312: Microsoft Q2, Visa & Mastercard + Durbin 2.0, Jack Ma & Ant Group, Heico's Biggest Acquisition Ever, and Deepmind Alphafold's 200m Protein Structures

"it also forces you to adapt to it"

The advancement and diffusion of knowledge is the only guardian of true liberty.

—James Madison

🏃♂️🫀 The graph below comes from my Oura Ring.

The black line is my ‘lowest resting heart rate’, and the blue line shows when the ring detected ‘high activity’.

Can you spot when I started running? Ha!

I wouldn’t have expected to see a difference in resting heart rate that quickly, but there it is. Our bodies adapt pretty quickly to what we ask of them — in both directions.

💚 🥃 Woke up this morning to a wonderful new arbitrary milestone:

And the Liberty Labs 🧪🔬🧬 🔭 Discord now has around 80 members in a little over a week!

🧩 A Word From Our Sponsor: Heyday 🧠

Do you have 100+ browser tabs open right now? 😬

Give your memory a boost with Heyday, the research tool that automatically saves the content you view, and resurfaces it within your existing workflows. 👩💻

It’s like cheat codes for your memory. 😲💡

🧩 Give your memory a boost today 🧠

🏦 💰 Liberty Capital 💳 💴

🔥 Microsoft Q2 Highlights 🔥

I can’t believe that Azure is still growing 46% (without the foreign exchange impact) at this scale. And this is with rumors about supply chain constraints and some of their data-centers being low on chips and running in the yellow… (what’s the 🐔 and what’s the 🥚?)

A few highlights from the Q2 conference call (yea yea, fiscal Q4):

Amid this macroeconomic environment, the Microsoft Cloud surpassed $25 billion in quarterly revenue for the first time, up 28% and 33% in constant currency.

$100bn+ annual run rate for MSCloud as a whole! Not only is this *gigantic*, but it’s also pretty much all sticky high-margin cashflows.

Azure: We are seeing larger and longer-term commitments and won a record number of $100 million-plus and $1 billion-plus deals this quarter.

They’re probably trading some pricing for longer commitments, but the predictability is probably worth it.

Our new Microsoft Cloud for Sovereignty helps public sector customers meet urgent compliance, security and privacy requirements.

This is very much in line with what Matthew Prince at Cloudflare has been saying is an increasingly important use case for customers.

Making sure that data follows various regulations about where it’s stored, computed, and where it passes through is a benefit to those who have locations in more countries and the software logic to guarantee that those rules are followed.

In this environment, we are focused on 3 things: first, no company is better positioned than Microsoft to help organizations deliver on their digital imperative so that they can do more with less. From infrastructure and data to business applications and hybrid work, we provide unique differentiated value to our customers. Second, we will invest to take share and build new businesses and categories where we have long-term structural advantage. Lastly, we will manage through this period with an intense focus on prioritization and executional excellence in our own operations to drive operational leverage.

Looks like they intend to use their strength during the downturn to gain over weaker competitors that may have to slow down and turn from offense to defense (well, it’s a question of degree — MS will also get more defensive, but maybe not as much as others).

When it comes to AI, we are seeing a paradigm shift as the world's large AI models become powerful platforms themselves. With our Azure OpenAI service, a diverse set of customers from HSBC, PwC and RTL Group to Shell and Wipro are applying language models to advanced scenarios like content and code generation. [...]

GitHub Copilot is the first-of-its-kind AI pair programmer, which helps developers write better code faster. More than 400,000 people have subscribed since we made it generally available a month ago.

They also mention that their security segment revenues are up 40% year-on-year 🔥

On Xandr and Netflix:

We closed our acquisition of Xandr last month and now power one of the world's largest marketplaces for premium advertising. [...]

Just 2 weeks ago, Netflix chose us as its exclusive technology and sales partner for its first ad-supported subscription offering, a validation of the differentiated value we provide to any publisher looking for a flexible partner willing to build and innovate with them.

