319: Post-Acquisition Trajectories, Qualcomm Server CPUs, Amazon.com, Diablo Canyon, Koyfin, China's Hydro, Grand Theft Auto's 1995 Design Docs, Mad Men

"Making great work is its own reward"

In every battle there comes a time when both sides consider themselves beaten, then he who continues the attack wins.

—Ulysses S. Grant

🏔🚶🏻♂️🚶♀️🚠 While on vacation in Mont Tremblant last week, my wife and I had a couple of days without the kids (they were at my parents’), so we decided to walk up the mountain.

We looked at the map of the various trails, and most of them zig-zagged up the slopes to keep the incline not-too-steep, so it took hours to get to the summit.

One of the trails went straight up and was rated as taking only “60-90 minutes”, so we took that one.

Boy, that mountain was higher than I expected!

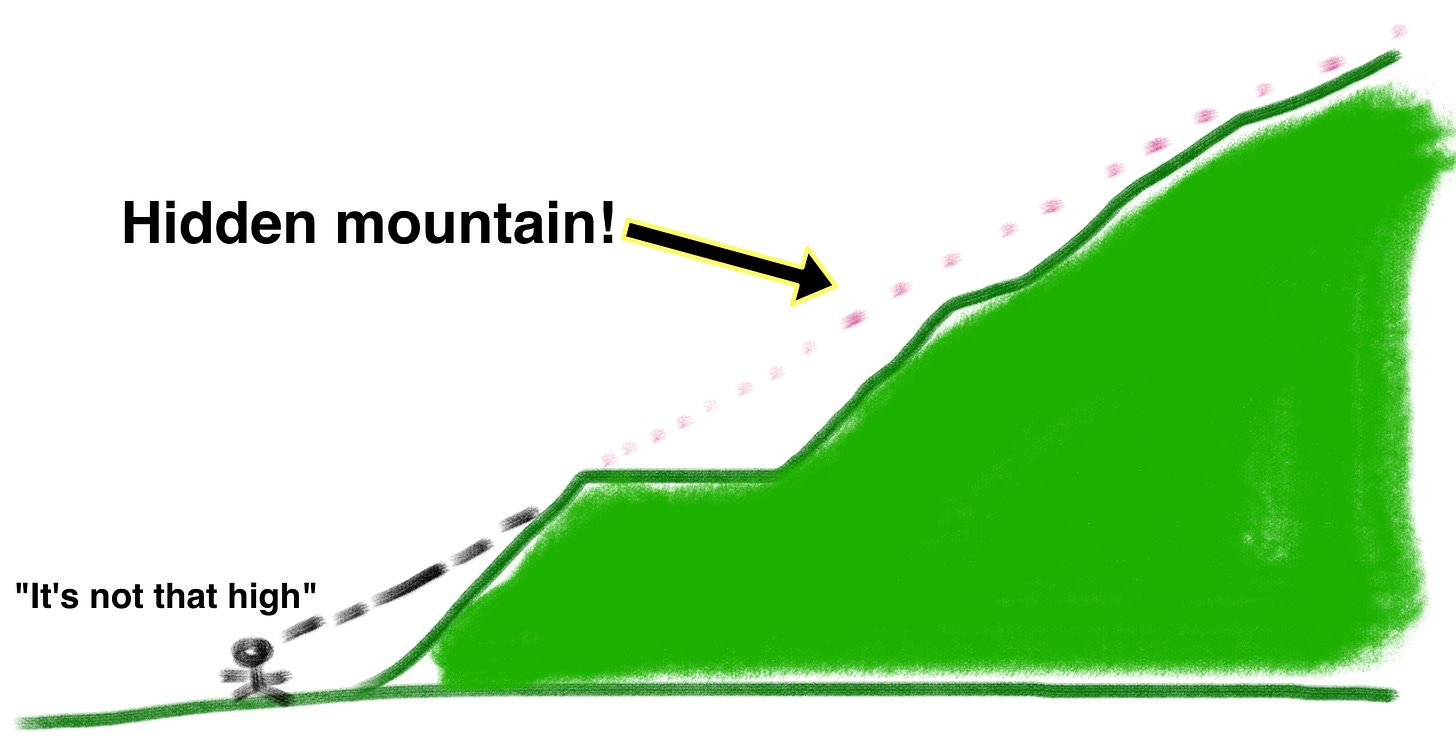

There’s an interesting optical phenomenon that prevents you from seeing how high it really is when you’re at the bottom. It turns out that 3/4 of it was in that blind spot that you can’t see when you’re in the resort village.

So yeah, it was quite a challenge, but once it was done, it felt great to have accomplished. I was wearing my Xero minimalist shoes and a lot of the trail was on pointy rocks and rough gravel, but it was fine. I definitely felt very connected to the ground…

We only saw two other people on our trail the whole way, making it feel more like an adventure!

The view from the summit was grand (and as usual, photos don’t do justice to what you see — and feel — in person).

