479: Elon and I, State of the Cloud, Nvidia, Hermès, Jeff Bezos Sells Amazon, Teen Jobs, OpenAI Sora, Win a Book, and Beauty is Powerful

"Catnip to early adopters"

The best revenge is not to be like your enemy.

–Marcus Aurelius

📸🧐😐🤯 I usually prefer to stay pseudonymous, but this spit-take moment is worth making an exception.

I was scrolling through my friend MBI’s Tesla deep dive, searching for a graph I knew I had seen there before, and this time something caught my eye. 👀

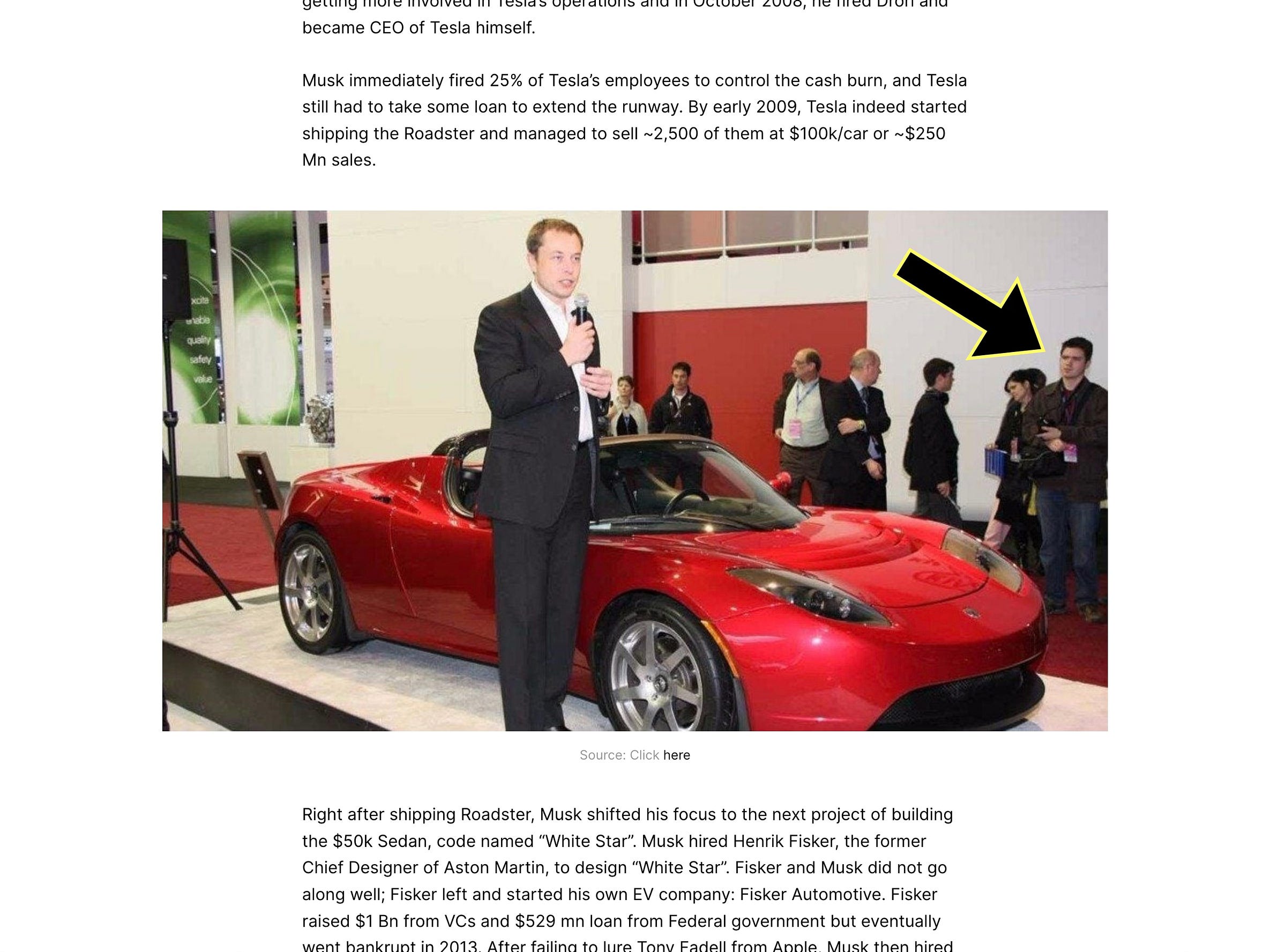

In this photo from Tesla’s early days, a young Elon Musk is talking about the company’s first EV, the Roadster:

