Interview with David Kim a.k.a. Scuttleblurb (2024 Edition)

Special Edition #8

𝕊𝕡𝕖𝕔𝕚𝕒𝕝 𝔼𝕕𝕚𝕥𝕚𝕠𝕟 #8

One of my favorite annual traditions is interviewing my friend David Kim (💚💚 💚 💚 💚 🥃 ), author of the excellent Scuttleblurb newsletter where he analyzes companies through an investing lens.

In case you missed them, here are the past interviews we did together:

Note: My questions are in bold, none of this is investment advice, etc.

💚 🥃 If you enjoy this interview and would like me to do more, or find value in this newsletter project and want access to the paid editions, please consider becoming a supporter. It makes a big difference:

Q: First I gotta ask: how are the kids doing? It’s been fun to watch them grow up through these interviews.

The twins are good! They turned 3 this year. That’s a good age.

It’s fun to see their personalities shine through. Zoe’s strong-willed, unstoppable. Riley’s chill, introspective. They complement one another, they’re buddies.

Q: Now that the most important stuff is out of the way, we can talk business.

I’ll come back to Scuttleblurb a bit later — keeping the best for last! — but first I’m curious how you’ve been thinking about investing and the market in 2023.

What’s the vibe for this year? Where have you invested your R&D time? Any interesting situations or industries? Can you share some of the standout events of the year, both positive and negative, for you and for the market in general?

For the stocks I follow, the vibe this year was “it’s so over” and “we’re so back” on a repeating loop.

Investors seemed especially eager to extrapolate the nearest data point way out, which led to some wild, wild swings. So I directed my research efforts to fallen angels…names like SHW (long), APO (long), Adyen, DG (long), TRU, DHR, and TMO that were widely celebrated as moated compounders but fell out of favor for one reason or another.

Q: “It’s so over” and “We’re so back”! That perfectly encapsulates how this year has felt for me too. Truly wild swings in sentiment over very short periods of time, and the usual Mr. Market goldfish memory, quickly forgetting whatever happened two months ago.

Adyen’s a good example of how suddenly sentiment can shift, in both directions.

With PayPal loss-leading on Braintree fees to drive higher-margin PayPal-branded checkout adoption, Adyen’s stock cratered by more than 60% in August/September on fears of intensifying competition in North America. The stock then ~doubled off those lows 6 weeks later after management reported stronger-than-expected Q3 growth in their Investor Day.

Frankly, there was nothing in that Investor Day that changed my understanding of the business or gave me any more confidence in their long-term earnings power than I had before, nothing that made me think “after today I am way more confident that they’ll sustain 25% growth over the next 5-7 years” or whatever.

Management basically got on stage and said a number. I suppose you could justify the -60% to +100% swing over 4 months by literally replacing the 25% growth rate in your model with 15% after the August earnings report, then taking it back up to 25%+ after the November Investor Day. But that’s a weird thing to do. There isn’t much long-term signal packed into a single quarter's worth of results.

Transunion was in many respects an easier call (one I was not quick enough to put money behind, sadly), as it sold all the way down to 13x earnings on cyclical macro-related concerns rather than structural competitive challenges. Anyways, if you did the work and kept your composure, you could’ve reached into all sorts of air pockets and grabbed stuff at good prices. The ability to look out some years is a super power in a world consumed by immediate results and that seemed especially true this year.

I put most of the proceeds from the recent Adyen sale into GFL. That’s a levered waste management rollup. I wrote the company up in early ‘22 and am going to post a quick update soon. I guess that’s another thing… there are now more rollups in my portfolio. I went into the year with 2, SITE and URI. I exited the year with 3 more, GFL, APG and, an old favorite, BRO.

I’m calling a top. When I finally buy CSU you guys are all screwed!

Q: Ha! That wouldn’t worry me nearly as much as Constellation being featured in The Economist and starting to get more stan accounts on Twitter. I liked it better when it was more misunderstood and people kept comparing it to Valeant and calling it a rollup of sh!tcos with no organic growth or whatever.

Yea, you’ve been all over Constellation, well before it was recognized as a consensus GOAT. I may be the final straw that breaks this camel’s back.