We took a cable car to get down, though… 🚠

💚 🥃 While I was on vacation, we passed the 11,000 total subs mark on this steamboat! 🚢

We’re almost at a full Hobart (which is my yardstick, based on the 12,000 subs that friend-of-the-show and Extra-Deluxe supporter (💚💚💚💚💚 🥃) Byrne Hobart had when I started out 2 years ago):

Things are going less well on the supporter front… We’re now at just 3% supporting the project vs 97% not paying a cent. 🥹

That’s starting to feel unsustainable to me 🤔

A Word From Our Sponsor: 📈 Revealera 📊

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products.

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo.

🏦 💰 Liberty Capital 💳 💴

💸 Post-Acquisition Trajectories 🏗🛠 (Instagram, Youtube, Android, Booking, etc)

All the way back in the Paleoproterozoic era of edition #46, I wrote:

One thing that I always think about when the topic of many of the all-time-great acquisitions pops up is “how much was actually acquired and how much was built by the parent company after the acquisition”.

It’s too easy to say “Look, Google bought Youtube for $1.65bn and now it’s worth $XXXbn, so they have turned $1.65bn into $XXXbn!”.

It’s a hard question, because a lot of the time, even if not much is acquired and almost everything is built afterwards, *it may not have been built without the initial spark/prime mover that was the acquisition*.

But I think a lot of the time, too much value is assigned to the original acquisition, as if the same outcome was inevitable even without the deal. You hear about how they paid X for something and now it’s worth 100X, but it matters to the return if after the acquisition they invested 20X to get it there.

Would Instagram be Instagram if they had stayed independent? Would Booking be as big? Would YouTube or Android have won dominant positions as stand-alones? How about National Indemnity for a more clear-cut case… Probably ‘yes’ for some of them, but likely ‘no’ for others. It’s hard to untangle.

This question is interesting enough to dig a bit deeper into it, and into the various trajectories that I’m seeing companies take after acquisition.

You need to get a few things right to have a truly spectacular result:

If you have a great company with a bright future (say the blue line above) that gets acquired by some large company that makes it worse than if it had been standalone (usually through bureaucracy, bad leadership, dilution of focus into the larger entity, inability to attract or retain talent, internal politics, etc — *cough* Yahoo *cough*), you can get the red line.

But if you have a company with real product-market-fit (blue line) that gets acquired by a company with a lot more resources, know-how, talent, missing pieces of the puzzle that are difficult to replicate, and good leadership that provides focus, you can get a turbo-charging that turns the blue line more into something like the green line (which is probably what happened to Youtube, Instagram, etc).

It’s not that these companies were necessarily always destined to do as well and become as big as they became — we’ll never know for sure without the ability to rerun history, but we can make informed guesses.

YouTube without Google was having trouble keeping up with the infrastructure needs of serving up all that video back in the day when bandwidth, storage, and CPU cycles were *a lot* more expensive than they are today and few companies had true expertise scaling something that large globally. 🌏

They also didn’t have Google’s expertise with digital ads (targeting, customer self-service and auctions, etc)… So who knows what may have happened if the company had stayed independent (same for Twitch and Amazon).

Similarly, Instagram had great traction, but it didn’t have the ad engine to monetize, and who knows how Facebook may have decided to compete with it by building its own clone if it hadn’t been able to buy it (product matters, but so does distribution).

It’s very possible that Instagram may still have had great growth and success, but may have been a more Twitter or Snapchat-sized company rather than the juggernaut that it is today.

This is all just speculation, of course, but it’s the kind of framework I try to use when I think about historical acquisition — how much was acquired and how much was later built under the same name, but provided by the acquirer — and about new acquisitions — is this acquirer likely to nudge things in the green line direction, or the red line?

GOOG 0.00%↑ BKNG 0.00%↑ META 0.00%↑ AMZN 0.00%↑

🚚 📦📦📦 Amazon: 4+ Hours podcast on the retail business

Friends-of-the-show Ben and David (💚 🥃) recently released an opus on Amazon, and because I was on vacation I’ve only heard half, but it was great:

The good news is that there’s another symphony coming out soon about just AWS, which should be just as good if not even better! (what can I say, big warehouses full of computers > big warehouses full of random consumer products ¯\_(ツ)_/¯) AMZN 0.00%↑

‘Toyota, CATL Shut Plants in Sichuan as Power Crisis Worsens’ 🇨🇳 🔌

Business is built on top of energy infrastructure (never forget it):

Toyota Motor and [CATL], the world’s top battery maker, are closing plants in China’s Sichuan province as a drought-induced power crisis worsens. [...]

CATL has about 100 gigawatts of existing & planned capacity in the province, the most after Fujian. […]

the factory shutdowns add to a growing number in industries from solar panels to aluminum smelting. Volkswagen said.. that its [Chengdu] factory is affected by power shortages [...]

Sichuan, one of China’s most populous provinces, is highly reliant on hydropower. That makes it particularly vulnerable to a heat wave and drought that’s pushing up air-conditioning demand and drying up reservoirs behind hydro dams. It’s a key manufacturing hub and is also important for the production of materials including polysilicon and lithium that are vital to the energy transition. (Source)

As great as hydropower is when it works — and I live somewhere that gets pretty much 100% of its electricity from it — it does depend on nature’s whims to work.

