274: NASDAQ Underbelly, Mark Leonard's 7 Lessons, Coca-Cola Riddle, Big Tech CapEx, ML Algos, Feynman on Trees, 1m Oura Rings, an Anne Applebaum

"You can try to offer people broccoli"

Information doesn't enter the mind intact like a puzzle-piece slotted into a jigsaw. Instead, it becomes distorted to fit the shape of its container, like water poured into a vessel.

–Gurwinder Bhogal

🤔 So is this when Buffett finally starts buying a big position in Amazon?

(this would be on top of Todd and/or Ted’s existing ownership)

🤖 🥦 🍫 “Algorithms” are often blamed for polarization, and that blame flows upstream to those that make the algorithms.

Some of that is probably deserved, but what if things are more nuanced, and some blame should flow *downstream* too..?

Let’s say you have a search engine that tries to answer your questions as “objectively” as possible — it’s impossible to be 100% “objective”, because what does that even mean for a human-made thing? How can it not carry the stamp of its creators? But for the sake of argument, let’s say it’s as close to it as possible…

These algos are trained on human-made data, both the corpus of content on the internet and usage data, to discover where the needles are in the haystack.

What if you give users 10 results, and everybody clicks on #5?

The algo will take that into account and over time, #5 will rank higher, as it seems to be a better answer to that query. People keep clicking more on it, so over time, it migrates to #1 for that search.

Well, what if you originally gave people 9 pretty ‘objective’ answers and #5 was the worst one, some BS inflammatory partisan site… But that crap goes up the search rankings over time because humans have a revealed preference for it over more boring, but more accurate sources..?

I fear there’s truth in there, and it *partly* explains some of what is happening.

Not all of it, but I don’t think the users who create the data-points used by those machine learning algos are entirely free of blame in all this. A trained ML model can’t help but reflect the data on which it was trained 🤖 (it’s just a lot politically harder to point the finger at ‘human nature’…)

You can try to offer people broccoli 🥦 over and over again, but if there’s also candy 🍫 nearby, chances are many will reach for the candy…

(btw, I’m NOT saying there’s no problem, nothing should be done, etc. Incentives matter and we could probably do MUCH better. Just pointing out one under-discussed aspect of this dynamic)

👷♂️🪛🏠⚡️ Reader and supporter (💚 🥃) David Goldberg educated me about the existence of whole-house surge protectors.

They’re small boxes that are connected to a house’s electrical panel — get an electrician’s help! — and if there’s ever a big surge, the kind that can damage electronics and even large appliances, this will absorb all or part of it (depending on how severe it is).

It’s not a panacea, but for a few hundred bucks, it seems like fairly cheap insurance, especially if you live somewhere that has a lot of power spikes.

Note: It doesn’t replace the other surge protectors inside power strips that I hope you already have to protect your stuff. It’s a complement to them.

💚 🥃 I frequently hear variations on this from new supporters:

I've been meaning to become a supporter for a while, but just never did it for whatever reason... I kept procrastinating on filling out the payment stuff--it's always annoying to fill those forms.

Then I pressed the subscribe button on my phone and saw it had Apple/Google Pay and it took 3 seconds! It wasn't the money, the amount is immaterial, it was the friction!So if you are repulsed by filling out forms, click this button on your phone and get your face/fingerprint scanned, it’ll be painless:

A Word From Our Sponsor: 📈 Revealera 📊

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products.

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo.