Don’t add to my anxiety!

What else. The mini-banking crisis in March feels like a distant memory now, but people were losing their minds at the time.

Some were cock-sure that Schwab was a 0. Earnings power was and remains a reasonable concern, but with cash sorting tapering off, client assets continuing to grow, and a maturing securities book being reinvested at higher rates, you can get to some pretty juicy owners’ earnings 3-5 years out, though I’ll concede that the stock at ~$70 has priced a lot of this in. And I think bankruptcy is pretty much off the table at this point.

I hope that doesn’t sound like a victory lap. I took the other side of the “Schwab → 0” thesis, sure, but I also owned the stock heading into the crisis and it’s definitely fair to say that I wasn’t as tuned in to the impact of rate hikes on the deposit base as I should have been.

Q: It was a pleasure to see your Schwab post ride that wave and resonate with a new audience. You just need to do that a couple of times each year and you’ll be golden!

Apollo, which gets ~2/3 of its earnings from a balance-sheet intensive life and annuity business, Athene, also got ensnared in the chaos. But unlike Schwab, or deposit-taking banks generally, Athene is funded by liabilities whose duration matches that of its assets. Fixed indexed annuities are locked in by surrender charges and annuitants don’t think of retirement contributions as ready sources of cash. So the risk that Apollo would suffer heavy outflows the way regional banks did was always overblown. At the lows this year, you could have picked up for just 12x owner’s earnings that have years of double-digit growth ahead.

As for high-level market and macro views, I certainly have them like everyone else but they aren’t worth a damn, so I keep those to myself and they in no way influence how I pick stocks anyhow.

I suspect some of your readers will disagree, but I’m of the opinion that you can own resilient, well-managed companies at reasonable prices and do quite well over many years without any regard to macro positioning.

I do think extreme macro conditions can be a good test of said resiliency. For instance, the dizzying cost inflation and aggressive rate hikes of the last few years validated GFL’s pricing power even as it exposed the soft underbelly of Schwab’s business model. You can use stressful macro periods to better calibrate your understanding of a business, which in turn will inform what you’re willing to own and in what size. But you need not make sweeping portfolio changes based on what stocks you think will “work” in this or that macro environment or even whether to own stocks at all, which is much harder to do than people realize.

Q: I like that way of looking at it. You should always learn from macro, and use it to be better calibrated. But you shouldn’t try to outsmart and predict macro turns.

I mean, we just went through the most aggressive rate hiking cycle in decades and the S&P 500 hit fresh highs anyways. I don’t recall anyone who had that combination of events on their Bingo card.

I'll put it this way... I want to know how the machine works, that the output over its life is likely to be as good as I thought, but I don't need to precisely predict what that output will be in any given year.

If you suddenly find yourself caring a lot about macro where once you didn’t, it’s likely because the economy sucks and stocks are down. But consider that you are obsessing over macro at exactly the same time as everyone else, that your macro intuitions are informed by the same sensationalized articles and tweets that others are freaking out about. So you may find yourself gun-shy at the worst possible time.

Q: Amen!

One way that I try to keep perspective on macro is to remind myself whenever I look at a long-term stock chart (like 20 or 50 years) that during that period, there were countless news cycles and macro shocks, yet a good business just keeps doing what it does, adapting, iterating, rebounding, taking advantage of the weakness of more fragile competitors.

There’s no way to benefit from long-term compounding without accepting all that comes with it — you can’t choose to just live through the good times and sidestep the bad times. Or maybe some people can do that, I don’t know, but I know that I can’t.

Totally. I’m a big fan of this chart:

The first downturn I experienced as a professional investor was 2008-2009. I know some investors who moved to cash in Fall ‘08 and felt very smart about that (believe me, they let you know at every opportunity!) for, oh, about 6 months.

Stocks will turn well before the macro recovers.