It’s more predictable/reliable than wind and solar, especially if you have large reservoirs and aren’t doing run-of-the-river, but you’re still vulnerable to droughts…

🔥 Koyfin’s brand new equity screener 📊

My friends at Koyfin just released a pretty big feature that I’m sure has been one of the most requested one for a while: An equity screener.

Here are the details:

Disclosure: I have a small private investment in the company — but I invested *because* I had been using the product daily for a long time and loved it; I don’t love it because I invested… so basically, I’m not just *saying* it’s great, I put my money where my mouth is.

🧪🔬 Liberty Labs 🧬 🔭

U.S. Navy Aviator reacts to DCS simulated dogfights

While it’s fun to look at ‘realistic’ games like DCS to get an idea of what the real-deal may look like, it’s also good to do a reality-check once in a while with someone who’s been there.

This F-35C pilot does just that.

Diablo Canyon ☢️ 🇺🇸

California Gov. Gavin Newsom, D, is proposing to keep the two units of the Diablo Canyon nuclear plant online until 2029 and 2030 – as opposed to shuttering the facility entirely by 2025 – while also exploring the option of extending the plant’s life through 2035.

Proposed legislative language released Friday includes a $1.4 billion loan from the state’s general fund to Pacific Gas & Electric, the operator of the plant, to cover the cost of relicensing the 2.2 GW nuclear plant.

For context, that 2.2GW plant produces about 6% of California’s electricity.

One plant powers 1/20th of the US’ most populous state. Not bad.

Last year, researchers at Stanford University and the Massachusetts Institute of Technology published a report concluding that California could reduce power sector emissions by 10% from 2017 levels and save $2.6 billion by keeping the plant online through 2035.

What a concept. With everything going on in California, not shutting down a large chunk of its clean, reliable baseload power for ideological reasons seems like a pretty good idea.💡

The costs are probably pretty small compared to the costs of an unreliable grid… What are the societal costs of shortages of power and blackouts, the missed opportunities because heavy energy users go elsewhere, where power is cheaper and more reliable? Not to mention the environmental costs of having to depend on natural gas to replace these 2.2GW (especially when the sun isn’t shining, which is every evening and whenever it gets cloudy).

California has over 30GW of natural gas capacity and thought closing its last nuclear plant would help it decarbonize?

🎮 ‘Grand Theft Auto’ design document (1995) 🚗 🚓

Note that this is for the game that came out in 1997 and looked like this:

The working title was “Race’n’Chase”!

Qualcomm Server CPU (again) 🤔

After trying to get into the server market with ARM chips in 2017 and then shutting down the effort, Qualcomm is trying again, this time with the Nuvia team that they acquired last year (founded by ex-Apple people):

Qualcomm’s return to the server business will require a rebuilding of trust among the prospective customers it courted the last time. The industry also has changed dramatically in the past few years. Amazon has developed homegrown processors for servers, though it also buys chips from other vendors. And startups such as Ampere Computing LLC have made inroads, winning contracts with customers such as Microsoft Corp. [...]

according to the people, who asked not to be identified because the discussions are private. Amazon.com Inc.’s AWS business, one of the biggest server chip buyers, has agreed to take a look at Qualcomm’s offerings

This won’t be easy. Some context on Qualcomm and CPUs:

Despite having a near-monopoly on high-end Android phone CPUs, Qualcomm isn't really a CPU company.

Qualcomm SoCs feature CPUs straight from ARM, the same as many other vendors like Mediatek, Samsung, and Huawei's HiSilicon. What keeps Qualcomm on top is all the non-CPU parts—mainly its hyper-aggressive licensing around its modems and cellular patients.

Qualcomm owns enough basic cellular patents that you need a license from them to sell a phone no matter what, and by bundling a cheaper patent license with its own chips, Qualcomm can squeeze out the competition. Qualcomm does some good work in GPUs and modem design, but it has never paid much attention to the CPU part of its SoC offering and is currently several generations behind the market leader, Apple.

😬

🎨 🎭 Liberty Studio 👩🎨 🎥

🚬🥃 The great Mad Men rewatch of 2021-2022 is over

That’s it. It’s done. Over. My wife and I watched the series finale of Mad Men.

It’s hard to do endings, especially with large ensemble casts, but I think they pulled it off (as Six Feet Under did).

What a great show, what an accomplishment to create and execute it to that consistent level of quality (writing, acting, photography, sets, costumes, music, etc).

How much care and attention to detail went into it!

It must be great to be part of a team creating a show like that — the closest that I can analogize it in my life is being part of a startup that is getting traction. Making great work is its own reward, but it’s also great when the rest of the world agrees.

Great memo today my friend, really enjoyed the M&A segment. Congrats on 11,000 too, i am not far behind 🏃♂️🏃♂️🏃♂️

"Things are going less well on the supporter front… We’re now at just 3% supporting the project vs 97% not paying a cent. ... That’s starting to feel unsustainable to me 🤔"

I think you're making a mistake chasing that 5% mark. 3% of a growing number will get you to the absolute dollars you need, eventually. 2% of 20k is better than 5% of 5k. And look at that curve turn upward starting in March/April of this year. Keep it going, Lib!