand Netflix’s subscriber base, which is not only good for the company’s long-term growth prospects, but also competitive position when it comes to acquiring content. This also applies to the company’s recent attempts to crack down on password sharing, and struggles in the developing world: an advertising-based tier is a much more accessible alternative.

Second, advertising would make it easier for Netflix to continue to raise prices: on one hand, it would provide an alternative for marginal customers who might otherwise churn, and on the other hand, it would create a new benefit for those willing to pay (i.e. no advertising for the highest tiers).

Third, advertising is a natural fit for the jobs Netflix does. Sure, customers enjoy watching shows without ads — and again, they can continue to pay for that — but filler TV, which Netflix also specializes in, is just as easily filled with ads. [...]

This, I will note, is an about face for me; I’ve long been skeptical that Netflix would ever sell advertising, or that they should. [...] I’m not convinced, though, that customers appreciate or care about the differentiation that Netflix claims to be leveraging in gaming, whereas they would appreciate lower prices for streaming, and already have the expectation for ads on TV.

I’m sure Jeff Green, the founder & CEO of The Trade Desk and one of the pioneers in programmatic connected-TV advertising, will crack a smile and nod along!

He’s been arguing for years that someday Netflix would have ads — because the business model would eventually push them in that direction, when all the of the early-part-of-the-S-curve growth starts to slow down while content costs keep ballooning and competition becomes fiercer.

The way *I* look at it is pretty simple:

Would ads on Netflix take anything away from anyone?Not if they do it right. If it’s purely additive and they keep the ad-free paid tiers around, who’s losing anything?

So it’s purely a gain: for those who couldn’t afford Netflix, or were marginal subs who were going to churn out and leave the service entirely (and now can stick around as ad-supported customers), or in countries where incomes are lower and it’s harder to justify paying a monthly fee, etc.

And the beauty here is that even paid subscribers who never even see an ad (👀) can benefit from this, because the revenue stream from the ads ends up in the same bank account, and helps finance more original content, more licensed content, better infrastructure and innovation, etc.

So as a customer, you get more and better shows without having to change anything. Seems win-win to me!

(I understand the psychological aspects of such a change, and it’s the most credible argument against that I’ve seen, but despite that, it may still be worth the trade-off)

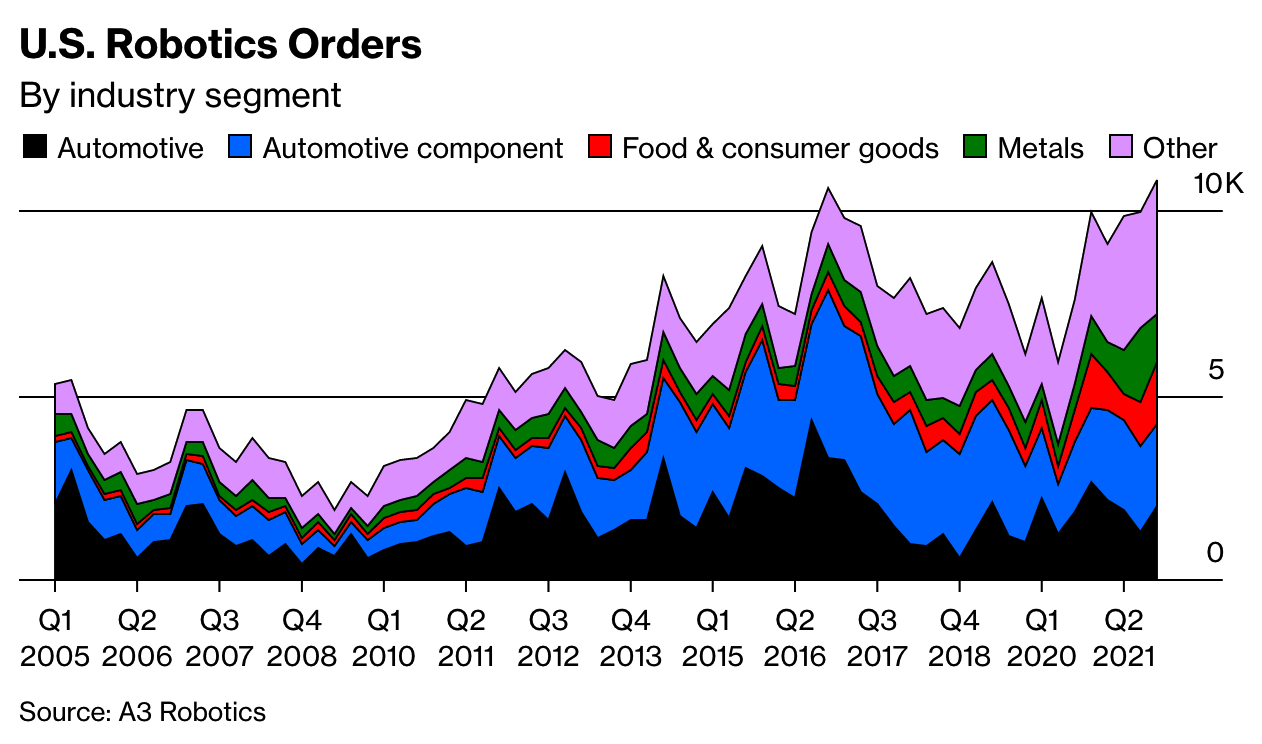

🦾🤖 Robots as a Service (RaaS)

The robots are coming—and not just to big outfits like automotive or aerospace plants. They’re increasingly popping up in smaller U.S. factories, warehouses, retail stores, farms, and even construction sites.

