320: Lots of Thoughts on Nvidia Q2, Intel + Brookfield Asset Management, South Korea Fertility, Japan & Nuclear, Su-57 vs F/A-18 Super Hornet, and Treme

"Always remember that *you* can change"

Prediction depends on events outside your control.

Creation depends on events within your control.

Don’t guess about the future. Shape it.

—James Clear

🎭 Good advice from a friend-of-the-show and supporter Andrew Wilkinson (💚 🥃):

A simple insight that sounds depressing but makes life a lot easier in the long run:

Never expect people to change.

In your romantic, personal, and work life.

Most people generally continue their pattern of behaviour...

I'm not saying people don't change.

They do.

But typically only after a breakthrough/rock bottom disaster, which most people never go through...

Of course, there are obvious exceptions.I'd add this:

Never expect *others* to change

Always remember that *you* can change

It's the mindset that leads to the best results, IMO.

It's a bit similar to:

Filter what others say through the most charitable interpretation

Pre-filter everything you say through the least charitable interpretation (to avoid being misunderstood or accidentally hurting others)

💚 🥃 Creating this newsletter and publishing it 3x a week, along with podcast interviews, written interviews, and other special projects that I haven’t made public yet… it’s a full-time job.

I hope I bring a lot of value to you — information, entertainment, curation, and discovery of things you wouldn’t have stumbled upon otherwise.

If you want the project to continue, please consider becoming a paid supporter — it’s quick and inexpensive. 🤜 🤛

🧩 A Word From Our Sponsor: Heyday 🧠

Do you have 100+ browser tabs open right now? 😬

Give your memory a boost with Heyday, the research tool that automatically saves the content you view, and resurfaces it within your existing workflows. 👩💻

It’s like cheat codes for your memory. 😲💡

🧩 Give your memory a boost today 🧠

🏦 💰 Liberty Capital 💳 💴

🛞 Nvidia Q2 😬

As the company warned about a few weeks ago (and I wrote about in edition #317), Q2 was pretty rough, especially on the gaming side (which includes a lot of crypto-related sales).

Q2 revenue of $6.70 billion, up 3% from a year ago and down 19% QoQ 😬

Gaming revenue of $2.04 billion, down 33% YoY and down 44% QoQ 😬😬😬

Data Center revenue of $3.81 billion, up 61% from a year ago 🔥🔥

Automotive revenue of $220 million, up 45% YoY and up 59% QoQ 🔥

Gross margin 43.5%, down 22% Q/Q 😬😬

“Gross margin includes $1.22 billion in charges for inventory and related reserves based on revised expectations of future demand and $122 million for warranty reserves.” 😬😬

“These charges incurred in the quarter reflect purchase commitments that we made during a time of severe component shortages and our current expectation of ongoing macro uncertainty. We believe our long-term gross margin profile is intact.” (this is largely to TSMC and Samsung fabs)

The situation reminds me a bit of what happened to Amazon post-pandemic. Knowing what we know now, it’s easy to say that they overbuilt, over-ordered, over-hired, and expected growth that didn’t materialize, so now they’re stuck with higher expenses and lower revenues, which cut them twice… 🔪

But as I wrote about Amazon’s Q1 results in edition #275, it’s only with the benefit of hindsight that what they should’ve done is clear. It wasn’t nearly as obvious at the time with the lead times that they’re dealing with. Everything they do has to be decided many months — sometimes a year+ — in advance.

How much capacity do you want to buy with TSMC and Samsung’s fabs? That decision was made a long time ago. How much inventory to manufacture and send through the channel? You can’t change that overnight.

And if things had played out differently — crypto was roaring to the moon, the Ethereum proof-of-stake switch was seeing delays again, the economy was strong and demand for gaming GPUs and laptops were robust — it’s very possible to imagine a scenario where Nvidia had played it more carefully with fab capacity and inventory and didn’t have enough product on hand to sell into the demand, which would be pretty terrible considering the margins they’re making on everything they sell.

I feel like they took logical steps to try to minimize crypto exposure risks — the reduced hash rate on gaming cards, creating the crypto-specific CMP line, etc — and it’s hard to blame them for not being able to predict crypto cycles and economic cycles many months in advance. If they could do that, they wouldn’t have to design semiconductors, they could just open up a macro fund ¯\_(ツ)_/¯