People intellectually understand this but they don’t feel it in their bones. You need to pull a “Costanza” in the bleakest times. We can also be biased to consistency. So if you move to cash because the macro looks bad, you’re probably not going to move out of cash when the macro gets even worse. Then, before you know it, stocks have surged, the macro still sucks, and you’ve become that guy…the one angrily bloviating about how irrational everyone is acting. This is catastrophic to long-term financial well-being (and not great for your mental health besides). Finding great businesses at good prices is hard enough for me as it is. I see no reason to handicap myself further by pivoting around macro opinions that aren’t likely to be differentiated anyways.

Q: Exactly! And since most of a year’s return is clustered in a few days, and a lot of the best days are very close to the worst days, missing the turn or being out at the wrong time can have a huge impact.

We think we’re so different from everyone else, but we all have very similar brains. When others are afraid, chances are you’ll be afraid for the same reasons that they are. When they are excited and feeling positive, chances are you’ll feel the same.

Independent thinking is very difficult, and so is independent feeling.

Well said.

Q: I’ve been wondering, as your archives are growing and the number of companies and industries you’ve studied goes up: Do you find it easier or harder to study entirely new industries?

I can imagine how the more reference points you have, the easier it becomes from a pattern-matching point of view. This is a big argument for Buffett being able to do what he does. He’s looked at so much over the decades that anything new is rarely *entirely* new, it likely has similarities to a bunch of things he knows well.

But I can also imagine that over time you’ve developed favorite ponds to fish in, and it can be harder to venture away from those into areas that are likely to be less interesting and worse businesses..? I know I often feel like that.

Without the benefit of context, it can be easy to fool yourself into thinking that an investment is more compelling than it is.

I think we’ve all probably had the Dunning-Kruger experience early on in our careers where you get up to speed on a concept, come across a business that exhibits signs of it, delude yourself into thinking you understand its applications better than you do, and find yourself concluding that Teladoc (or whatever) has this amazing cross-side network effect because you haven’t studied Visa and Mastercard and therefore don’t have a frame of reference for what it sounds like when a truly durable network effect hums.

Reading about business models in the abstract is one thing but it takes lots of research reps to develop a felt sense of their limits.

Q: Yes, that sounds very familiar. A lot of investing is pattern matching, and when you start out, you have few points of reference, so it’s very easy to be miscalibrated. False positives abound!

For sure. One caveat I’d add is that I don’t mean “pattern matching” in the sense of using a familiar-seeming set of conditions to predict outcomes at a given point in time, which can be tough to do in complex, dynamic environments. I mean it more in the sense of cluing in on general principles and attributes that tilt the odds in favor of a business enduring the test of time.

Certain kinds of knowledge compound over time. As usual, Buffett is right about that. You often hear investors talk about how they started out as a special sits/cigar butt investor and evolved into a “quality” investor, but you almost never hear anyone say the reverse.

I wonder if there’s something to the idea that fluid intelligence, the kind that relates to processing power, wears down over time while crystalized intelligence, the kind that relates to pattern matching, builds up, and the style of investing we pursue acclimates to that transition. Who knows.

Anyway, I suspect there is more reliable knowledge carryover and less brain damage from analyzing the stuff that good businesses are made of than in moving from one ad hoc special situation to the next? And if you think that’s the case, you’re likely to prize duration and durable knowledge. Staying in the game for as long as you can and adding to your web of knowledge along the way is how you get the upside from pattern matching. Every piece of new knowledge is made more valuable by the context you’ve built around it. Still, not gonna lie, in my PA I will every so often roll around in the mud.

I haven’t gone full-Akre just yet, to my own detriment. Give it time!

Q: What are your favorite industries and types of businesses to study and invest in (and are they the same or different?)?

From an investment standpoint, I haven’t been able to build much conviction in retail, online consumer, and media businesses. I lean toward B2B stuff. Just a personal preference. But I find pretty much every industry, even those I wouldn’t invest in, enjoyable to study and I don’t think I have any favorites, to be honest.

They’re all interesting if you dig into them enough. I don’t think I’ve ever walked away from researching a company or industry thinking “That was boring”.

Q: That’s the kind of mindset that can keep you going for so many years. Infinite curiosity! Everything can be interesting if you look at it from the right angle!

