285: Nvidia Q1, VMware + Broadcom, Cloudflare S-Curves, 70% Inflation, Fertilizer Prices, EV Charging, Microsoft's Keystone, and AWS' Graviton 3 ARM CPUs

"I’m trying to look at it as leveling up"

The biggest barrier to rational thinking is organizing your mind such that it's safe to think.

—J. Hazard

🏃♂️👟 I went on my second run yesterday. It went a bit better than the first time, and I ran more of it — I still alternate between running and walking, maybe 70% run/30% walk at this point.

My self-talk is: Just gotta keep going and build up the habit, it’s a long-term thing. Never give up, never surrender!

I’m trying to look at it as leveling up: I’m trying to improve something at a low-enough level in my life that almost everything else above it will benefit.

Similar to when I improved my sleep: I felt better on many fronts, physically 💪, mood and mental health 😋, cognitive performance 🧠, etc. I’m trying to get something similar here — or at least, looking at it like that provides more motivation to my nerd brain.

😯 🃏DUNE playing cards!

Oh Theory11, just when I thought I was out, they pull me back in!

I’m weak. I *certainly* don’t need more playing cards, but I ordered them ¯\_(ツ)_/¯

💚 🥃 I hope you have a good weekend!

If you can, try to go out in nature and take a moment without inputs (podcasts, conversation, reading, etc) to just process your thoughts and let your mind go in whatever direction it naturally drifts to.

🌳🌳🐝🌳🌳🌳🏕🌳🌳🌳🚶🏻♂️🌳🐇🌳🌳🐿🌳🌳🌲🌳💐🌳🐌🌳

🏦 💰 Liberty Capital 💳 💴

Broadcom plans to buy VMware for $61 billion 😯

That’s not what you call a ‘tuck-in’ acquisition…

The deal would be one of the largest technology acquisitions of all time, behind Microsoft’s pending $69 billion deal to purchase Activision Blizzard and Dell’s $67 billion purchase of EMC in 2016. [...]

When this was announced, VMware stock had been down about 44% from peak (which would be notable if we weren’t in a market where everything tech is down in that range +/- 30%.).

Broadcom is the most acquisitive semiconductor company and has strategically used mergers to fuel its growth in recent years. It previously purchased CA Technologies in 2018 for $18.9 billion and Symantec in 2019 for $10.7 billion. But Broadcom had not made a large acquisition since 2019. [...]

Broadcom planned to purchase Qualcomm in 2018 for $117 billion before the deal was hampered by then-president Donald Trump, citing national security.

The big winner here is Michael Dell (💰💰💰). He owns about 40% of VMware, which he got through the EMC acquisition in 2016.

🔥 Nvidia Q1 Highlights 🔥

The first thing to note is that after getting to about 50/50 recently, the data-center segment is now bigger than the gaming segment:

Data-center: $3.75bn growing 83% in Q1 (acceleration from 71% in Q4)

Gaming: $3.62bn growing 31% in Q1 (vs 37% in Q4)

Friend-of-the-show Mule has a good overview of the financials and the potential impact of crypto on the business, with some plausible scenarios modeled.

Regardless of how well crypto is doing, it was always on the near horizon that Ethereum was moving to proof-of-stake (and Bitcoin is already on non-GPU ASICs), so while visibility was poor, the getting-while-the-getting-was-good was predictably ending.

As usual, what interests me most for the purpose of this steamboat (🚢) is the business and the tech, so I’ll let you decide what you think about the stock.

Some highlights from the transcript:

The gaming industry has grown tremendously, with 100 million new PC gamers added in the past 2 years.

We estimate that almost 1/3 of the GeForce Gaming GPU installed base is now on RTX.

This is a good reminder that the current generation of gaming cards is 2 years old, and yet they’re just starting to see supply constraints loosen up a bit.

The new Hopper-based cards are coming in the fall, and hopefully by then the supply picture looks better because they still have a pretty huge installed base that isn’t on any RTX-capable chips (which came out 4 generations ago, if you count Hopper).

Driving this growth are not just gamers, but also the fast-growing category of content creators from whom we offer dedicated NVIDIA studio drivers. We've also developed applications and tools to empower artists, from Omniverse for advanced 3D and collaboration to broadcast for live streaming to canvas for painting landscapes with AI. The creator economy is estimated at $100 billion and powered by 80 million individual creators and broadcasters.