I guess you can say that was a well-timed acquisition. I’m sure that ‘bagging Netflix’ wasn’t on the deal model.

How they’re dealing with the macro environment:

Overall, we're not immune to what's happening in the macro broadly, right? [...]

in some sense, businesses trying to deal with the overall macroeconomic situation and trying to make sure that they can do more with less. So for example, moving to the cloud is the best way to shape your spend with demand uncertainty, right? [...]

We are incenting even our own field to ensure that the bills for our customers come down. And that, in fact, even shows up in some of the volatility in our Azure numbers because that's one of the big benefits of the public cloud. And that's why I think coming out of this macroeconomic crisis, the public cloud will be even a bigger winner because it does act as that deflationary force. [...]

there are 2 numbers that I talked about. One is the triple-digit growth in Cosmos DB and triple-digit growth in container app services. You take those 2 things and you say, what are people doing? People are writing applications at a completely different frontier of efficiency, which is cloud-native serverless container-based types of applications. And so to me, that's one of the way for you to make sure that your IT spend goes a long way in a time like this.

Friend-of-the-show C.J. Oppel shared this 2-year-stack by division:

Not only did Azure more than double, but Search + Ads is #2, which I wouldn’t have guessed.

But that includes LinkedIn (“LinkedIn Talent Solutions surpassed $6 billion in revenue over the past 12 months, up 39% year-over-year. And LinkedIn Marketing Solutions surpassed $5 billion in annual revenue for the first time”) and some Bing revenue comes from third parties that use its API, like DuckDuckGo (they’ve been growing fast), so I suppose it makes sense. MSFT 0.00%↑

🇨🇳 Jack Ma to give up control of Ant Group 💸

It feels like Chinese entrepreneurs and celebrities are only ever renting their success from the government.

If they ever become *really* successful and influential, then they get on the radar of the regime and <things> start happening to them (they get into legal problems, some disappear, some die, some give up control of their companies, some are erased from recorded history…).

Billionaire Jack Ma plans to relinquish control of Ant Group, people familiar with the matter said, part of the fintech giant’s effort to move away from affiliate Alibaba Group Holding Ltd. after more than a year of extraordinary pressure from Chinese regulators.

“Pressure” is a nice euphemism for what happened…

The authorities halted Ant’s $34 billion-plus IPO in 2020 at the eleventh hour and are forcing the technology firm to reorganize as a financial holding company regulated by China’s central bank. As the overhaul progresses, Ant is taking the opportunity to reduce the company’s reliance on Mr. Ma, who founded Alibaba.

[Jack Ma] has controlled Ant since he carved its precursor assets out of Alibaba more than a decade ago. Over time he built it into a company that owns the Alipay payments network with more than one billion users, an investing platform that houses what was once the world’s largest money-market fund, and a large microlending business. Ant was expected to be valued at more than $300 billion had it gone public. [...]

Mr. Ma doesn’t hold an executive role at Ant or sit on its board, but is a larger-than-life figure at the company and currently controls 50.52% of its shares via an entity in which he holds the dominant position.

🛫 Heico’s biggest acquisition ever 🛰

The Electronic Technologies Group acquired Exxelia International in France for €453 million in cash (plus assuming €14 million of liabilities and the management will still own about 5%).

Exxelia is a global leader in the design, manufacture and sale of high-reliability, complex, passive electronic components and rotary joint assemblies for mostly aerospace and defense applications, in addition to other high-end applications, such as medical and energy uses, including emerging "clean energy" and electrification applications.

Among Exxelia's products are high-end capacitors, resistors, inductors and complex slip rings. Exxelia produces over 50,000 discrete part numbers, which it provides to over 3,000 customers worldwide.

50,000 SKUs!

They have 2,100 employees and 676,000 square feet of plants and offices at 11 locations around the world.

The transaction would be HEICO's largest-ever acquisition, in terms of purchase price and revenues.