Switching gears a bit, I’m curious how things have been on the Scuttleblurb front. I think you’ve crushed it on the content front, but I’m curious how things are going behind the scenes, both on the business side of SB and also for you, as a solo entrepreneur wearing the CEO/researcher/writer/customer service/marketer hats at the same time.

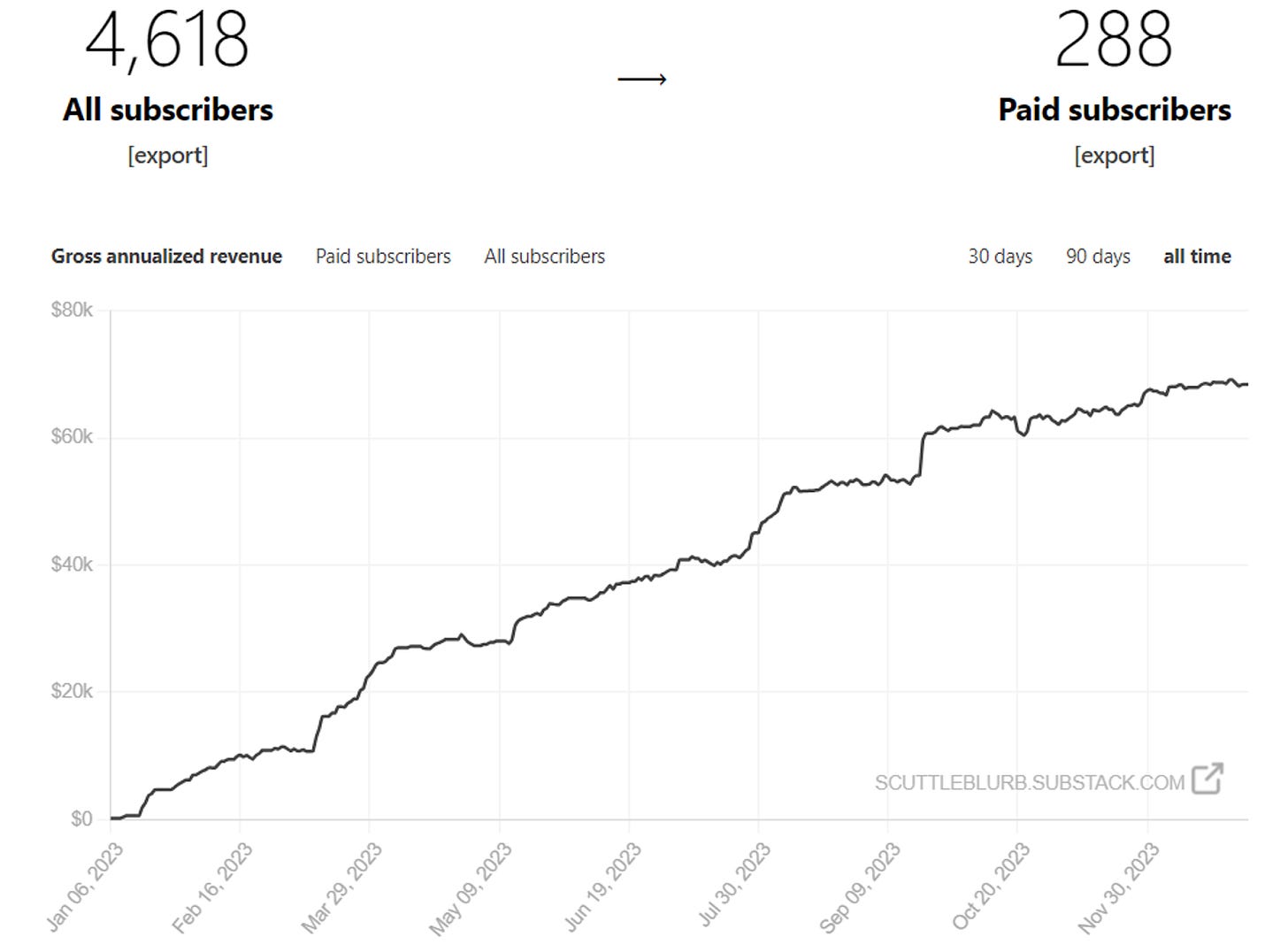

First, I’m happy to report that after declining last year, my paid sub base grew again. Only by 4.5%, so not much, and I’m still down from my ‘21 peak. But I’ll take it!

