273: Microsoft Q1, Twitter's Oops, Coke vs Pepsi, Apple M1 Ultra, Crypto Rule-Hacking, Electricity Map, AMA Podcast, and Automatic Painting

"a download of your thoughts over a beer"

Some things in life are more important than being happy. Like being free to think for yourself.

—Jon Krakauer

🎧 🗣🎙🍺 I pressed “publish” on the Ask Me Anything #2 podcast yesterday:

I expected to record each question separately, stopping the recording each time to have time to think about what I wanted to say, but I ended up doing the intro, and then doing all the questions in one take.

Once things are going, keep the momentum!

Friend-of-the-show and podcaster extraordinaire David Senra (🎙📚) gave my favorite feedback:

…it sounds like a free flowing conversation. Like a download of your thoughts over a beer.I love that because it’s what I’m going for. Conversational, informal, friendly…

🛀 🏴☠️ 💻 💰 I wonder what kind of personal cyber-security measures most billionaires and CEOs/CFOs use on their home computers.

Like, Elon Musk and Max Levchin are probably doing well there, but a lot of these people aren’t technologists. There’s probably a lot of non-public material information that ends up on their hard drives (and not necessarily company files, there’s all kinds of other ways that useful information can end up there)…

I wonder how many seemingly inexplicable big market moves are caused by someone getting in through malware or hacking the email of some CEO/CFO/billionaire and finding valuable information, and nobody ever learns about the hack…

We’ll never know the extent of this, but it’s interesting to think about ¯\_(ツ)_/¯

🤔 Sometimes, it feels like some great businesses are hidden in plain sight.

My wife recently bought plastic covers for bathroom ceiling fans, and they were like $25 CAD. For a piece of molded plastic that probably costs 15 cents to make!?! 😲

What’s the margin on that, I wonder? 🫤

Seems like the kind of thing where competition should’ve brought prices down close to zero, but for some reason, these parts all seem to be priced around the same.

Is there a bathroom fan cover cartel that I’m not aware of?

💚 🥃 I can’t believe it, it’s my birthday in a few days. I’m turning 40. 🎂

On one hand, it’s just another day. We all age by 24 hours every day. ⏳

But it’s still weird — where have all those years gone? Seems like yesterday that I was in high school, wondering where I would end up in this great big hazy future in front of me…

If you want to get me something for my birthday, it’s simple: What I really want is to keep writing for you, because it’s fun, and the best way to give me that is by becoming a supporter.

It’s inexpensive and quick. Thank you! Have some 🍰

🧩 A Word From Our Sponsor: Heyday 🧠

Do you have 100+ browser tabs open right now? 😬

Give your memory a boost with Heyday, the research tool that automatically saves the content you view and resurfaces it within your existing workflows. 👩💻

It’s like cheat codes for your memory. 😲💡

🧩 Give your memory a boost today 🧠

Investing & Business

🥤Sugar-Water-Dot-Com 🫧

Kinda weird that Pepsi didn't participate in the 2000 bubble the way Coke did 🤔

Does anyone remember what was the common explanation at the time (if any)? Or is it just “one of those things” ¯\_(ツ)_/¯

Chart via chartr. KO 0.00%↑ PEP 0.00%↑

🔥 Microsoft Q1 Highlights 🔥

Ok, Azure grew 49% in constant currency (46% with the FX headwind). That’s kind of crazy at that scale! MSFT 0.00%↑

The more time passes, the less surprised I’ll be if Azure becomes bigger than AWS at some point… (Update: in Q1, AWS grew 37% ex-FX)

Free cash flow hitting $20bn in a single quarter, up 17% year-on-year!

Highlights from the call:

Cosmos DB transactions and data volume increased over 100% year-over-year for the third quarter in a row. Synapse data volume more than doubled year-over-year [...]

In AI, we continue to see strong usage of Azure machine learning. The number of monthly inference requests increased 86% year-over-year

🤖 These are not tiny businesses… (I wish they broke out the numbers the way they did with security last Q)

Power Platform surpassed $2 billion in revenue over the past 12 months, up 72% year-over-year, making it one of the fastest-growing businesses at scale. Power Apps is the market leader in low-code, no-code app development, and Power BI has more than 200,000 customers.

🦾 Making more on low-code/no-code than anyone else I can think of 🤔

Our Game Pass library now includes hundreds of titles across PC and console, including more games from third-party publishers than ever before. Billions of hours have been played by subscribers over the past 12 months, up 45%.

Funny how, thanks to subscriptions, gaming may turn into a Netflix-like kind of dynamic, where it’s about engagement, hours spent on the service, and finding ways to pretend churn with targeted releases and exclusive blockbusters. 🎮

Here’s Satya on demand for Azure services and the impact of macro/inflation:

I don't hear of businesses looking to their IT budgets or digital transformation projects as the place for cuts. If anything, some of these projects are the way they're going to accelerate their transformation or, for that matter, automation, for example. I have not seen this level of demand for automation technology to improve productivity because in an inflationary environment, the only deflationary force is software.