Investing & Business

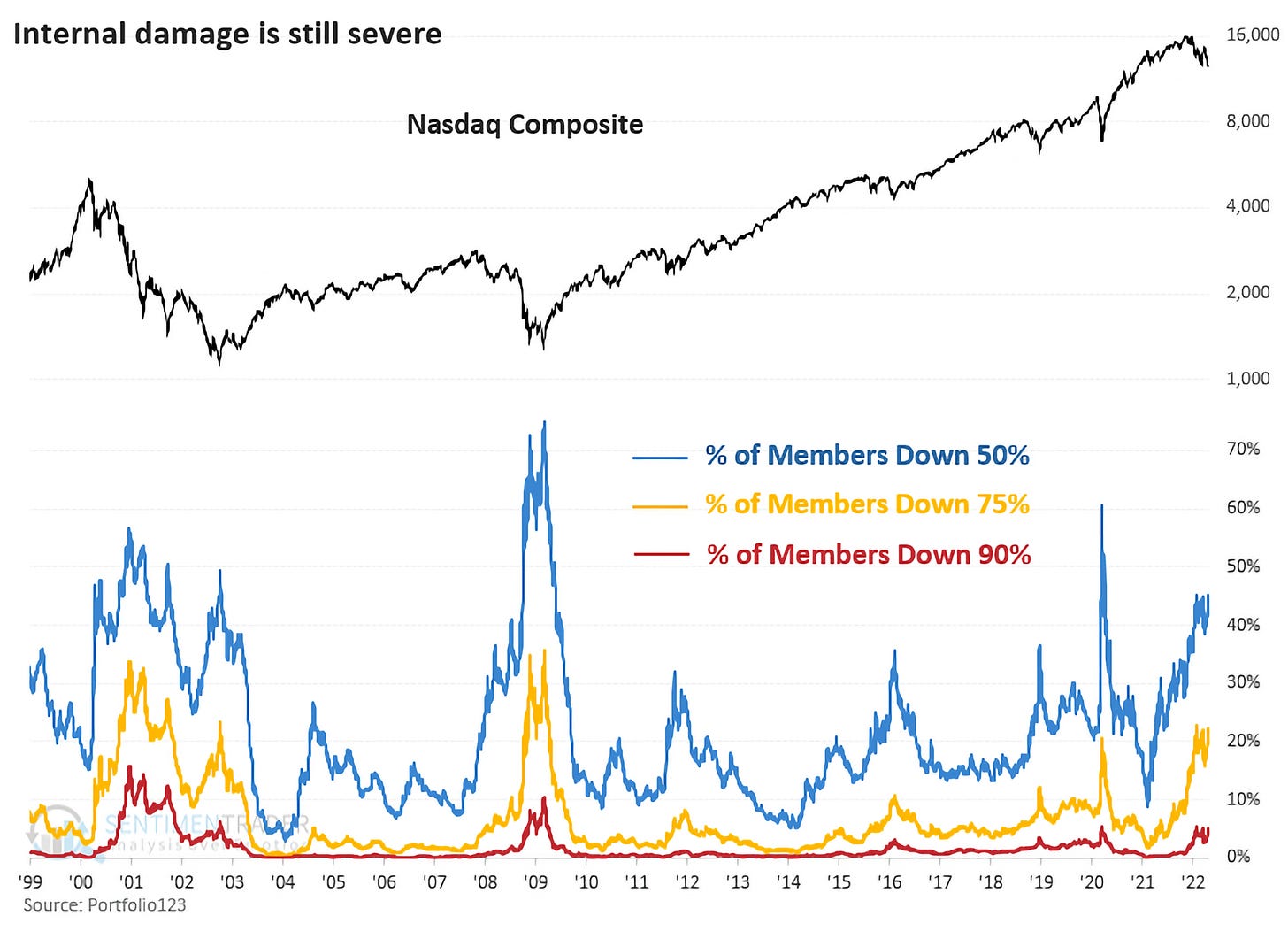

Under the hood of the Nasdaq Index 📉

You probably know the one about the man who drowned in a river only 4 feet deep *on average*.

Averages can hide a lot of what is going on below the surface. The chart above, via Jason Goepfert, shows some of what is going on ‘inside’ the Nasdaq:

More than 45% of stocks down 50%

More than 22% of stocks down 75%

More than 5% of stocks down 90%.

Mark Leonard on ‘Seven lessons from a late-starting entrepreneur’ 🧙♂️📜

Nice little note on the VMS Fund website (Constellation’s new venture arm) website, riffing on a Financial Times piece on ‘late starting entrepreneurs’.

Here are the main points:

Ideas are great, but execution is all

what distinguishes success from failure is rarely the quality of the idea itself but how well it is executed.

Your new boss is the market

When you work in a big company, you need to please your boss. Whether or not you climb the corporate ladder often depends on how well your words and actions rhyme with your boss’s narrative rather than the results you achieve. But when you launch a start-up, you do not have someone above telling you what to do. The only judge of your performance is the reality of the market, which is arguably more honest but invariably more brutal. Are you producing something that enough people are prepared to pay for to keep you in business? If not, you’ll soon be fired by your disembodied new “boss”.

Find fellow travellers

Treasure patient backers

Learn from mistakes quickly — or die

Another liberating lesson is that you do not need to know all the answers when you start. Indeed, the core methodology of a start-up is experimenting, and failing, fast.

‘Happiness is positive cash flow’

Water on granite

Highlights from Mark Leonard’s note:

I was an intrapreneur, and I didn't start a business until I was 39 years old, so I saw myself in John.