Exxelia is expected to generate approximately €190 million in revenue during the calendar year ending December 31, 2022, of which approximately 60% is expected to be generated in European markets, with the remaining sales occurring in the United States and other international markets. HEICO did not disclose Exxelia's income, but noted that the company meets HEICO's pre-intangibles amortization operating income margin criteria, though it is less than the ETG's average Margin.

So that’s around 2.3x sales, and while we don’t know operating income or EBITDA, we can take some guesses based on what they say about it being below ETG’s average (which has been a little under 30% lately).

For example, if they have 25% margin, that’s about 9.5x. HEI 0.00%↑

Visa & Mastercard facing Durbin 2.0? 💳

Two U.S. senators are preparing legislation that would give merchants power to process many Visa and Mastercard credit cards over different networks.

The bill, which could be introduced as soon as this week, aims to create more competition among U.S. credit-card networks, a sector where Visa and Mastercard have long dominated. [...]

The bill would mandate that merchants in many cases have the right to route payments through an unaffiliated network. This would apply on Visa or Mastercard credit cards that are issued by banks with more than $100 billion in assets. [...]

Visa and Mastercard handled roughly 77% of all general-purpose credit-card spending last year that occurred on cards issued in the U.S.

Tom Noyce, who knows a thing or two about payments, is skeptical that competition would center on the network fees. V 0.00%↑ MA 0.00%↑

For more on payments, check out this recent podcast I did with MBI:

🧪🔬 Liberty Labs 🧬 🔭

Deepmind Alphafold: Computation Protein Structure Prediction 🧬🔍🤖

Above is a top-down view of the human nuclear pore complex, the largest molecular machine in human cells. It’s made up of around 1,000 proteins, and until Alphafold, we couldn’t figure out its structure (more on this in Nature).

Yesterday, something pretty big happened in biology:

In partnership with EMBL’s European Bioinformatics Institute (EMBL-EBI), [Deepmind is] now releasing predicted structures for nearly all catalogued proteins known to science, which will expand the AlphaFold DB by over 200x - from nearly 1 million structures to over 200 million structures - with the potential to dramatically increase our understanding of biology.

To give an idea of the scope of change, the purple dot is experimentally derived protein structures and the blue circle are the newly released ones:

This treasure trove includes proteins from plants, bacteria, animals, and other organisms.