Big picture:

I mean, none of us here are trying to forecast macro. So all we think of is the TAMs that we are competing in are large. As a percentage of GDP, tech spend is, on a secular basis, by the end of the decade, going to double. We just want to keep driving usage, driving share and be competitive [...]

there's still a lot of that TAM left to go after. And it is quite early still in the transitions you're talking about from a digital transformation perspective, from an automation perspective, from type of value and real productivity enhancements that can be made

🌊

🐦 Oops, Twitter ‘accidentally’ over-counted active users… for more than 3 years

Oopsy-daisy, I guess ¯\_(ツ)_/¯

Twitter also said it accidentally over-counted the number of monetizable daily active users because of a feature that allowed people to link multiple separate accounts together in order to conveniently switch between them. It counted those two separate accounts as two users for more than three years.

This isn't the first time Twitter has admitted to over-counting its user base. In 2017, the company said it overstated its user base numbers for the previous three years. (Source)

What a well-run company…

Isn’t it weird that when there are problems on metrics, they always are in the direction that helps the company’s optics (EXCEPT for Adyen, as I wrote about in edition #45 — “[after the restatement,] in 2019, their EBITDA margin wasn’t ˜56%, it was actually much closer to 60%… And in the first half of 2020, it goes from 50.3% → 54.4%.”) TWTR 0.00%↑

🏴☠️ $182m Crypto Hack While Following the Rules ☠️

On Sunday, a hacker exploited a new algorithmic stablecoin project called Beanstalk and drained it of $182 million worth of digital assets. [...]

The Beanstalk hack was the fifth-largest crypto theft on record, according to Rekt.news, which tracks crypto hacks. The hack follows a $540 million theft last month from the platform for the online game Axie Infinity. [...]

The 2022 pace of roughly a hack a week is in line with last year, but the amount stolen is rising, according to Rekt. Since August, there have been 37 hacks in 38 weeks that have drained about $2.9 billion worth of cryptocurrencies.

That is on par with the $3.2 billion stolen in all of 2021, according to analytics firm Chainalysis.

That’s a lot of dough, er, bits, er, tokens, whatever.

What’s interesting in the Beanstalk hack is that, technically, it was done by following the rules (🤯). Some people are just very good at finding loopholes that allow them to break the spirit of the rules while following the letter of the law:

According to blockchain-analytics firm Elliptic, the hacker borrowed about $1 billion worth of different stablecoins, using an ultra-short-term kind of loan called a flashloan, and then added that to Beanstalk’s funds. That was enough to give them an overwhelming percentage of voting power.

The hacker proposed donating money to Ukraine, and voted to approve the idea. The proposal, however, included code that instead sent all the funds locked up in the Beanstalk protocol to a wallet controlled by the hacker, according to Elliptic.

Once they stole the funds, they repaid the loan, and pocketed the difference.

Ironically, Mr. Galka pointed out, the hacker was following Beanstalk’s stated rules. The problem is there was no contingency for somebody taking over the voting mechanism, which reflects the newness of the project itself, he said.

“Everything this guy did was consistent with the code,” Mr. Galka said. (Source)

“The code is law” certainly has downsides when the code didn’t foresee stuff like this and you can’t just appeal to some arbiter’s common sense…

Also a good reminder that if you don’t have security, eventually you don’t have *anything*…