The article enumerates the lessons learned in John's three-year start-up experience. Without doing complete justice to John's article, his lessons that struck me were:

Your business's demands will far outstrip your own skills, determination, and energy. You'll need a team. They need to be enthusiastic, hard-working, critical and challenging. The challengers are the hard ones to find… most of us are taught to avoid confronting the boss with his occasional abject stupidity.

You are going to make lots of mistakes, often in parallel. You'll need to recognise and learn from those experiences in the midst of constant crisis.

Don't give up: if you are getting out there, customers and prospects are going to tell you what they need. Listen to their feedback and keep trying. [...]

I'll leave you with a quote from his article:

"The past three years… have been the most exhilarating, unnerving, frustrating and rewarding I could imagine."

h/t friend-of-the-show Pearnick (🔐)

🥤A Coca-Cola Riddle Answered

In edition #273, I wondered why Coca-Cola’s stock spiked during the dot-com era while Pepsi didn’t.

A few helpful readers (thanks Philo, Mike, Snarkout 👋) pointed out that at the time, Coke was spinning out its bottling operations to make themselves more asset-light and higher margin, which the market really liked at the time.

Thanks to financial engineering fancy-footwork 🕺, they got Wall Street to value some of these one-time gains as if they were indicative of longer-term earnings growth, something similar to what GE was doing at the time (*tsk tsk tsk*).

Im-Balance Sheet 📊

Steve Clapham writes:

Best bit of [the Berkshire Hathaway] meeting for me was the revelation that the Salomon Bros balance sheet didn’t balance for 12 years so they just used a plug number. Auditor Arthur Andersen went on to audit Enron.