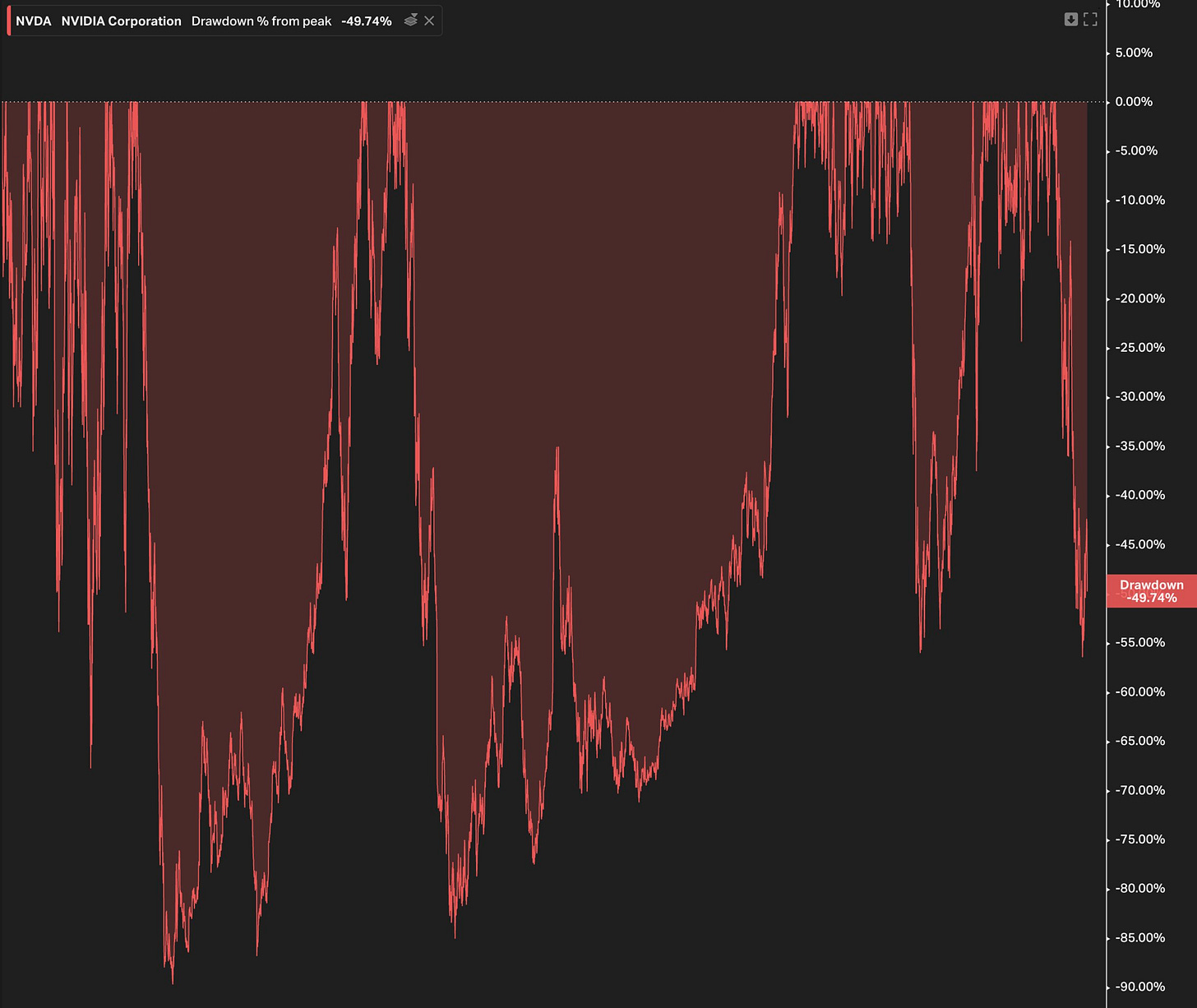

I posted this chart before, but I think it’s worth posting again:

Semiconductors is a cyclical industry, and while there’s been secular demand trends and some consolidation that has helped smooth out some things, the cycle hasn’t been tamed.

The chart above shows Nvidia stock drawdowns since 1999.

During that period, the stock increased 47,000% at a 29.8% CAGR over 23.5 years (and that’s with the recent 50% drawdown. At peak, it was up 95,000% at a 35% CAGR over 22.5 years).

Here’s another chart that I think illustrates Nvidia’s transformation over time:

Back in early 2017, the data-center segment barely registered.

Now, it’s the biggest segment and helps compensate for the air pocket in gaming (caused by a mix of things: Crypto crash, bad economy, post-covid slump, new generation of GPUs coming soon, Russia’s war in Europe, etc).

Some highlights from Nvidia’s Q2 call:

NVIDIA's GeForce GPUs are the most coveted brand by gamers, representing 15 of the top 15 most popular GPUs on Steam.

Not a bad stat, though AMD is not to be underestimated.

Estimated GeForce sell-through is up over 70% since before the pandemic, and peak concurrent users on Steam are also up more than 70% over the same time period.