This isn’t as big a segment as gamers, but it’s becoming more important over time and helps diversify the customer base further.

Gamers can now access RTX 3080 class streaming, our new top-tier offering with subscription plans of $19.99 a month. We added over 100 games to the GeForce NOW library, bringing the total to over 1,300 games. And last week, we launched Fortnite on GeForce NOW with touch controls for mobile devices, streaming through the Safari web browser on iOS and the GeForce NOW Android app.

Their game-streaming cloud service is a new monetization approach for the company, moving away from monetizing pretty much only through hardware, along with their other recent paid software products like Omniverse and some ML models.

Data Center: Record revenue of $3.8 billion grew 15% sequentially and accelerated to 83% growth year-on-year.

Revenue from hyperscale and cloud computing customers more than doubled year-on-year, driven by strong demand for both external and internal workloads. Customers remain supply constrained in their infrastructure needs and continue to add capacity as they try to keep pace with demand.

As more and more workloads become very compute-intensive thanks to the use of increasingly large datasets & ML models, I think Nvidia can probably keep growing faster than overall compute capex for a while, as the relative share of compute done on CPUs keeps going down…

Also note that this level of growth is with their Ampere architecture, even though Hopper is already in the hopper (ugh) and shipping soon. No Osborne effect here.

the supply chain has been problematic. We're doing our best. And our supply has been increasing from Q4 to Q1. We're expecting it to increase in Q2 and increase in Q3 and Q4. And so we're really, really grateful for the support from the components industry around us, and we'll be able to increase that.

They also mention that the networking segment is “highly” supply-constrained and demand is “really, really high”….

I’d sure be curious to know how much more they could’ve sold in the past two years without any supply issues, but I guess we’ll never know ¯\_(ツ)_/¯

Grace is the ideal CPU for AI factories. This week at Computex, we announced that dozens of server models based on Grace will be brought to market by the first wave of system builders, including ASUS, Foxconn, GIGABYTE, QCT, Supermicro and [ Y-Win ].

Their first CPU, which is ARM-based, is launching in 1H 2023, and that includes the “superchip” version that is basically 2 Graces fused together with a very very fast interconnect, and integrated with Hopper-based GPUs.

It should really scream, and further increase ARM’s invasion of the data-center (along with the no-doubt-coming other ARM-based CPUs that are in the pipeline). I’m sure Nvidia regrest not buying ARM, but I don’t think it’ll stop them from making more ARM chips.

On the margins vs inflation front:

We have been able to offset rising costs and supply chain pressures. We expect to maintain gross margins at current levels in Q2.

Going forward, as new products ramp and software becomes a larger percent of revenue, we have opportunities to increase gross margins longer term.

Both data-center products and software are bound to have, on average, higher margins than the gaming stuff, so as these segments grow into progressively larger slices of the pie, it would make sense to see margins keep marching upward (though that also depends on overall growth — they’d get negative leverage in a downcycle).

We are closely managing our operating expenses to balance the current macro environment with our growth opportunities, and we've been very successful in hiring so far this year and are now slowing to integrate these new employees. This also enables us to focus our budget on taking care of our existing employees as inflation persist.

Like pretty much everybody else right now, they’re stepping off the gas a bit and being more conscious about the expense lines.

These are really AI factories, where you're processing the data, refining the data and turning that data into intelligence. These AI factories are essentially running one major workload and they're running at 24/7. Deep recommender systems is a good example of that.

In the future, you're going to see large language models essentially becoming a platform themselves. That would be running 24/7, hosting a whole bunch of applications. [...]

the net of it all is that our ability to support every single workload, because we have a universal accelerator running every single workload from data processing to data analytics to high-performance computing to training to inference, that we can support ARM and x86, that we support PCI Express to multisystem NVlink to multi-chip NVLink to multi-die NVLink. That capability makes it possible for us to really be able to serve all of these different segments.

🏭🤖🤖🤖

There are thousands and thousands of species of AI models and -- in all these different industries.

One of my favorites is using Transformers to understand the language of chemistry or using Transformers and using AI models to understand the language of proteins, amino acids, which is genomics. To apply AI to recognize the patterns, to understand the sequence and essentially understand the language of chemistry and biology is a really, really important breakthrough.

I love that stuff too.