Gross revenue for the year grew a little faster, by ~5%, to ~$284k.

You may recall that at the start of ‘23, I launched a Substack version of Scuttleblurb, which now runs alongside the “Classic” WordPress version. Well, Scuttleblurb Classic continued to suck. I lost more paid subs this year than I did last year:

But those losses were more than made up for (cannibalized?) by the paid sub gains on Substack:

(note: the paid sub count above includes 16 comp’ed subscriptions. So the true paid sub count at year-end was 272)

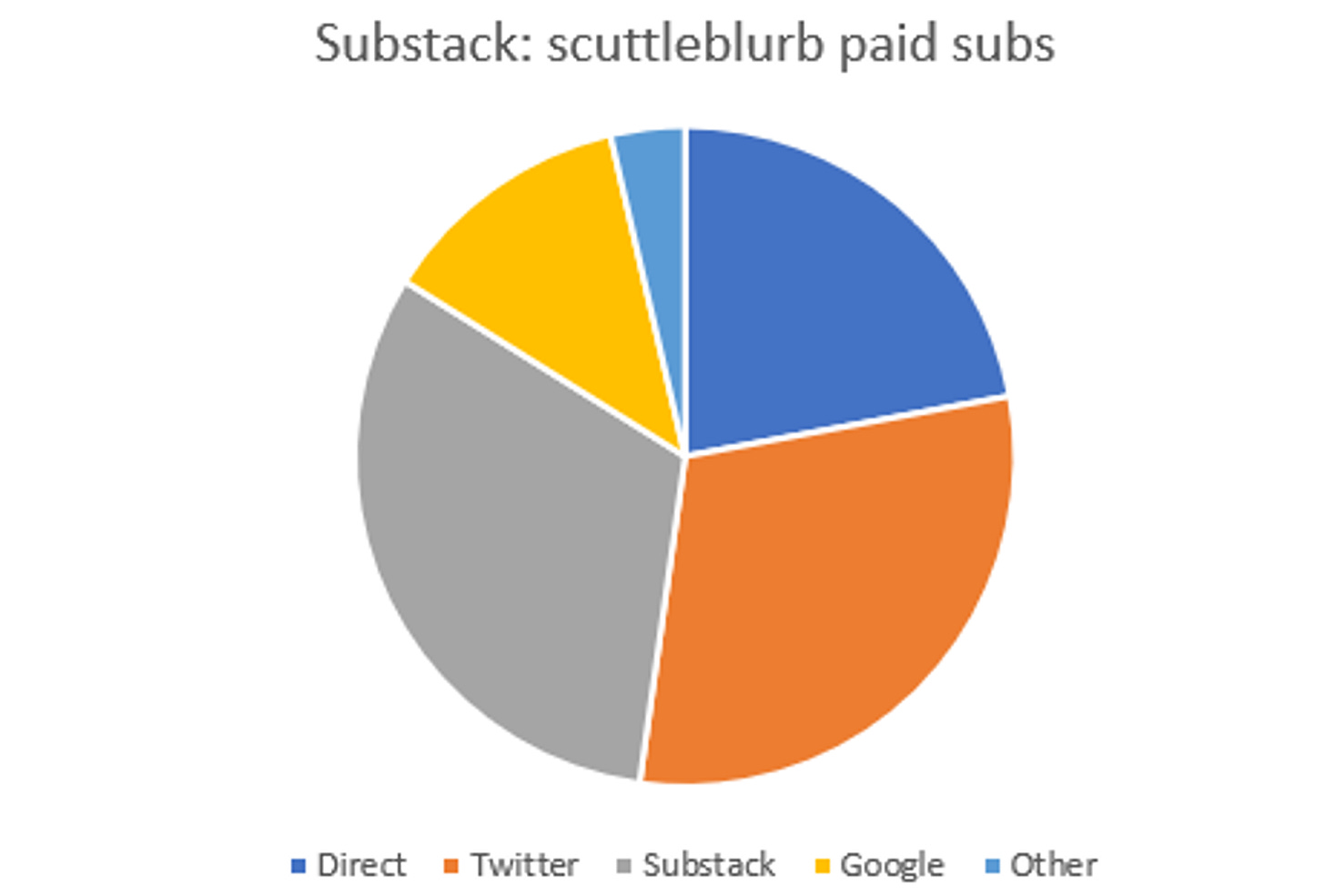

When Hamish spoke to me in late ‘22 about moving to Substack, he pitched the growing contribution of the Substack recommendations in driving subs, and I know that behind the scenes Substack is experimenting with discounts, gifts, referral incentives…. all kinds of stuff that I never would’ve tried on my own. It appears to have made a difference. Substack was my primary source of new paid subscribers on Substack, closely followed by Twitter. With Twitter suppressing links to third-party sites, I would expect the Substack network to account for an even greater % going forward.

However, while I’m pleased that my paid subs grew, that growth was fueled by a few idiosyncratic events that I can’t consistently bank on: 1) the price hike I announced last summer was a catalyst for pulling in folks who wanted to be grandfathered in at lower rates and 2) there were a few salient blow-ups (Schwab and Adyen) that I happened to be well-placed to cover.

Nothing draws more interest than a blow-up.

This is why we got the deluge of Schwab hot takes from people who clearly had no more than a cursory understanding of banks. They spotted an opportunity to draw attention to themselves and wrote/Tweeted low-calorie but high-conviction, sensationalized material to seize on it.

I’ll pull a section from Haruki Murakami’s writing memoir, Novelist as a Vocation, which, except for the parts where he shits on nuclear energy, I thoroughly enjoyed:

“…before you start writing your own stuff, make a habit of looking at things and events around you in more detail. Observe what is going on around you and the people you encounter as closely and as deeply as you can. Reflect on what you see. Remember, though, that to reflect is not to rush to determine the rights and wrongs or merits or demerits of what and whom you are observing. Try to consciously refrain from value judgments - conclusions can come later. What’s important is not arriving at clear conclusions but retaining the specifics of a certain situation - in other words, your material - as fully as you can. Some individuals decide what or who is right or wrong based on a quick analysis of people or events. Generally speaking, though (and this is just my opinion), they don’t make good novelists.”

