541: Regulatory Warfare, Nvidia in Crosshairs, AI Peer Review, Honda + Nissan?, Perplexity Financials, Bell Labs, Private Billions Club, Unreal Engine 5.5, and Nirvana Jazz

"the massive benefits of catching errors (and fraud)"

Anger is like an oven; heat without light.

Forgiveness is like the moon; light without heat.

—James Clear

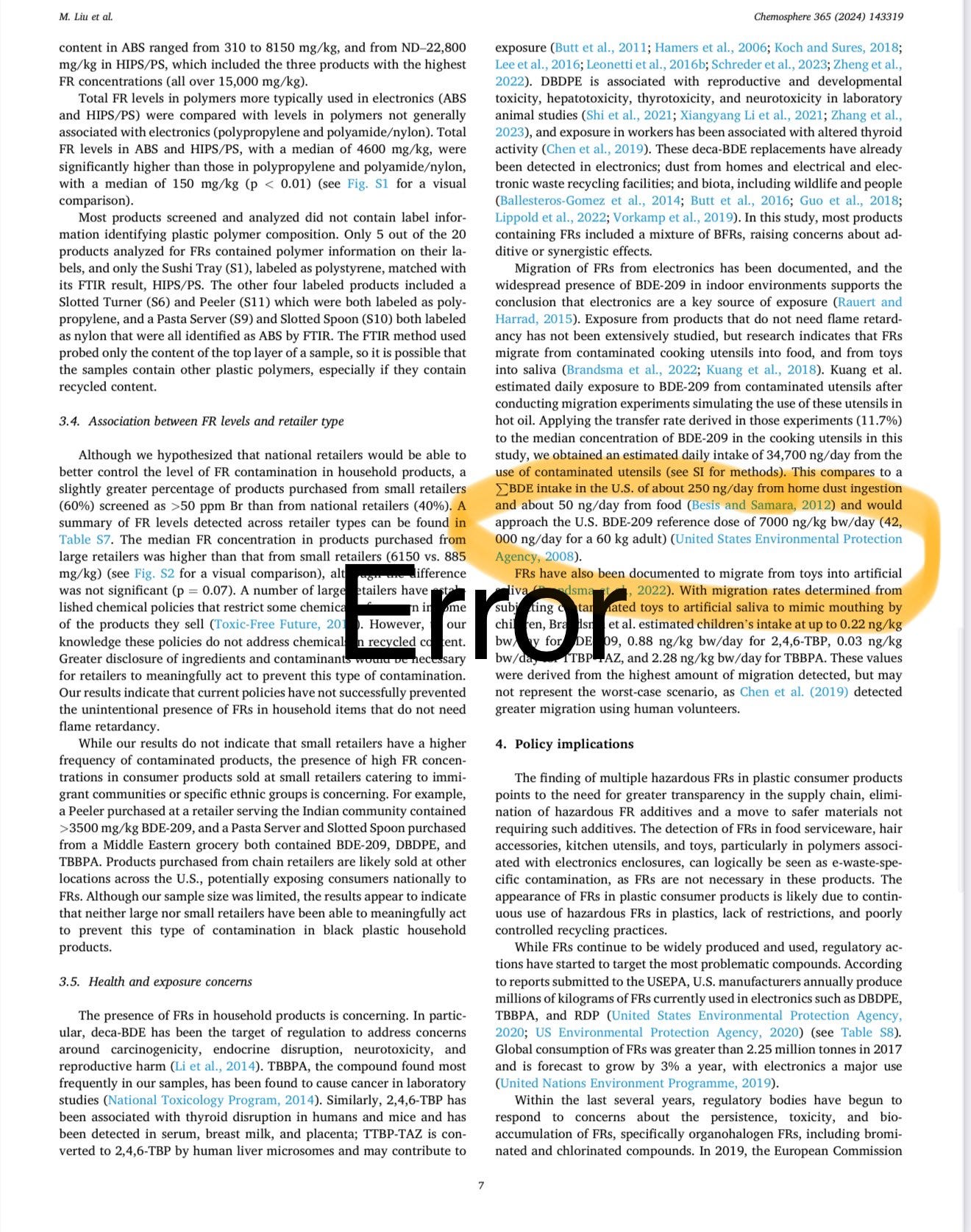

👩🏻🍳🍳🗑️ Good news about the study on flame retardants in black plastic utensils that I wrote about in Edition #537. It had a math error:

The paper correctly gives the reference dose for BDE-209 as 7,000 nanograms per kilogram of body weight per day, but calculates this into a limit for a 60-kilogram adult of 42,000 nanograms per day. So, as the paper claims, the estimated actual exposure from kitchen utensils of 34,700 nanograms per day is more than 80 per cent of the EPA limit of 42,000.