I can’t wait to see what breakthrough will come from AlphaFold and similar applications of this tech to computational protein design. This will be world-changing stuff! 🧬

all of these different models need an engine to run on. And that engine is called NVIDIA AI.

In the case of hyperscalers, they can cobble together a lot of open source, and we provide a lot of our source to them and a lot of our engines to them for them to operate their AI.

But for enterprises, they need someone to package it together and be able to support it and refresh it, update it for new architecture, support old architectures in their installed base, et cetera, and all the different use cases that they have.

Hyperscalers get all the attention, but there’s still a *gigantic* amount of servers out there outside of the big clouds. Many of these are huge, but may not have the internal IT skills that AWS/Azure/GCP have, so getting a nicely packaged solution with a bow from Nvidia is probably very appealing. 🎁

So when is Hopper joining the party? 🥳

most of the ramp that we have of our new architectures, we're going to see in the back half of the year. We're going to start to see, for example, Hopper will probably be here in Q3, but starting to ramp closer to the end of the calendar year

Before I leave this topic, if you want a good overview of Nvidia’s data-center segment, check out Punch Card Investor’s write-up.

👋

⛅️ Cloudflare on Stacking S-S-S-S-Curves

The way we think about our business, when we think about products is we're stacking a series of S curves one behind another. And different products are at different development points on those S-curves. And so a product like DNS, like we are the biggest DNS provider in the world. I mean there's -- DNS is super mature.

We're at the very end of that S-curve. There is not going to be a ton of growth from DNS. But it's strategically important. We'll continue to do it. We invest in it.

We make it better. We don't want anyone to be able to sneak in behind us. So that's that.

This isn’t unique to them, of course. Almost any company can be looked at this way (Apple’s various S-curves are very product-centric, other companies have S-curves that are more about riding certain broad trends, etc).

They’re just particularly good at finding new S-curves at a rapid pace.

On the other hand, something like Cloudflare for Offices, which is really true MPLS replacement and taking that -- I think that's an act 4 product. Like that's at the very early stages of how that's going to develop. Exciting. We've got -- we're learning a lot. We're trying to figure out how that's going.

We want to have products that are all of those different stages. And so depending on what your time frame is, I think how much the buckets grow really depends -- I think your time frame that you laid out was sort of in the next 2 to 3 years, Zero Trust is going to be a big part of our story over that time. And that's the place where I think you're going to see, that's right hitting that hockey stick growth. And I think it's going to be great for us. I think it's going to be great for Zscaler.

I think it's going to be great for Palo Alto Networks. I think you can be actually bullish on all 3 of us in that space. But when we go head-to-head with them, I think we love our win rates, and I think that we can be -- we can make that business bigger than what all of our traditional platform services businesses are.

If you’re in a rapidly-enough expanding area, it’s possible for multiple companies to do well without stepping on each others toes too much, but there’s generally a power law that develops and most of the profit goes to the top players.

Cloudflare seems to think that its ability to bundle broad offerings can help it differentiate and climb up the ranks.

If you had said, what do you think over the next 10 years, now you're in Workers land, right? And the opportunity that there, I think, will dwarf everything that we've done with Platform Services and Zero Trust. And if you said, what do you think over the next 20 years, now we're Cloudflare for Offices. And if you look at IT budgets, what are -- what's the biggest thing that every Fortune 500 company spends IT budgets on, telecommunications and connectivity. And we've built a network where we're not that far from every physical office in the world.

And if we can build an intelligent network that says, well, we'll take over some of that telecommunications and connectivity spend. I think that's a big opportunity over the long term. But it's a much longer term. So I think that it's going to shift. Over time, we're going to make our way through that S curve.

And what I have faith is that our product team will continue to launch new things, find new areas and find something else where you're kind of at that slow initial part of the S-curve that we'll continue to stack over. And that's why our revenue, I think, is so durable over the long term.

Boundless ambition! Their mission to “help make the internet better” is bringing them from being known almost solely as a CDN/DDoS protection company a few years ago to now thinking about basically having a finger in every pie of internet infrastructure, building a kind of private internet that provides security, performance, and a developer platform to build on.

Long-term vision and ambition is often underrated in business. No Cloudflare watcher 5 years ago predicted what they’re doing today, so I’ll be very curious to see what they’re doing in 5 years.