Nor do they, generally speaking, make good analysts. Trendiness need not act as a cue for strong takes. You can say “I don’t know” or calibrate your opinions to your limited state of knowledge or even (gasp) just not say anything at all.

That’s not to denigrate those who write about what’s hot. But there’s a right way to do it. With investing, you learn about interesting businesses even if they don’t make for interesting investments today because you want to prepare for a time when they might be. Likewise, you don’t need to scan Twitter for what’s trending and immediately throw a strong opinion out there to ride the wave. You can do the research first, even when no one cares. Then, if things blow up you’ll have built a knowledge base on which to provide credible commentary.

Ben Thompson does this well. He has opinions on just about every hot story in tech, sure, but he’s earned the right to have them because he’s invested years of study beforehand and can provide proper nuance and context.

So, I can’t be ambulance-chasing blow-ups to drive subscriber growth. But I do want to be more attuned than I historically have been to stuff that’s “hot” and that I’m interested enough in to cover anyway and that I feel ok opining on because of the work I’ve already put in. So as my understanding of the companies I’ve written about grows, so too should the odds that I’ll be placed to do just that. Still, I can’t really bank on that happening every year.

Which leads me to a second point. Even after writing several well-circulated pieces about high-interest names and announcing a price hike that pulled forward subs, my paid base grew by a mere 4%.

Churn is a beast, far higher than I expected it to be when I launched. On Scuttleblurb Classic, churn improved over last year, but it’s still way higher than it was 2-3 years ago:

On Substack, things look even worse:

Source: Stripe

It’s basically a coin flip whether a subscriber retains over the course of a year. I mean, that’s terrible. This blog is like a deflating balloon that needs to be flicked with hit pieces to keep afloat (maybe Grok was right after all!). But hit pieces can take different forms.