While the pandemic has distorted things and made them hard to predict, it does seem like the underlying secular trend of gaming becoming ever more popular is still going strong.

GeForce Now registered members now exceed 20 million. This quarter, we added 80 more titles, including the hugely popular Genshin Impact, bringing our total to over 1,350.

This is their game-streaming service, which runs the game in the cloud and streams the video and audio outputs to your screen. I suspect we’re still very early in the growth of this.

In the data-center:

Although a record, this was somewhat short of our expectations as we were impacted by supply chain disruptions.

Revenue from hyperscale customers nearly doubled year-on-year. Sequentially, sales to North America hyperscale and cloud computing customers increased but were more than offset by lower sales to China hyperscale customers affected by domestic economic conditions. [...]

The Chinese hyperscalers and the Chinese Internet companies really, really slowed down infrastructure investment this year, particularly starting in Q2. This slowdown can't last forever. And the number of new technologies in software, the number of people who are using clouds and the number of cloud services is continuing to grow. And so I fully expect investment to return.

They're a very important market for us, a very large market for us. And the fact that North American hyperscalers doubled year-over-year, our revenues at North American hyperscalers, and that was offset by declines in China, says something about the slowdown in China.

Wow, so if China didn’t have that slowdown and they had the supply to meet demand, how much would data-center have grown..? Sounds like “a lot”.

While Tesla has been developing its own Dojo chips, they’re apparently still using plenty of Nvidia:

Tesla recently upgraded its supercomputer to use over 7,000 A100 GPUs for autopilot training.

One cool thing about Nvidia putting so much emphasis on software (not just hardware), is that customers benefit from improvements even after they bought the iron:

Last month, we announced an update to the NeMo Megatron framework that can speed up the training of large language models by up to 30%. Improving a multi-hundred million-dollar AI infrastructure by 30% translates to significant value for customers.

Here’s Jensen on data-center demand:

on data center end markets, we hear fairly broadly that GPU supply is in shortage in the cloud. We hear quite broadly that demand for GPU rentals far exceeds current supply.

This makes sense when you consider just how big machine-learning models are getting, how fast they’re growing, and how many more companies are finding use-cases for them.

Pretty much every big tech company is using recommenders, every car company is trying to create self-driving cars and so have craploads of data coming in, and very large language models and transformers are having their moment in the sun… All of this requires *a lot of compute*.

Jensen mentioned that Hopper — their new generation of data-center chips — is now in “full production”, and they expect to ship “substantial Hoppers in Q4.” Part of the delay is Nvidia has to wait for Intel’s new CPUs, which are delayed…

Here’s Jensen on gaming market demand and on why Hopper is a big deal:

we are selling in or we're selling far below market sell-through. And the reason for that is to allow the inventory, the channel inventory and the OEM inventories to correct. And this allows us to prepare for our next generation. And our next generation has Hopper for compute, but we also have the next generation for computer graphics that will be coming to market.

Hopper is a giant new generation because it is designed to perform this new type of AI model called Transformers.

It has an engine inside it called Transformer engine, with numerical formats and pipelines that allows us to do a spectacular job on Transformer-type of models, which includes large language models, but it also includes computer vision models that are now able to be processed with this new type of AI model called Transformers.

And so I fully expect Hopper to be the next springboard for future growth. And the importance of this new model, Transformers, can't possibly be understated and can't be overstated. The impact of this model across robotics, computer vision, languages, biology, chemistry, drug design, is just really quite spectacular. And I'm sure that you've been hearing about this new breakthrough in AI, and Hopper was designed for this.

🦾🤖

I liked how the CFO described what they do:

we're almost putting together a full data center for our customers and getting it shipped out.

Final note on the automotive segment:

Our Automotive revenue is inflecting, and we expect it to be our next billion-dollar business.

Autonomous driving is one of the biggest challenges AI can solve, and computing opportunity for us spans the data center to the car. Autonomous driving will transform the auto industry into a tech industry. Automotive is one of the first to transform into a software-defined tech industry. But all industries will be.

Computers on wheels 🚙 💻 NVDA 0.00%↑

👋

Intel + Brookfield Asset Management ($30 billion deal to finance fabs) 💰💰💰 🤔

Gelsinger is really trying to find all the big bucks that he can:

Under the deal, which company executives described as a first of its kind for the industry, Intel would fund 51% of the cost of building new chip-making facilities in Chandler, Ariz., and will have a controlling stake in the financing vehicle that would own the new factories.

Brookfield will own the remainder of the equity and the companies will split the revenue that comes out of the factories, he added.