🇹🇷 Learning from Turkey’s 70% yearly inflation 💸

The Wandering Investor wrote about his experience with very high inflation in Turkey. Some highlights:

Quote from a local friend “Everyone loses sense of money. We don’t know the prices. We shoot blind”

As soon as people have money they buy something. Anything. Food, non perishables, white goods, etc [...]

Real estate prices have actually been going up in USD terms. People pool their savings together and buy apartments if they can’t afford one on their own [...]

People who earn foreign currency live like kings. Local workers earning Liras suffer

Inflation adds daily anxiety to people’s lives. Not knowing what you will be able to afford is extremely stressful

No more fancy menus in restaurants. Such price stickers are the norm, and QR code menus

🦃

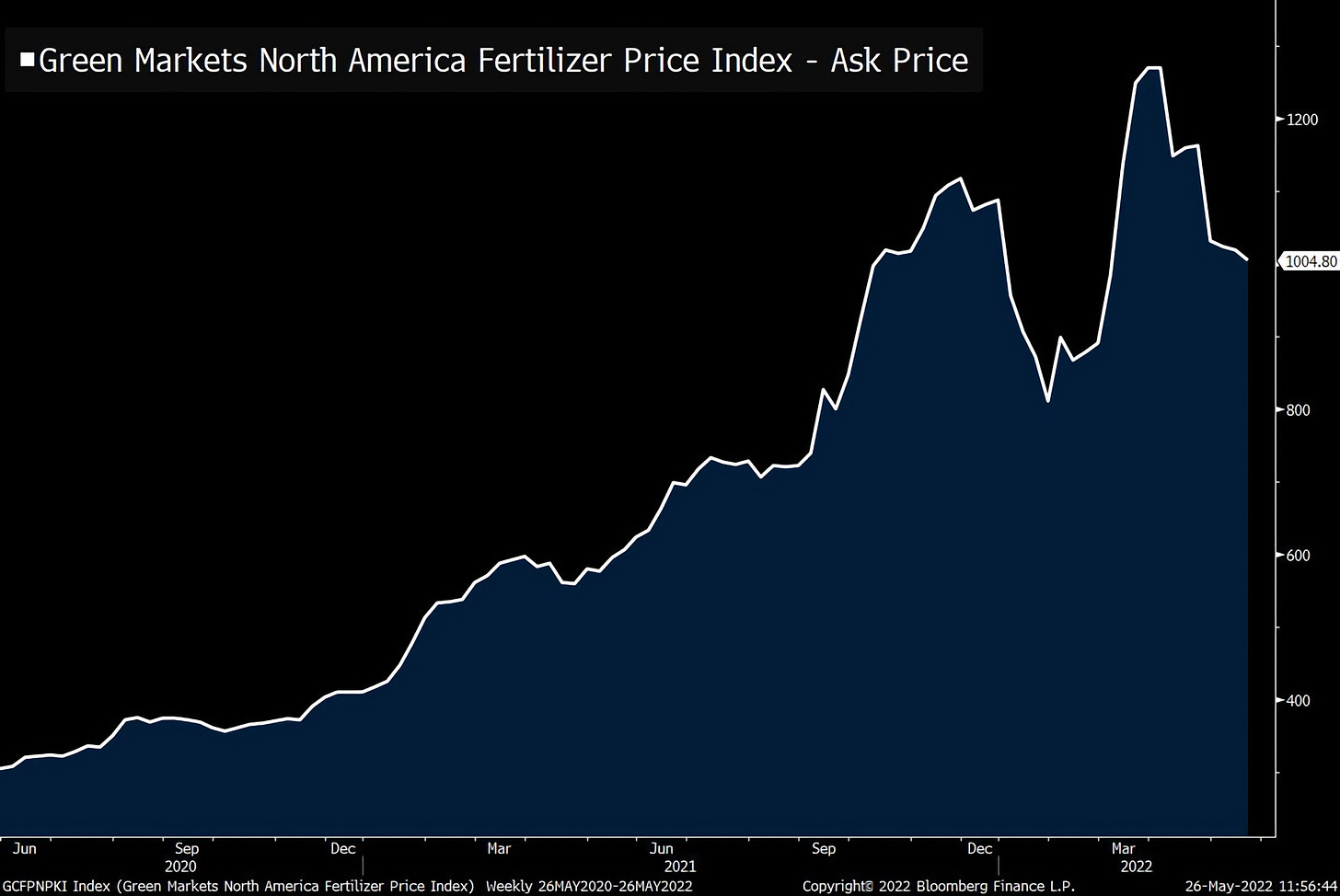

‘Fertilizer Prices Plunge Nearly 30% Giving Relief to Farmers’