Evan Armstrong at Every wrote a compelling piece this year about why there is so much sensationalism in online content. To quote:

“Extremely edgy is easier to consistently achieve than extremely high quality. We are in an all-out war for eyeballs, in every category of personal life and business. Truly great material can stand out from the sea of things beckoning for our attention. But edgy is easier to achieve than excellence. Every time some edgy creator flames out, there is someone willing to go even farther to take their place.”

This maps to my own experience. Beyond a certain point, to grow an audience or even just to retain the one you already have, you need to keep pushing boundaries and it is far easier to be sensational than thoughtful. I will be annoying and signal virtue by picking the latter, but I really do mean it. I enjoy being an analyst but don’t much care for the other roles I play as a solo entrepreneur (marketer, CEO), which I suppose is obvious from my lack of podcast appearances and Twitter engagement. That I can’t even be bothered to do that other stuff makes it all the more imperative that I keep raising the quality bar…sharper analysis, crisper prose, more relevant context, fair consideration of alternative views.

And it’s not just that quality craftsmanship is the way forward for me from a business perspective. The way I express my opinions and explore the angles on Scuttleblurb is twirled up in my self-concept, how well or poorly I abide by personal standards of intellectual integrity. Am I taking cheap shots to build my ego? Have I summarized the opposing view in a way the opposition would agree with? Am I knocking down strawmen? Am I overstating my case? Am I making points that I think are right or that I think will play? These are grandiose questions for a newsletter author whose subject matter is, let’s be honest, pretty low stakes. Still, I think about this stuff a lot, even if I often slip.

Q: I’m also curious what you think is the state of the field for newsletters in general in 2023 and going into 2024.

If you happen to cover the bullseye of popular business and investing interest — namely, AI, semiconductors, and big tech — you likely had a phenomenal year.

Otherwise, for newsletters that have reached a certain scale (say, hundreds of paid subs over several years), my sense is that things have slowed down. I’ve heard this from other writers. I also noticed more price-hiking in the past year, which makes me suspect that volume-led growth has gotten harder to come by. Also, newsletter writers will typically provide business updates when things are going well (it’s good marketing) and I’ve seen far fewer of those in 2023 than in years past.

As far as I can tell, the “business and investing” genre has gotten far more crowded and mainstream since I started. There is a well-understood playbook now for how to build a newsletter business - write a handful of posts, build a free subscriber base, post aggressively on Twitter, throw up a paywall when ~5% x # of free subs x annualized subscription rate = acceptable income, pitch your ideas on podcasts or launch a podcast of your own to stay top of mind.

Ben Thompson figured this out years ago. It’s since become table stakes. Aside from income generation, newsletters are becoming a standard tool for anyone who trafficks at the intersection of ideas and commerce. If you’re seeking employment or raising a fund, I can think of few better ways to showcase thoughtfulness, passion, and commitment than writing a newsletter. And beyond newsletters, there are countless podcasts dedicated to stock pitches and business analysis. Within that milieu I think you can still carve out a niche through unique combinations of style and coverage, but it’s gotten much harder to stand out compared to when I started. And the standard for adding value is getting more rigorous. Newsletters that focus on “what” questions - “margins did this, ARPU did that, here are some charts, here’s what management is forecasting, etc.” - rather than “why” and “how” questions are being disrupted by LLMs. You could once get away with summarizing a prospectus and calling it a “deep dive”. Can’t do that anymore.

Q: Thank you for doing this and keeping the tradition alive, David! Let’s do this again next year!

For more from David, go sign up for Scuttleblurb!

💚 🥃 If you enjoyed this and want more 𝕤𝕡𝕖𝕔𝕚𝕒𝕝 𝕖𝕕𝕚𝕥𝕚𝕠𝕟𝕤, as well as the regular and paid editions, you can support the project by clicking the button below:

Great work, both of you ... Wishing you much success through 2024.

Great interview. If I'm interpreting David correctly, he recently sold his Adyen stake. Is that correct?