The scene felt familiar to me…

I AM IN THE BACKGROUND OF THE PHOTO!

I have my own photos from that event in late 2009, or maybe January 2010, but I’m not in any of them. MBI had no idea, he just found a photo to illustrate his section about the early days of Tesla.

What are the odds? And on my friend’s website!

It’s even funnier because the journalists were not listening to Musk, they weren’t taking him seriously. At the time it was considered a nice novelty that Tesla had made a sexy electric car, but almost everyone expected failure.

Having been interested in EVs for a few years, I was paying close attention.

I remember joking with Musk that he should’ve brought a Falcon 5 rocket 🚀 to the Tesla booth, that would’ve gotten him more attention. He then nerded out with me about the rocket’s specs and how hard it would’ve been to make it fit the venue.

I hadn’t thought about that in a while. It feels like a lifetime ago…

🚨🤞 🎟 📚🎁✍️🏆 My friend Jimmy Soni (📝📚) wrote a book called ‘Founders’ about PayPal and the incredible agglomeration of talent in the early days of the company. He and I and David Senra discussed the book on this podcast.

The paperback version just came out!

I’m giving away *10 signed copies* to supporters (💚 🥃 📖)

Here’s how to throw your name in the hat:

If you’re a paid supporter of the newsletter, send me an email to let me know you want to participate (you can reply to any of the newsletter emails). Send this before February 29th at 11:59 PM EST. That’s it.

I’ll compile a list of participants and draw a name out of a hat, or buy one of those bingo machines with the balls bouncing around, or use randomizing software, whatever, and pick 10 winners. I’ll email the winners to ask for shipping details.

If you’re NOT a paid supporter but would like to become one before the 29th, no problem. Hit the subscribe button, and then drop me an email to say you’re interested in the book.

Not all supporters will participate, so if you do, your odds of getting a signed book are excellent.

A Word from our Sponsor: 💰Watchlist Investing 💰

Investors face two main problems:

Identifying good businesses 🕵️♂️

Keeping track of them over time 👀

Watchlist Investing is a monthly newsletter devoted to studying great businesses and helping readers be ready to pounce when Mr. Market gets irrational (🤪).

Independent Research: Benefit from 40-50+ hours of primary research on each Deep Dive

Regular updates on Watchlist companies: Don’t miss opportunities by staying on top of important business and industry changes!

Other Benefits: Private Google Meetups, Detailed sum-of-the-parts Berkshire Hathaway valuation, Private Discord server, Subscriber introductions

Watchlist Investing founder Adam Mead spent over a decade in commercial credit, has skin in the game as a value investor, and is the author of ‘The Complete Financial History of Berkshire Hathaway’. 📕

⭐️ Sign up here and get 20% off your first year with the coupon code “Liberty20” ⭐️

Here’s a free taste from the back catalog:

🏦 💰 Liberty Capital 💳 💴

☁️🌩️☁️ State of the Cloud 💰💰💰

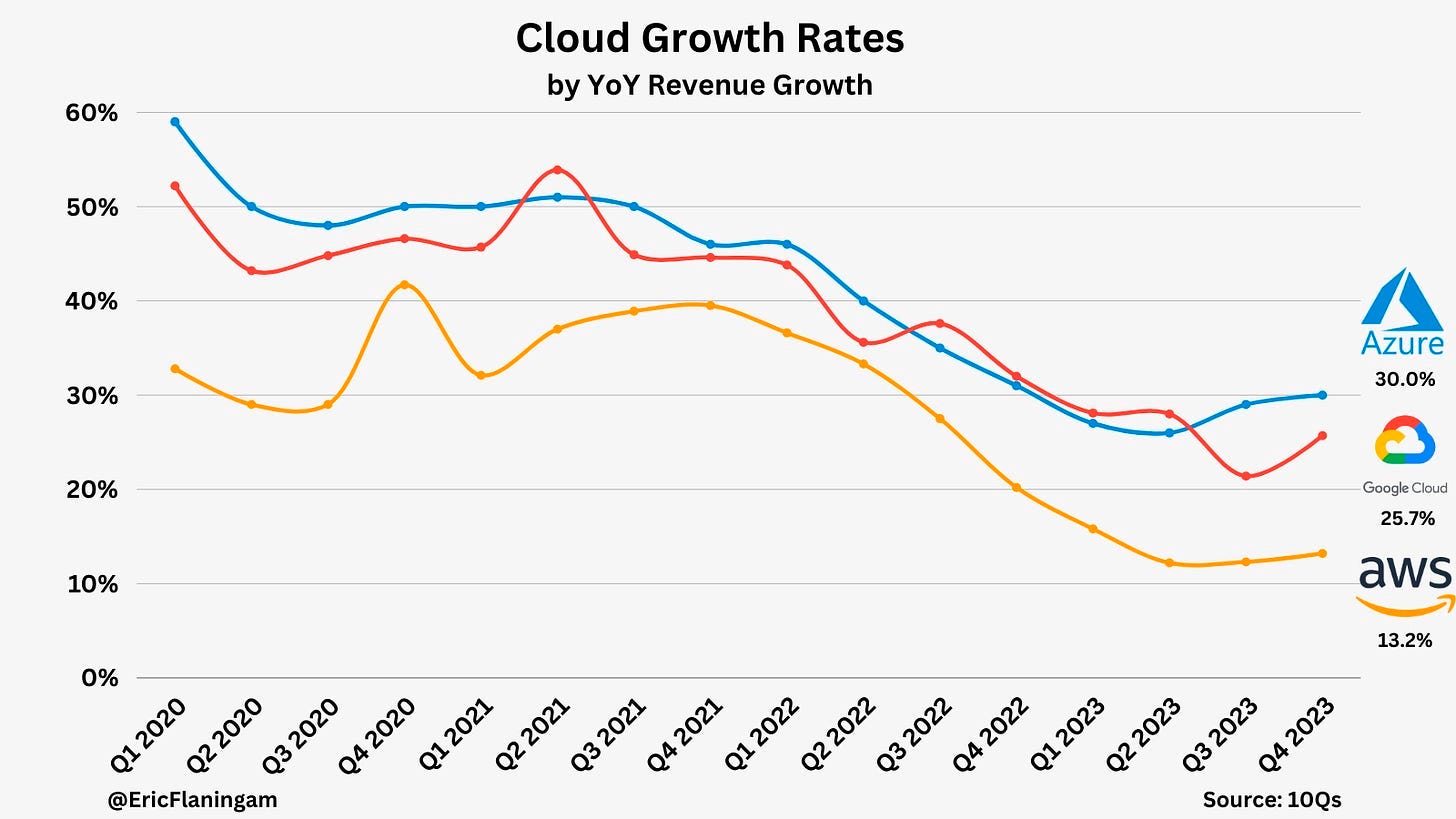

Eric Flaningam wrote a good overview of the hyperscaler cloud space. I want to highlight a few parts:

Overall revenue between the 3 cloud providers grew 20.7% YoY, up from 19.1% in both of the last two quarters. Net new revenue was up YoY for the first time in 5 quarters

Early sign that we’re moving past the “everybody’s optimizing every cloud bill” phase of the cycle?

Azure and GCP took share in Q4. Azure’s market share gains came in large part from AI, which contributed 6 points which works out to about $800M in AI revenue this quarter

GCP’s gains seemed to be a rebound to former trends, buoyed by AI and fiscal year dynamics of Q4 being the strongest quarter for these companies. AWS continues to focus on providing the lowest cost compute and storage but with less upside from AI and managed services.