The June spot price in Tampa, Florida for the nitrogen fertilizer ammonia settled at $1,000 per metric ton, a drop of 30% from May’s $1,425 per metric ton

That’s great to see, though prices are still very high, and the relief isn’t all coming from the supply side:

Demand destruction is part of the decline. Places like Southeast Asia are seeing buyers unwilling to pay the record high prices that were posted in April and May, said Green Markets analyst Alexis Maxwell. It also reflects the declining cost of ammonia production as European natural gas prices fell in the second quarter (Source)

🧪🔬 Liberty Labs 🧬 🔭

Masterclass on Electric Vehicle Charging Infrastructure

What a great video.

If you have any questions about how charging EVs work in 2022, the pros and cons, how long-road trips and at-home charging work, the different connectors types, AC fast-charging vs DC fast-charging, the impact on the grid of adding lots of fast-charging stations, etc… This is for you!

👾 Keystone: Microsoft R&D’ing tiny box for Xbox Game Pass video game streaming 🎮

It’s not quite done yet, so expect a bit more time in the oven, but they *are* working on it:

“Our vision for Xbox Cloud Gaming is unwavering, our goal is to enable people to play the games they want, on the devices they want, anywhere they want. As announced last year, we’ve been working on a game-streaming device, codename Keystone, that could be connected to any TV or monitor without the need for a console," a Microsoft spokesperson stated.

"As part of any technical journey, we are constantly evaluating our efforts, reviewing our learnings, and ensuring we are bringing value to our customers. We have made the decision to pivot away from the current iteration of the Keystone device. We will take our learnings and refocus our efforts on a new approach that will allow us to deliver Xbox Cloud Gaming to more players around the world in the future.” (Source)

With game streaming, all the heavy lifting happens in the cloud, so such a box would probably only need to be optimized for internet connectivity, peripheral connectivity (game controllers), and low-latency overall between these things.

AWS makes Graviton3 ARM CPU generally available to customers

Today we announce the general availability of C7g. These are the first EC2 instances powered by the latest generation Graviton3 processor. C7g provides up to 25% better performance than the predecessor C6g, which already offered up to 40% better price-performance over comparable x86 instances. It’s only been two years since we launched Graviton2, and I believe that the 25% generational performance gain we’re delivering in Graviton3 is a big step forward for customers.

Amazon’s Annapurna acquisition in 2015 (which I’m sure they’ve internally built up a lot since) is still paying dividends.

Here’s the nerdy stuff 🤓:

Comparing Graviton3 to our previous generation processor, we see up to 2x better floating-point performance, up to 2x faster crypto performance, and up to 3x better machine learning performance. It’s based on the Arm Neoverse-V1 core where each core has a private 64KB L1 as well as a private 1MB L2 cache.

Graviton3 is the first server in the AWS fleet to support DDR5 memory and it delivers 50% more bandwidth than the previous generation DDR4. Throughout the Graviton program, we have always focused on the importance of memory bandwidth to real-world application performance and, with Graviton3, we continue that focus by offering 8 lanes of DDR5 per socket.

Each Graviton3 package has 55 billion transistors and is made up of 7 chiplets, 1 main compute-die housing all the cores, 4 DRAM controller dies, and 2 PCIe dies. [...]

We exploit the power efficiency of Graviton3 to cost effectively deploy 3 servers per Rack Unit (1.75“) without requiring exotic or expensive cooling solutions. This reduces costs but the energy efficiency of Graviton3 also helps customers reduce their carbon footprints. Graviton3 instances use up to 60% less energy for the same performance than comparable EC2 instances. (Source)

Cool side-by-side from NextPlatform:

🎨 🎭 Liberty Studio 👩🎨 🎥

Amulet — Still going strong 📚

We’ve now read five books of the Amulet series together, and my eight-year-old is still really really into it.

He’s sad when we have to stop at bedtime and begs for a few more pages. If that’s not a sign of a good graphic novel, what is?

I dig it too, though I wish I had read it at his age, it would have had a much bigger impact on me.

There’s a box set, though we got ours from the public library.

Your son is a lucky kid!

Masterclass on Electric Vehicle Charging Infrastructure- it was OUTSTANDING! 👏