469: The Market's Goal, Synopsys + Ansys, Nvidia, Spyderco, Intel AI Spin, Nuclear Arsenal Forgotten Secrets, Recessions Since 1860, and Searching for Bobby Fischer

"The real challenge is more about the dynamism"

Research widely, select carefully.

Broad funnel, tight filter.

—James Clear

🗓️🚦😁😐😔📲 I’ve been using a mood-tracking app for a few years. The one I use is called Daylio, but I’m sure there are many others.

At the end of each day, it prompts me to rate how I feel from 1 to 5, with 3 being neutral. I can also tag activities (ie. exercise, time with family, working, fasting, alcohol, being sick, walking in nature, seeing friends, extended family, etc).

Above is this year’s overview. Not bad!

Compared to past years: In 2020 I had 65 neutral “meh” days and 5 “bad” ones, largely because of the pandemic. In 2022, which also was a tougher year for various reasons, I had 72 “meh” days and 9 “bad” ones. No truly “terrible” 1-out-of-5 days yet!

This year, I recorded zero “bad” days and only 25 “meh” ones, which is the best year since I’ve been using this app (I started in Q4 of 2019).

Looking back, can I identify things to tweak to make 2024 even better?

A few things that are correlated with better days for me are exercise, walking outside (especially in nature), and setting time aside to read books.

🚨🛎️🗣️🗣️ The annual tradition continues:

I always enjoy chatting with David — it’s the 4th year that we do this type of interview. If you missed previous ones, you can find them linked at the top of the page if you follow the link above.

🖊️➰ Back in the intro of Editions #225 and #244, I told you about one of my little hobbies: doing cardistry tricks with playing cards.

I haven’t learned any new moves in a while, but I have muscle memory for about 4-5 tricks that are fun to do whenever I feel like fidgeting with something.

I feel like learning a new trick — but rather than stick with cards, I challenged myself to learn some pen twirls.

There are plenty of tutorials on YouTube. Here’s a good one.

I’m starting with the classic spin around the thumb. So far it seems impossible, but maybe after failing 10,000x something will click ¯\_(ツ)_/¯

🚢 👀 I just had a look at Substack’s stats, and this steamboat has had over 4 million views since inception in July 2020. That’s pretty cool!

💚 🥃 🐇🕳️ If you feel like you’re getting value from this newsletter, it would mean the world to me if you became a supporter to help me to keep writing it.

If you think that you’re not making a difference by becoming a supporter, that’s incorrect. Only 2% of readers are supporters (so far — you can help change that), so each one of you makes a big difference.

You’ll get access to paid editions and the private Discord, and if you only get one good idea here per year, it’ll more than pay for itself!

🏦 💰 Liberty Capital 💳 💴

📉 The Market’s Goal — The difference a year makes 📈

Humans believe that they *predict* the future, but they mostly just *extrapolate* the recent past forward (which, to be fair, is not always a bad strategy).

At the beginning of 2022, most people expected the continuation of 2021 (how did that turn out?).

At the beginning of 2023, most people expected the continuation of 2022 (…).

I like to think of the market as a mechanism optimized to confuse and inflict pain on the most number of people while still mostly going up over time.

That’s a tall order!

It would be a lot easier to achieve that if the market was purely random and evenly balanced between the positive and negative, but since it goes up about 2 out of 3 years, it needs to get creative to achieve its goal. Once in a while, it throws a low volatility year in the mix (like 2017) so that the next period of volatility feels worse, or a sideways rollercoaster ride (like 2011), or a sudden 15-20% correction (like in 2016 and 2018) to shake things up.

I have no idea what 2024 will be like. I only expect to be surprised ¯\_(ツ)_/¯

🇺🇸 US Recessions since 1860 🏚️

While complaints about the economy in the U.S. certainly haven’t decreased over time, the amount of time spent with shrinking GDP certainly has.

Is this because of government and central bankers?

Is it that more mature, more diversified, and more globally connected economies are inherently more stable than more concentrated and developing ones?

It’s likely a mix of a bunch of factors — but whatever the cause, I’ll take it.

The real challenge is more about the dynamism during the blue periods on the graph. We could be doing so much more to build a better future if only we could get out of our own way.