A few years ago, people were trying to estimate the likelihood of Azure surpassing AWS in size, and how long that may take. We’re not there yet, but that seems more probable today than it was then.

While SaaS was booming, AWS was reaping the benefits, but now that is cutting the other way:

Azure has had the best year of the cloud providers, largely at the expense of AWS.

Several dynamics are causing this. First, AWS is the most exposed to software companies born in the cloud. A large number of these are SaaS businesses, which have not re-accelerated growth rates after the slowdown in 2022. Second, Azure has benefitted the most from AI. The race is in its early innings but it’s unclear if AWS can regain market share.

Third, AWS has focused on a higher-margin strategy aimed at delivering compute and storage services. They haven’t invested in managed services as much as the other clouds. This has led to slower revenue growth but a more profitable business than their competitors.

Other dynamics are at play, but these are the major ones as I see them.

It’s one thing to look at the top line, but it’s the bottom line that ultimately matters. A lot of that AI revenue has lower margins because it’s a lot more compute and storage-intensive than your average web application.

Is that transitory until the hardware and software get optimized? Is it structural because whenever you increase your efficiency, you get into a race with the competition to just throw more resources at the models to try to be competitive?

Will some AI models be differentiated and able to maintain premium pricing (ie. high margins), or will models be commoditized, making it hard to get good ROIC on what has to be a large investment in R&D and hardware…?