The pandemic has kicked orders for robots into high gear as companies deal with a labor shortage, rising wages, and a surge in demand for their products. U.S. robot orders jumped 28% in 2021 from the previous year, to an all-time high of almost 40,000 units

But robots are expensive, and if they are to become popular in industries that can’t make huge upfront capital investments… Well, how about the software model?

a nascent trend of offering robots as a service—similar to the subscription models offered by software makers, wherein customers pay monthly or annual use fees rather than purchasing the products—is opening opportunities to even small companies.

That financial model is what led Thomson to embrace automation. The company has robots on 27 of its 89 molding machines and plans to add more. It can’t afford to purchase the robots, which can cost $125,000 each, says Chief Executive Officer Steve Dyer. Instead, Thomson pays for the installed machines by the hour, at a cost that’s less than hiring a human employee—if one could be found, he says. “We just don’t have the margins to generate the kind of capital necessary to go out and make these broad, sweeping investments,” he says. “I’m paying $10 to $12 an hour for a robot that is replacing a position that I was paying $15 to $18 plus fringe benefits.” (Source)

h/t friend-of-the-show and OG supporter (💚 🥃 🎩) Nick Ellis

What matters when investing depends on your holding period 🕰 💸 (duh)

Friend-of-the-show and supporter (💚 🥃) John Huber quoted Nick Sleep in a new blog post, and I think it’s worth highlighting — as I sometimes say, almost all the important things in investing are simple, but they’re difficult to execute, and they’re hard to keep top of mind, so it’s good to refresh our memories once in a while:

One thing Sleep wrote a lot about is how the average holding time period for many of the stocks he owned was around 50 days, whereas he planned to hold these stocks for more than 250 weeks (5 years). I think his key observation is important: The marginal buyer who is holding a stock for 2 months is not placing much emphasis on that company’s competitive advantage because that advantage won’t matter much at all over the next few months; what matters over that period of time are things like market perception, news flow, sentiment, and perhaps short-term business momentum.

This is so true. If you’re going to constantly churn in and out of positions, doing a ton of deep fundamental analysis probably won’t help you much. I mean, it’s still positive, and if you end up stuck in a position for a long time, at least you’ll better know what you own.

But if your goal is to move on quickly, then it’s other factors that will be much bigger determinants of your returns than whether you truly understood the competitive dynamics in the industry or the reinvestment opportunities.

All that stuff takes time to play out, the metabolic rate of business isn’t *that* fast.

Science & Technology

How Russians are trying to bust out of the new digital iron curtain

The cat & mouse games VPN companies will play vs the Kremlin will be epic. They’re doing important work, though, and I wish them the best.