🫱🫲 Synopsys and Ansys are in merger talks 🤝💰💰💰

This is big.

Really big.

These software players are extremely dominant in their niches.

Synopsys and Cadence are the duopoly making the software used to design semiconductor chips (for example, Intel and Nvidia use it), and Ansys makes engineering simulation software used for countless use cases, from simulating consumer products to airplane engines to bridges, figuring out which materials to use to get certain characteristics, how to optimize manufacturing, simulate crash tests, etc.

The WSJ reports that Synopsys is looking to pay around $35bn for Ansys.

Before the recent report on the merger, the company’s market cap was around $26bn, well below its peak of about $36bn in late 2021.

The two companies are in exclusive negotiations, according to people familiar with the matter. A deal could come together as soon as the middle of next week, granted the talks don’t fall apart.

Synopsys is discussing paying around $400 per share for Ansys.

Cadence also tried its luck:

Cadence Design Systems, a rival company with a market value of almost $70 billion, initially approached Ansys with an unsolicited offer for the company, thereby putting it into play, the people said.

If a deal goes through, it will reshape that industry.

🇨🇳 Nvidia goes ahead with China chips 🤔

After some delays and uncertainty about whether they would be blocked by the US government, it looks like Nvidia will go ahead and make the China versions of its latest crop of chips (known as the H20, L20 and L2):

It was originally scheduled for launch last November but that plan was delayed, with sources telling Reuters at the time that the delay was due to issues server manufacturers were having in integrating the chip.

One of the people said initial production volume will be limited, with Nvidia set to primarily fulfil orders for major customers. [...]

Chinese companies are reluctant to buy the downgraded H20 and are testing domestic alternatives amid fear the U.S. could again tighten restrictions

I’m still very unsure about how the US is playing its hand here.

If they decide that they want to constrain China’s access to the type of compute necessary for cutting-edge AI, they probably should go a lot further than they are going.

Otherwise, it will just create an adaptive response in China, where a ton of resources will go to develop alternatives for both the hardware and software ecosystems.

Meanwhile, the sanctions seem to have quite a few loopholes and there aren’t enough enforcement resources to put a meaningful dent in smuggling. Isn’t it strange how a bunch of small countries are now HUGE buyers of GPUs? Could it be that these are passing through and ending up in China? Or in data-centers there that Chinese entities use remotely?

🤖 Intel spins out AI software firm 🐜

I’m rooting for Intel to succeed with its transformation/turnaround. Truly.

Partly because of its great history of innovation and excellence, and partly because I prefer to see multiple competitive players pushing each other to do their best and stay on their toes.

This is not only better for the industry, but it’s also better for the customers of these firms (ie. you and I, since we all use plenty of semiconductors both at home and in the cloud).

The firms themselves benefit from competition because, while they would all love to have a monopoly in the short term, in the long term it would make them bloated and mediocre and eventually cause their downfall.

With that context, here is Intel’s latest move:

[Intel] said it was forming a new independent company around its artificial intelligence software efforts [...]

Intel executives would not comment on the value of the deal or whether it would retain a majority stake in the new venture, other than to say the firm would have an independent board of directors and the chipmaker would remain a shareholder.

The new entity will NOT be publicly traded.

It will be called “Articul8 AI”.

A truly terrible name that was no doubt selected by a committee of consultants 😣

Hopefully, this partial spin will help Intel keep the focus on what really matters to its future and will help the AI firm have more focus and better incentives than as some tiny organization inside of the giant. We’ll have to see… But I’m personally more excited about Intel becoming a strong player in the GPU space to compete with Nvidia and AMD.

🔪 Knife-Maker Spyderco 🏭

This is a private company specializing in folding knives that I'd love to be able to learn more about — maybe visit the manufacturing plants, see the financials, talk to management about strategy, learn more about their history, etc.

It has been around for 46 years, still family-owned and run by founders, still experimenting and innovating with design and materials, loved and respected by customers. It has a great niche. It seems like a good business.

I found this video, which gives a quick overview of the history of the company and then looks at the manufacturing process. But it’s 8 years old and the company has evolved a lot since then, and it doesn’t go into the product design aspects or the financials.