¯\_(ツ)_/¯

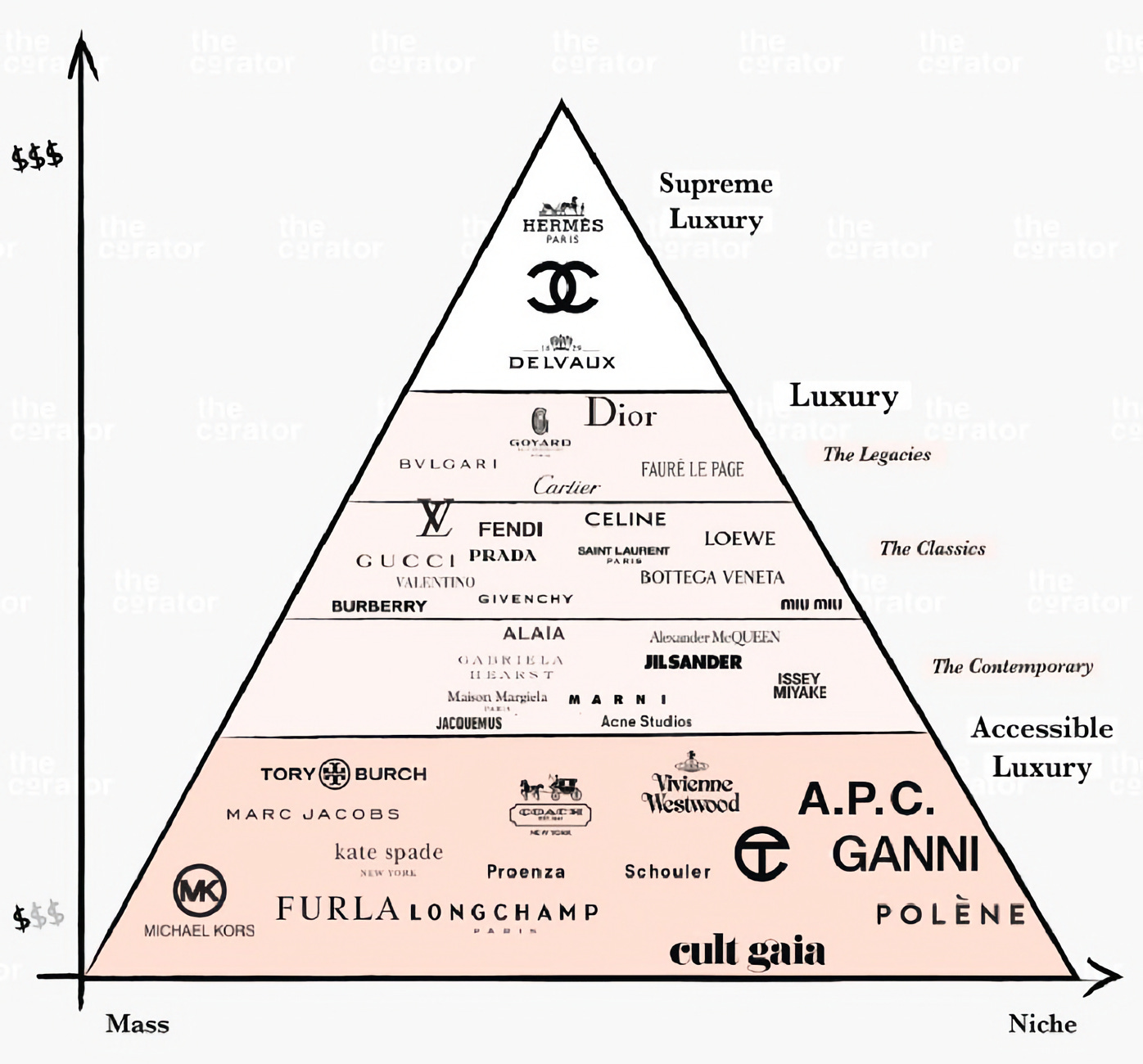

👜 💰 Understanding what Hermès *Really* Sells 🥂🍾

Friend-of-the-show Trung Phan (check out our podcast together, that was a fun one! — 💚 🥃 ) wrote a great piece on Hermès.

It’s particularly insightful for someone who doesn’t spend much time thinking about luxury goods (like me). I knew about Birkin bags only because it’s a plot point in the show ‘The Gilmore Girls’ (great show! and great marketing for Hermès).

Some highlights from Trung’s piece:

Axel Dumas — the current CEO and Executive Chair of Hermès and a 6th generation member of the Hermès-Dumas family — says that “what we do at Hermès is sell time.”

This sentiment echoes a statement made by his uncle and former Hermès CEO Jean-Louis Dumas: “Time is our greatest weapon”.

A good example of this is the obstacle course that they’ve designed to buy their Birkin bags:

You can't simply walk into a Hermès store and ask for one. Instead, Hermès flips the buying process on its head and decides whether or not it wants to sell the bag to a buyer. [...]

[The] book Luxury Strategy noted that one of the key ratios in luxury is (# of people who know about product) divided by (# of people that can actually get the product).

With its managed supply, Hermès has a sky-high ratio — because the denominator is limited — and everyone in the numerator is left waiting. The wait for a Birkin can be up to 5 years [...]Hermès HQ … does not reveal the number of Birkin bags to the store managers… but HQ requires all stores to stock items in every categories (shoes, watches, fragrances, scarves etc.). The consumer surplus from unmet demand for Birkin bags spills over into these other products, as customers "settle" for available Hermès items while waiting for the bag. [...]

First-time shoppers — even very wealthy ones — don't walk into a store and ask for a Birkin. Hermès gives them the opportunity to purchase it. To be eligible for a Birkin, a shopper must have a relationship with the sales staff. The way to establish that relationship is to purchase some of the items mentioned earlier. This tiered buying approach psychologically connects a shopper to the Hermès brand.

It’s pretty bonkers to think that a bag that came out in 1984 generated this much revenue:

In the four decades since the release of the Birkin Bag, Hermès has seen its annual sales grow 140x from ~$100m to $14B.

Note that this is annual sales — which means that over the years, the Birkin bag has sold for tens of billions, maybe even over $100bn 🤯

There’s a lot more, check out the full piece.

Update: After I wrote the above, friends-of-the-show Ben and David (💚 🥃) released a podcast on Hermès. I haven’t had a chance to listen yet, but with the Acquired stamp of quality, you know it’s going to be good:

🚀👨🏻🔧 Jeff Bezos sells $8.5bn in Amazon stock (50 million shares) 💸

A few years ago, Bezos mentioned that whenever he was selling Amazon stock, it was mostly to finance Blue Origin.