Science & Technology

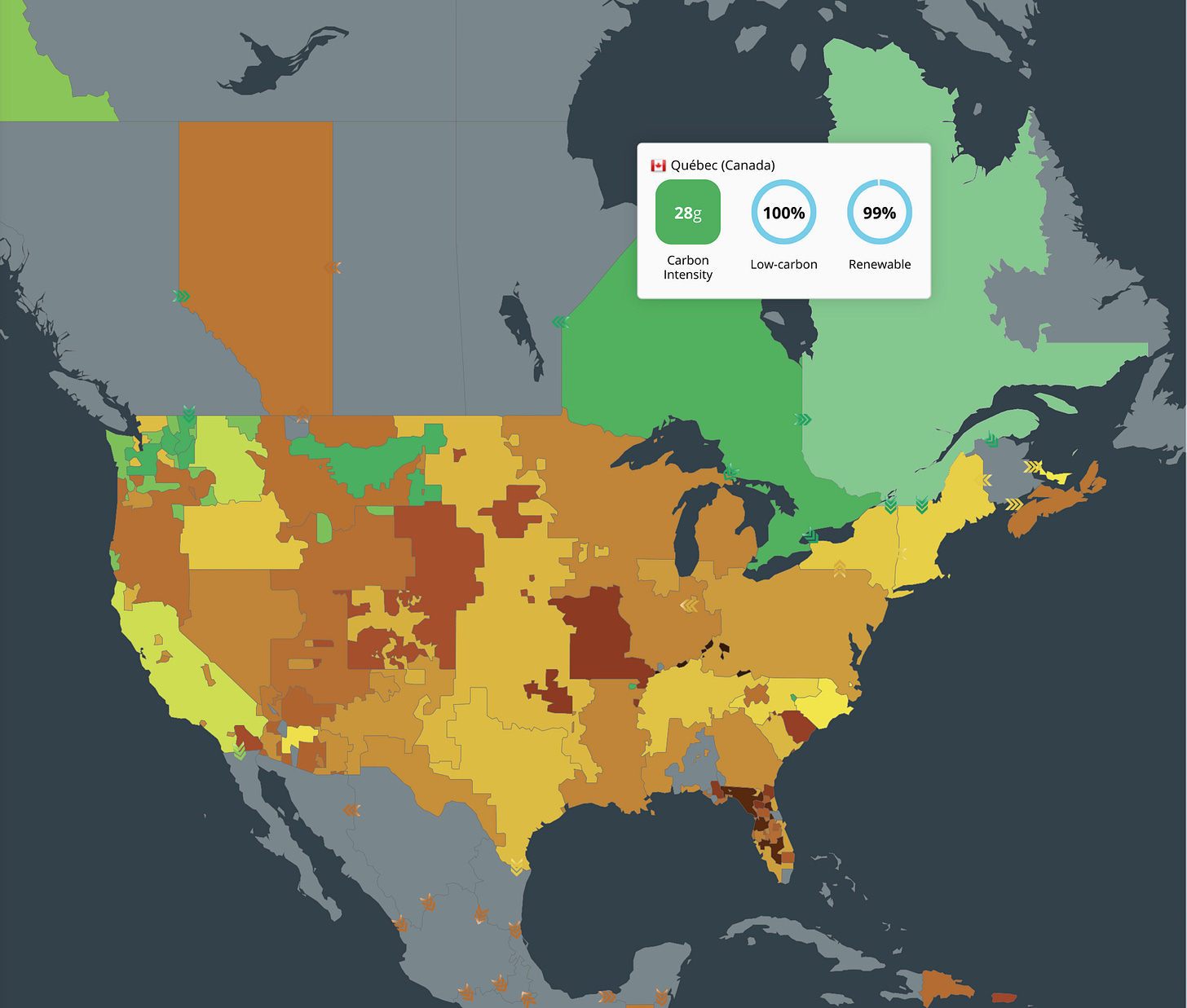

🔌 Electricity Map ⚡️

This website shows various grids around the world where open source data is available.

You can zoom in to see what’s the ratio of power sources (hydro, wind, gas, nuclear, coal…) and what that all adds up to when it comes to carbon intensity (the metric they use is grams of CO2 per kWh).

They also show installed capacity for each source vs actual production.

This makes it obvious that, for example, some grids have huge natural gas capacity that only fires up during peaks or when intermittent sources aren’t producing.

What’s neat is the map also shows cross-border exports if you hover over the little arrows between states and countries. This makes it clear just how complex the energy situation is in Europe:

It’s a lot of fun to explore the world through this lens. Click around to see what’s powering various parts of the world!

There’s also a free mobile app called ElectricityMap on iOS and Android.

Apple Mac Studio + M1 Ultra 🤯

This chart…

It shows how the new M1 Ultra SoC compares to various high-core count Intel chips, with GigaFLOPS (billions of floating-point operations per second) on the vertical axis and the number of cores on the horizontal one (note that this only shows the 16 performance cores of the Ultra — it also has 4 efficiency cores that make the real-world total even higher):

Now that’s nice scaling! AAPL 0.00%↑

Source. h/t John Gruber (🍎)

The Arts & History

🎨 Automatic Painting, Cool Geometry Edition 👨🎨

This one is simple, but I like it.

A paint bucket with a small hole in the bottom is balancing on a wire above a canvas that is itself balancing on wires. Kind of hypnotic… 👀

Coke was one of those blue-chip companies that traded at an incredible multiple at the time because they had "figured out" how to grow EPS at a steady 20% per year. In the case of Coke, because they were selling off pieces of their bottlers and recognizing the capital gains as operating earnings. Lots of others like GE doing this at the time too - basically all accounting shenanigans, but they all traded at incredible multiples as a result. People remember the dotcom bubble, but they forget the incredible split in valuations the giant blue chips (50x P/E) and small and mid-cap value (single digit P/E).

Coke is covered here on page 7, and The Snowball covers how Buffett was able to engineer a management behind the scenes at Coke to get the ship righted.

http://csinvesting.org/wp-content/uploads/2012/10/The-15-Percent-Delusion-by-Carol-Loomis.pdf

Pepsi is really more of a food company - their big asset was always Frito-Lay, which has a dominant position in chips (the potato kind) and the margins to match - remember Steve Jobs poaching John Sculley from Pepsi, then giving an interview to Playboy where he marvels at the lock Frito-Lay had on direct distribution ("sales and service") that gave them such control over market entry. Coke was much bigger globally in soft drinks - Pepsi does ok in a few markets here and there, but in most countries, Coke is dominant.

The electricity map is fascinating. Just spent the last half an hour on it. Amazing what kind of data are publicly available.