Still worth watching:

🧪🔬 Liberty Labs 🧬 🔭

👨🔬 The U.S. Nuclear Arsenal’s Forgotten Secrets 💣 🪛😐💭🤷♂️

The U.S. nuclear arsenal is getting so old, and details about it are so secret, that the knowledge to reproduce some of the parts for maintenance is being lost over time:

There is no better single example of this than a material that the U.S. Department of Energy has used to build thermonuclear warheads, also known as hydrogen bombs, that is so secret that no one knows exactly what it does or exactly what it's made of, and that is only ever referred to publicly by a codename, Fogbank. [...]

Y-12 had closed down a top-secret and specialized site known as Facility 9404-11, which was used to produce Fogbank, following the completion of the final W76 warhead in 1989.

About a decade later, they decided to restart production but there was a snag:

In 2009, an article had also appeared in an issue of Nuclear Weapons Journal, an official publication of the Los Alamos National Laboratory (LANL), which disclosed that the decision to re-start manufacturing Fogbank came in 2000 [...]

In a bizarre twist, the new production facility and reverse-engineered production process yielded a version of Fogbank that was of a higher purity than it had been in the past, according to the article. The problem, however, was that for Fogbank to work as intended in existing warhead designs, that previous level of impurity was actually essential. NNSA had to revise the process to ensure the final product was just as impure.

NNSA only succeeded in recertifying the production process in 2008, the better part of a decade after first deciding to restart Fogbank production. (Source)

It took almost *a decade* to reproduce the original level of impurity to get it to work in the old system!

There’s a similar story with the Minutemen III ICBMs that were made in the 1970s:

"Let me be very clear: You cannot life-extend the Minuteman III [any longer]," [Adm. Charles Richard, head of U.S. Strategic Command] said of the 400 ICBMs that sit in underground silos across five states in the upper Midwest.

"We can't do it at all. ... That thing is so old that, in some cases, the drawings don't exist anymore [to guide upgrades]," Richard said in a Zoom conference sponsored by the Defense Writers Group.

Where the drawings do exist, "they're like six generations behind the industry standard," he said, adding that there are also no technicians who fully understand them. "They're not alive anymore." (Source)

I can’t imagine how much of that type of knowledge was lost in Russia and some of the former Soviet republics after the collapse of the USSR…

h/t Ethan Mollick

🗣️👂🏻🤖📝 SuperWhisper Mac App — Voice-to-Text for the AI Age

I tried SuperWhisper for Mac after friend-of-the-show Luke Burgis recommended it.

Very impressive!

It uses the OpenAI Whisper voice-to-text model and you can trigger the app from anywhere with a key-combo, so you can use it as text input in any app or have it send output to the clipboard to cut & paste anywhere.

To test it and push it to the limit, I’ve been speaking really fast and mumbling. Despite that, it made very few mistakes.

I upgraded to the paid version (there was a 40% off coupon for the holidays) and the Pro Model (1.5gb) is pretty great. I haven’t tried the Ultra model yet (3gb).

I expect to be speaking some of my newsletter from now on (I spoke this sentence).

❄️🛞❄️☃️ Snow Performance: FWD vs RWD vs AWD

Not that this is fully scientific, but quality anecdotal data can be useful — especially since they were able to isolate the variables fairly well by using the same vehicle and just changing the drivetrain between the various modes (RWD → FWD → AWD).

As an aside, it’s cool that Tesla allows you to do that. I wish I was able to set this manually in my dual-motor AWD EV6, if only to play around with it a bit.