Now that he spends most of his time there, should we expect bigger things on the rocket front? Are they working on something even more ambitious?

Bezos is a competitive guy. I doubt he’s happy for Blue Origin to play second fiddle to SpaceX…

It probably also helps that he moved to a state with lower capital gain taxes 🤔

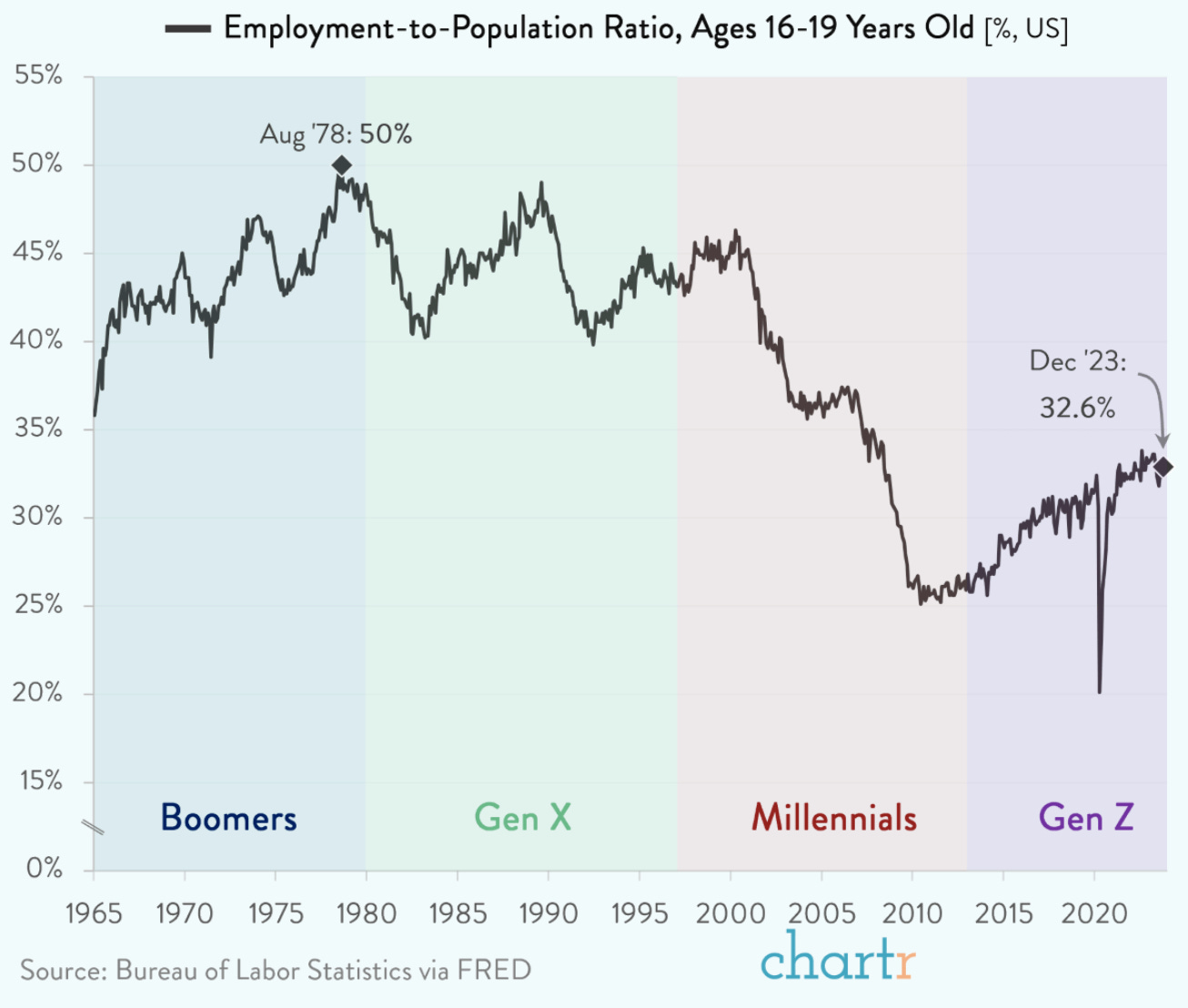

🇺🇸 How many US Teens Have Jobs? 🍔

Before we solely blame teens, let’s remember that a lot of this probably has to do with parents not wanting their kids to work, and with the declining amount of teen-appropriate jobs out there. I’m seeing automation replace a lot of low-paid unskilled jobs in grocery stores and fast-food restaurants…