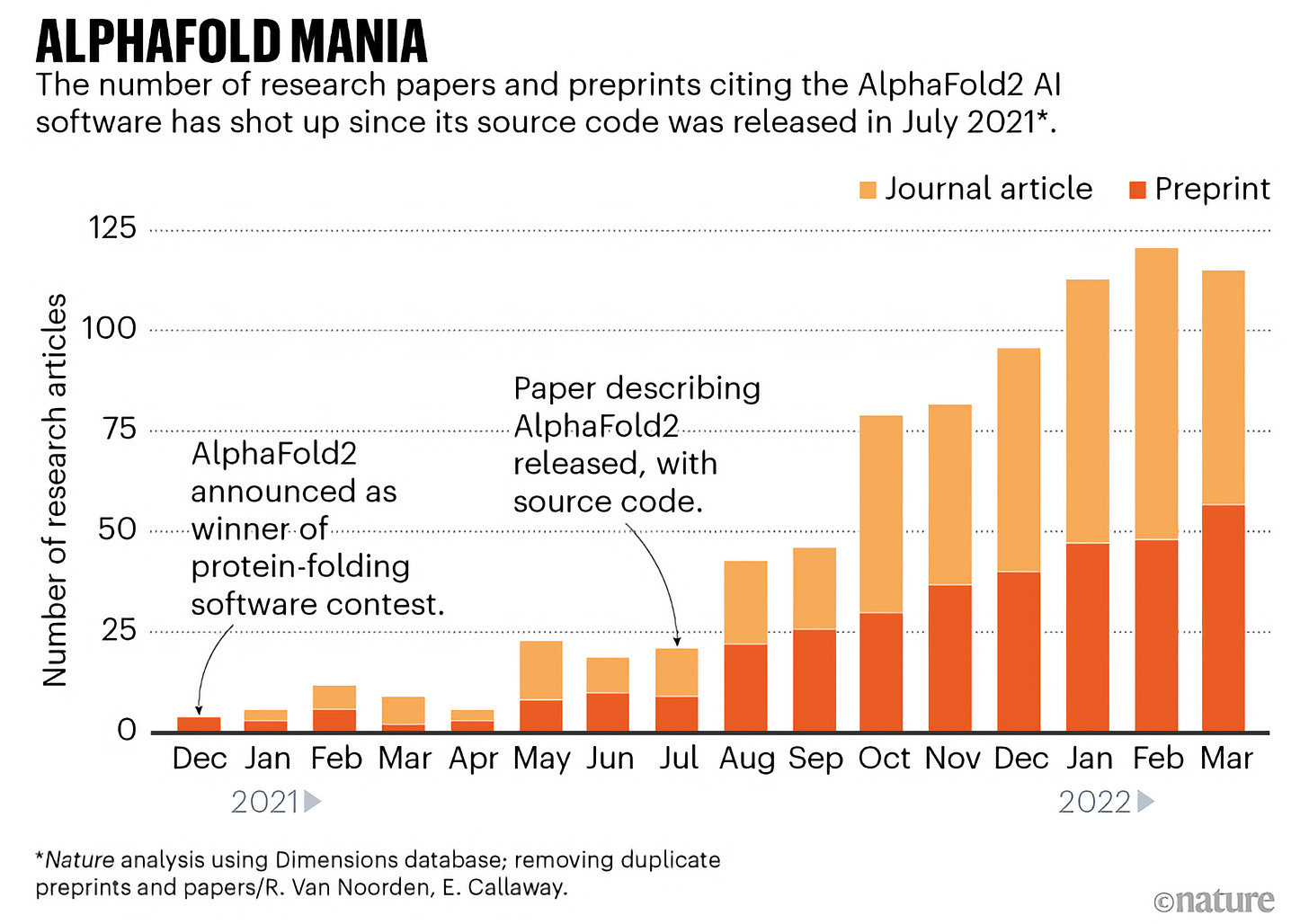

It hasn’t even been that long, but scientists have been using the tool and the data (the code for Alphafold has been open-sourced and a database of structures is freely available):

All 200+ million new structures will also be available for bulk download via Google Cloud Public Datasets, so I think we can expect a lot more experiments and studies to make use of them.

More on Deepmind’s announcement here. More to understand why knowing protein structures is useful here. GOOG 0.00%↑

🎨 🎭 Liberty Studio 👩🎨 🎥

📻 Ted Gioia on Arts vs Entertainment, the music industry vs tech, and more 🎶 🎹 🎸

I *really* enjoyed this conversation that friend-of-the-show Truang Phan had with Ted Gioia about music, entertainment, and art, and their relationhip — sometimes friendly, sometimes adversarial — to technology and business:

There’s a part near the end that I want to highlight. Ted gives his definition of “entertainment” and “art”, and I found it insightful.

I’m paraphrasing, but he says that “entertainment” gives the audience exactly what they want; “You liked that Spiderman movie? Here’s another one just like it. You liked that song? I’ll make another one that sounds the same...”

While “art” may give you some of what you want, but it also forces you to adapt to it (rather than the other way around). That’s how it can expand your horizons, take you to new places, and help you grow.

I love that.

I have 75% conviction that Search and News Advertising as disclosed by Microsoft doesn't include Linkedin Marketing Solutions.

Congrats on the Milestone! well deserved I would say.

On Microsoft Cloud for Sovereignty, isnt this bad for Cloudflare from a comp perspective? I thought they were building this type of services grounds up vs. trying to hack their way.