It’s not entirely clear how the deal is structured and whether BAM makes money just on being a landlord or if they also get a cut of the products — in which case, as friend-of-the-show Tren Griffin (🦞) points out, there are issues with transfer pricing because Intel would be a “partner, supplier, and customer.” INTC 0.00%↑ BAM 0.00%↑

🧪🔬 Liberty Labs 🧬 🔭

The Top Gun matchup *mild spoiler for Maverick*

I thought this was good at showing the capabilities of each plane and what thrust vectoring can do up close.

Here is another one showing a few rounds of the F/A-18 Super-Hornet against the Su-57 Felon:

🇰🇷 🤰🏻👩🏻🍼 South-Korea Fertility 📉 (not with a bang but a whimper)

That’s bad. From 6 children per woman to under 1 in one lifetime.

I know cynics always sound smarter, and nothing sounds smarter than the post-Malthusian misanthropic meme of “well, there are too many people anyway, humans are a disease on the planet and the sooner we’re gone the better, if we shrink we’ll be more sustainable, etc”

It may sound sophisticated at cocktail parties, but it’s a very bad take.

The planet is plenty big for many more billions of people, and the universe — as the JWST is reminding us — is nothing but endless space and resources, with nobody around to appreciate it (at least in most of it as far as we know). Expanding human consciousness and keeping our civilization vibrant enough to keep solving our problems is the way out, not a slow collapse into a zero-sum world…

Existence at all is so unlikely that it is a privilege, and we should be very careful about wishing non-existence on billions of future people based on shaky economic theories or temporary, solvable problems. After all, if our ancestors had stopped even trying because they were so sure there would never be enough food for 1bn+ people on the planet…

In the same way that a big city has more innovation, creation, entrepreneurship, cross-pollination between smart people, etc, than a small village, a planet with 10 billion people is more vibrant than one with 1 billion. We just have to decouple the number of people from various bad things (ie. It’s probably worse to have 1 billion people powered by coal and oil than 10 billion powered by nuclear and deep geothermal).

Back to South Korea:

The typical age of a new mother in South Korea is 32, according to the National Statistical Office. The number of births per woman sank to a record low of 0.84 last year, the lowest rate in the world; in Seoul the rate is 0.64. The United Nations estimates that by 2050, Korea’s share of elderly people will become the largest of any country. (Source)

It’s a tragedy. Too bad the human mind has trouble grasping the severity of events when they’re happening slowly… 🐌

I think an obvious solution is to massively increase worldwide efforts on curing and mitigating the diseases of aging to radically expand *healthy* and *youthful* life, but we’re also going to have more kids, because societies where the demographic pyramid flips around have all kinds of problems that aren’t easy to solve (especially not quickly — problems that are created slowly are rarely solved quickly).

Immigration helps, but fertility has been going down rapidly globally too, so moving people around can only help so much, and in the longer term we’ll need to really start caring about what gets in the way of people becoming parents and removing some of these roadblocks.

🇯🇵 Japan (re)turns to nuclear power ☢️

Prime Minister Fumio Kishida said Wednesday that the government will explore development and construction of new reactors as the country aims to avoid new strains on power grids that buckled under heavy demand this summer, and to curb the nation’s reliance on energy imports.

At the same time, Japan wants to restart seven more nuclear reactors from next summer onward, Kishida said at a government meeting on “green transformation.” That would bring the number of reactors brought back online after the 2011 Fukushima catastrophe to 17 out of a total 33 operable units.

Your turn, Germany.

🥃 Source.

🎨 🎭 Liberty Studio 👩🎨 🎥

Treme Season 1 🎷🎹 🎺 🎭👩🏼🍳🦐🍷

My wife and I are watching Treme (HBO, 2010, David Simon). It’s my second rewatch, and her first time.

We just finished season 1, and I found it just as good this time around. It’s a very underrated show, and I love the characters and the culture, but it’s not for everyone.

It’s mainly about artists, musicians, chefs, and entrepreneurs. There’s some cops & lawyers and violence, but that’s just part of the tapestry of life in post-Katrina New Orleans, it’s not the main focus.

Like David Simon’s better-known show, The Wire, the city is truly a character in the show, and a sense of place keeps everything grounded. It’s not a documentary, but it certainly tries to tell a version of truth about these people and what happened to them…

If you want to try it out, I recommend committing to at least 3 episodes. After that, you’ll know if it’s for you. Be warned, there’s lots of music in the show, and it takes its time with it, because music *is important* and not just a background element in the life of these people.

I was glad to hear that David Simon had a good experience making it:

Having more children to solve top heavy older populations is like a Ponzi scheme, no? I don't see any point in increasing cattle, cars, deforestation, and such when it's only kicking the can down the road. We won't be able to populate other worlds with significant amounts of people for decades at least so let's not encourage more offspring until we're ready.