The cliché paper route is pretty much gone. 🗞️🚲

🧪🔬 Liberty Labs 🧬 🔭

🤖🎥 Sora: OpenAI’s Text-to-Video Generative AI Model 🎞️

You’ve probably seen this because *everyone* was talking about it last week when it came out.

I won’t repeat the stuff I’m sure you’ve already seen, but I encourage you to go to this OpenAI page that shows a bunch of videos generated by Sora and see for yourself.

You may have seen one or two videos floating around, but there’s a lot more that showcase different aspects of the model’s capabilities.

The amount of subtle detail in the videos — from lighting to reflections to feathers and textiles — is very impressive. There’s still some weirdness, but we’re getting closer to hard-to-tell-apart-from-reality.

I particularly like the videos a little more than halfway through the page that shows a real drone shot following a car, and Sora’s videos based on that shot but in other styles (the last one in pixel art style is amazing).

The interpolation of two different videos is also pretty trippy. What happens when you mix a lizard video with a peacock video?

It’s also very interesting how Sora can simulate virtual worlds (they give Minecraft as an example). In other words, to generate a series of images that make it seem like footage from Minecraft, the model has to implicitly — somehow, someway — have a model of the Minecraft world and rules to keep things coherent and making sense.

On this, OpenAI writes:

We find that video models exhibit a number of interesting emergent capabilities when trained at scale. These capabilities enable Sora to simulate some aspects of people, animals and environments from the physical world. These properties emerge without any explicit inductive biases for 3D, objects, etc.—they are purely phenomena of scale. [...]

These capabilities suggest that continued scaling of video models is a promising path towards the development of highly-capable simulators of the physical and digital world, and the objects, animals and people that live within them.🤯

💻🤖 Nvidia Chat with RTX — Running LLMs on your computer

Nvidia is making it easier to run large LLMs locally (as long as you have a powerful Nvidia GPU, of course). What if you could have Mistral 7B or Llama 2 work on your documents without having them leave your computer?

This addresses many privacy and security issues with the ‘cloud’ approach to chatbots.

There are a few prerequisites; you'll need an RTX 30 or 40 series card with at least 8GB of VRAM, and a machine with at least 16GB of RAM.

Right now, Chat with RTX is only available on Windows, with no mention on when it will be coming to Linux.

This is an early demo, and it’s still a bit rough. Catnip to early adopters, but it’s not ready for prime time yet.

The 35gb free installer is here, if you’re feeling brave.

🎨 🎭 Liberty Studio 👩🎨 🎥

🌙 Beauty is Powerful, and doesn’t have to be expensive 🤩

Sometimes it can be. And it can still be worth paying up for it.

But sometimes, it’s just about giving a damn and deciding to do interesting things to spice things up. It’s about having taste and good design sense, or finding someone who does.

Here’s a tweet by Austin Tunnell about the photo at the center above (I found the other photos to show more examples of the same thing):

Out of a ~$3.2MM total project budget (Circa 2019), this Moongate cost us about $15k.

It made the project. People take prom and wedding photos in front all the time. It anchors it in people’s mind.

Where do you live? “I live by the Moongate” is a common refrain.

This taught me something: beauty is powerful, and the moments that make a project, and capture peoples’ hearts, can be quite small.

It’s the power of human scale, beauty and placemaking. I call these types of things Anchor Architecture now. Architecture that draws people in, that they remember, that anchors a place in people’s minds.

Often, it’s a tiny fraction of a project budget, but it can change everything.

That's a super cool photo! You should print and frame it! Better yet, send it to Musk for an autograph first!

This was a gem, thanks Liberty!