Human Nature, Exhibit #29A 🤦♀️

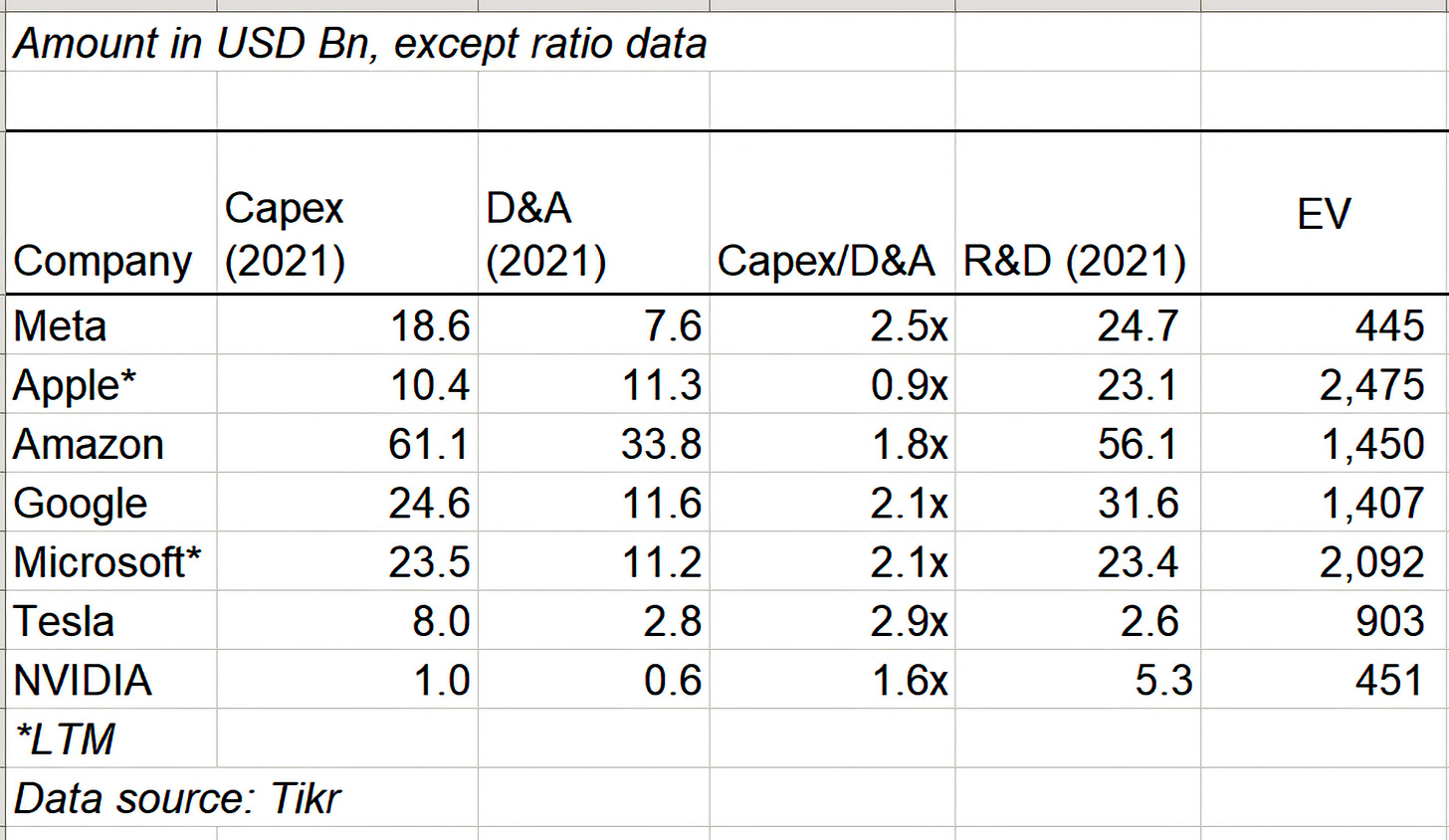

CAPEX, head-spinning edition 😵💫

My friend MBI (💎🐕) writes:

“my head sort of starts spinning every time I update this table.”

From the Amazon Q1 call:

Capital investments were $61 billion on the trailing 12-month period ended March 31. About 40% of that went to infrastructure, primarily supporting AWS but also supporting our sizable Consumer business. About 30% is fulfillment capacity, primarily fulfillment center warehouses. A little less than 25% is for transportation.