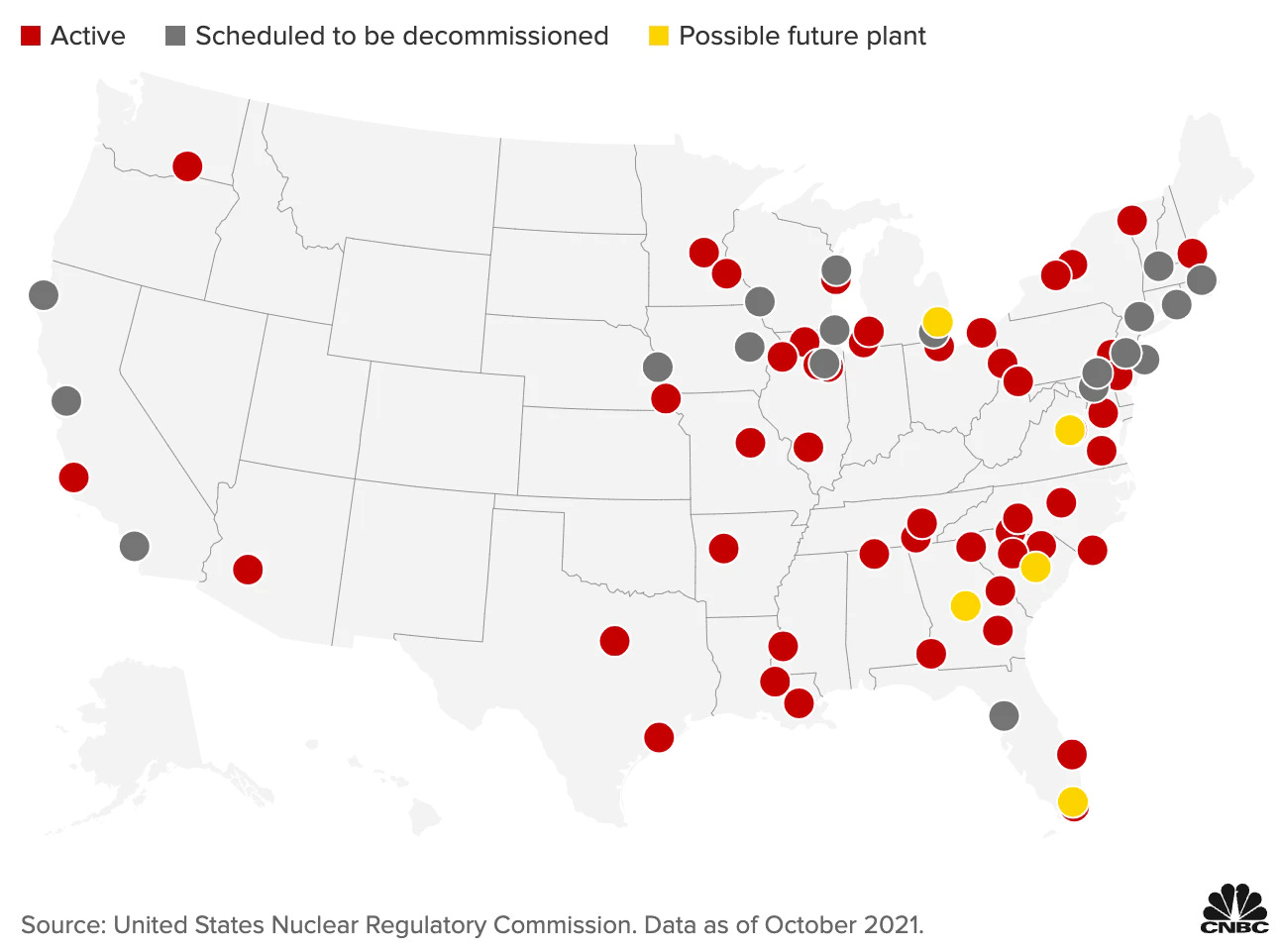

☢️ Map of US Nuclear Power Plants ☢️

According to the US EIA, nuclear power currently accounts for 18.9% of US electricity generation. For scale (banana for scale? 🍌), all renewables together produce about 20.1%, and coal also produces about 21.8% in the US.

There are 93 commercial nuclear reactors operating in the United States at 55 locations in 28 states. The majority of nuclear reactors are in the eastern portion of the U.S.

Currently, 25 reactors are in some phase of decommissioning.

There are also licenses approved for another eight nuclear reactors to be constructed in the U.S. However, only two of those reactors, units 3 and 4 at the Vogtle plant in Georgia, are currently under construction (Source)

In a saner world, there would be a lot fewer gray dots on that map, and more yellow ones, but sadly, we’re not there (yet?).

The Arts & History

‘Billie Eilish: The World's a Little Blurry’ Documentary (2021)

I saw this not knowing that much about Eilish. I enjoyed her second album, and think a few of the tracks are amazingly well-crafted bundles of emotions and musical textures. I had recently been discovering her third album. But I knew almost nothing about her as a person.

This documentary was excellent.

They really give the footage time to breathe.

There’s home videos from her family, recording her album at home with her brother, the launch and the ups & downs after it’s released, touring the world (she’s incredibly hard on her body, basically destroying her ankles jumping around on stage)…

Quite the arc, being a fly-on-the-wall as a teenage artist blows up and becomes a huge star.

Once the credits roll, you know them and it feels a bit like at the end of a book when you wish you could keep getting updates on these characters. It’s not cut like a promo video — there’s some ‘glamour’ footage, but also plenty of real moments that are less flattering.

I’ve always been fascinated by creative collaborations, and I love that they focus on how she creates with her brother.

I also love that they left the Tourette's syndrome stuff in.

I had no idea she had TS, and think it helps to demystify it. There’s a scene showing her having a bunch of tics when she’s tired, and it’s just a fact of life, nothing to be ashamed of. A few years ago, publicists would have hidden it, to no one’s benefit.

Her Wikipedia page says she has synesthesia (which I have too), but it’s not really mentioned in the docu.

This isn’t from the documentary, but it’s a neat self-contained vignette showing how much work and thought goes into a song, and gives you a taste for the film:

A slack or discord channel feels right to me.

Not sure how accurate the nuclear graph is. I see the source but it seems misleading. I grew up just a few miles from Millstone, the nuclear plant in CT. It's been scheduled for decommissioning for decades. Yet there's no alternative so it's perpetually renewed despite a less than stellar safety record. Most recently about a decade ago it was given a multi decade extension.