🎨 🎭 Liberty Studio 👩🎨 🎥

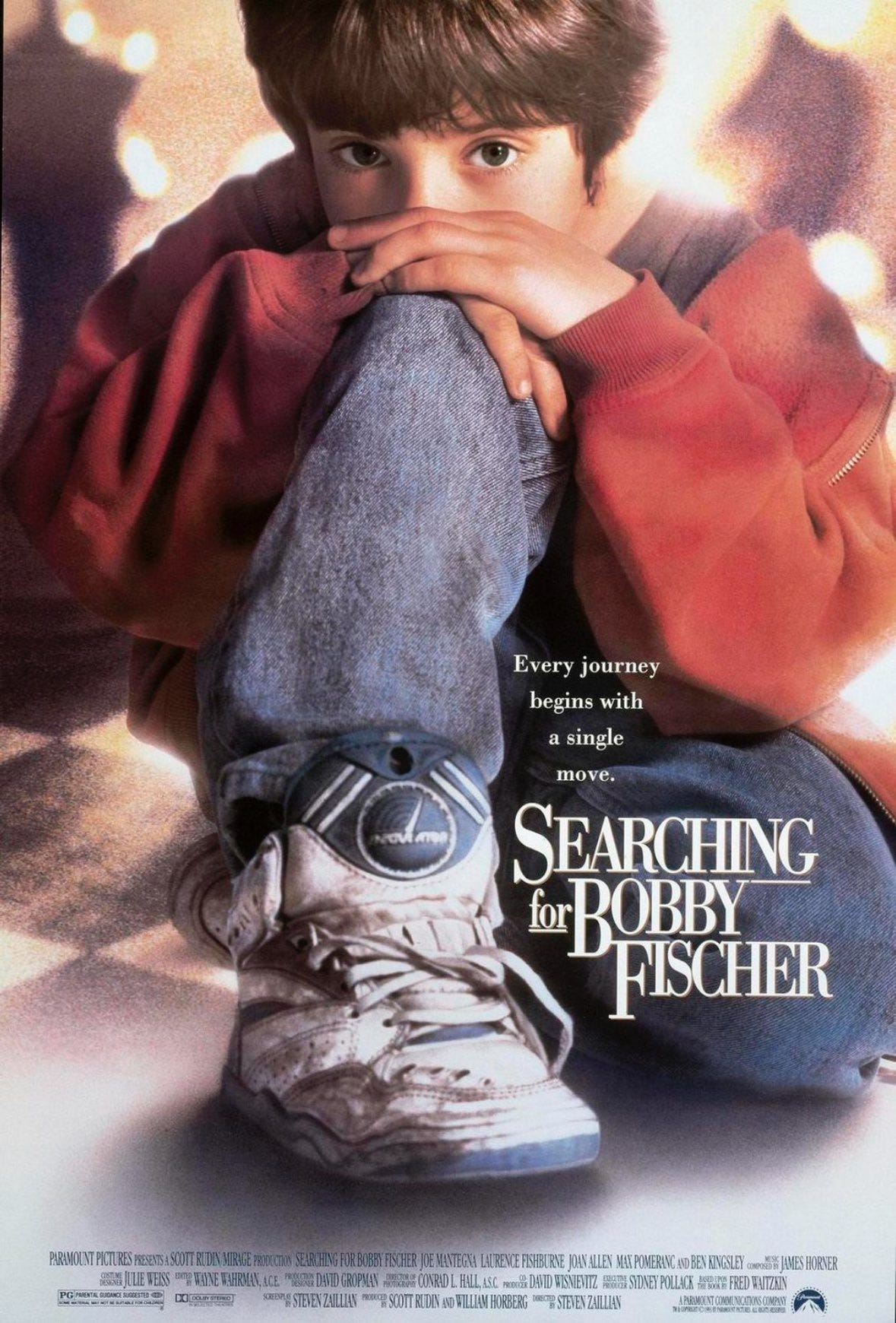

♟️ ‘Searching for Bobby Fischer’ (1993) 👑

We watched this on movie night with the kids recently. It had been a while since I saw it, but I had positive memories of it.

The kids really enjoyed it. My oldest used to play chess a lot when he was 4-5 ,but hasn't in recent times.

Well, this movie re-ignited his interest because he’s been playing and talking about chess non-stop for the past couple of days. I told him that there’s lots of chess content on YouTube, so rather than watch Minecraft videos, he’s been watching chess.

Someday when he's older, we'll have to watch 'The Queen's Gambit' together.

I also told him that the kid in the movie grew up to world-class at other skills and wrote a book about it. He seemed very intrigued, so I ordered ‘The Art of Learning’ (which I had read years ago — I gave it an ‘A’ in my notes) and last night we read a few pages together. So far he’s into it 👍