Banana for scale: AWS is now at a $74bn run-rate… 🍌

Science & Technology

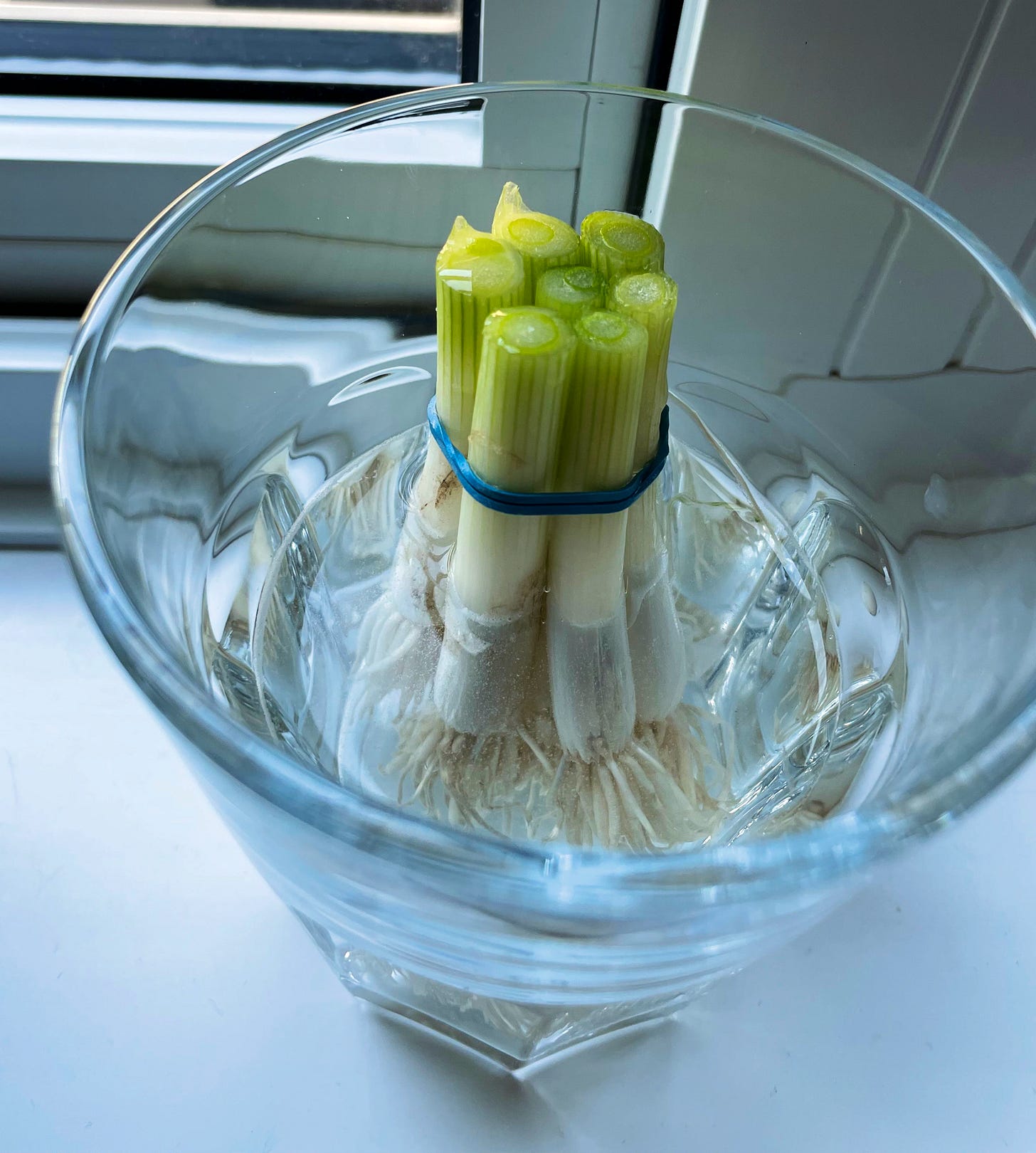

Liberty Hydroponics, Inc 👨🌾

I’m trying something I saw online… let’s see if I can grow a second batch of green onions from this (I hear from many others on Twitter that it works just fine).

I’m doing it half for the onions, and half because my kids will think it’s cool that we grew food in a water glass.

It’s also a good occasion to re-up something by Richard P. Feynman (are those initials familiar? Mm?) that I posted in edition #49, which applies to this, because our intuition is that things grow from the ground, and so something growing in a glass of water will be “starved”:

“The stuff of the tree is carbon, where does that come from? It comes from the air. People look at trees and think it comes from the ground. But where does the substance come from? It comes from the air… there’s a little bit from the ground, some minerals and such.”

Of course, I couldn’t indefinitely re-grow onions from the same roots in a glass of water, but I’m pretty sure that there’s enough of what is needed in the more dense base for at least one or two times… And if I planted it in soil, I could probably get many years of crops from it. Maybe I should 🤔

Oura sold 1 million+ Sleep-Tracking Rings 🥱 🛏 😴

Hardware is hard. Shrinking what is basically a computer into a ring that you wear on your finger, with sensors to detect heartbeat, temperature, and movement in fine-enough detail to use as proxy in ML models that extrapolate all kinds of physiological parameters… That’s extra-hard!

Congrats to the Oura team. I’ve been wearing their products for years:

On the heels of Sleep Awareness Week, it’s awe-inspiring to consider that we’ve delivered one million rings and recorded over 2.5 billion hours of sleep. I’m reminded of a quote from Matthew Walker, Professor of Neuroscience & Psychology at the University of California, Berkeley, and Oura Advisor:

“I was once fond of saying, “sleep is the third pillar of good health, alongside diet and exercise.” I have changed my tune. Sleep is more than a pillar; it is the foundation on which the other two health bastions sit. Take away the bedrock of sleep, or weaken it just a little, and careful eating or physical exercise become less than effective.” (Source)

When you track something, it stays more top of mind, you change your behavior to try to get better metrics (a kind of gamification), and you get faster and clearer feedback on how you’re doing and what causes have what effects.

f.ex. if you have an Oura ring, you know what happens to your resting heart rate and HRV and body temperature the night after you’ve had a few drinks and that big piece of chocolate before bed…

The Arts & History

Anne Applebaum goes to Kyiv, spends time with Zelensky, analyzes Putin’s strategy and tactics, etc. 🇺🇦 🇷🇺 ☭

I found this podcast with Anne really interesting.

Another one to file under the-old-days-become-scarily-relevant-again, as Anne has studied the Soviet Union, Russia, and Ukraine extensively for decades (and won a Pulitzer for her work on Gulags):

This is the piece she wrote with Jeffrey Goldberg about her visit to Ukraine:

When we met Zelensky in Kyiv on Tuesday night, he told us the same thing: The optimism that many Americans and Europeans—and even some Ukrainians—are currently expressing is unjustified.

You can read her latest piece on the psychology of how Russia prepared its population for this war:

“ if you have an Oura ring, you know what happens to your resting heart rate and HRV and body temperature the night after you’ve had a few drinks and that big piece of chocolate before bed…”

That’s why I got rid of my Oura ring. Problem solved! 😉