That sounds bad. But 60 times 7,000 is not 42,000. It is 420,000. This is what Joe Schwarcz noticed. The estimated exposure is not even a tenth of the reference dose. That does not sound as bad.

The dose makes the poison, so I’m glad the error was in the direction of it being a *smaller* percentage of the EPA’s “considered safe” limit rather than in the opposite direction.

That said, I don’t regret buying wood spatulas and ladles. Not only do they feel better and are more pleasant to use than their plastic counterparts, but the flame retardants were just one of several concerns.

Even with just a tenth of the flame retardants (which is still more than I'd prefer), I'd still rather not put plastics in hot foods, avoid eating plastic shavings from spatulas scraping around on hot surfaces, or risk any other potential yet-to-be-uncovered issues. Wood makes more sense all around.

🤖🔎📄👩🔬🧑🔬 The math error in the black plastic paper serves as a perfect illustration of an idea that I've been advocating for a while:

Scientific journals should pair AI systems with human reviewers to strengthen the peer review process.

This isn't just theoretical speculation. Prof. Ethan Mollick had OpenAI’s O1 model (not even O1 Pro) check the paper’s math and it found the error in one try:

I can’t think of many downsides to having every paper checked by one or many AI reviewers before publication. AI false positives may take time to verify, but this cost is negligible compared to the massive benefits of catching errors (and fraud). Flawed papers can send multiple other teams on multi-year, expensive wild goose chases based on erroneous premises — *that* is costly!

Ideally, you’d set up a system where every paper is reviewed by multiple leading models, leveraging their complementary strengths and improving odds that at least one catches problems that the others don’t.

But why stop at new papers?

We should also let these AI systems loose on the entire corpus of PAST published studies to identify errors/fraud. The process should be repeated periodically as models improve, ensuring that previously undetected errors may eventually be found.

There’s a TON of leverage to improving scientific rigor. Let’s do it!

🚑 🤕 My friend David Kim (💚💚💚💚💚 🥃 ) aka Scuttleblurb needs your help:

Earlier this year my kid brother, Rich, took his own life. Rich loved this country and devoted his adult life to its defense, first as a combat infantry officer in the Army, during which time he fought in Iraq, then as part of the US Intelligence Community, where he served in a covert capacity until his suicide. He will be missed by his three kids who brought light to his dark inner world, by their mom who tried tirelessly to help him, and by the warfighters and intelligence officers who operated steadfastly alongside him.

I don’t pretend to understand the range of factors that produced this tragic result. What’s clear, though, is that combat exacted a heavy toll on Rich’s mental health and changed him in profound ways. [...]

We can’t expect our warfighters to snap back to their former selves after being steeped in such brutal violence. Too often they don’t. My brother was just one of a significant minority of combat vets who carried the hell of war back home.

The Boulder Crest Foundation is a charity that, since 2013, has helped more than 100,000 veterans, servicemembers, and first responders transform their struggle with trauma into strength. Their Warrior PATHH training includes a 7-day in-person retreat, followed by 90 days of support and accountability. It is offered to participants at no cost. I wish my brother had the opportunity to be part of this program. If you can, please join me in supporting the brave men and women who have made enormous sacrifices on our behalf. I will match all contributions up to $10,000. Thank you for taking the time to consider this cause, it means a great deal to me.

(Note: David and I are planning this year’s interview. It should be out in a few weeks. It’ll be our *5th* one together — time flies. Here is last year’s.)

🦋🕸️⛓️ Almost *a thousand* people have come to the bunker!

Please come say hello 👋

To get started, here’s a Fintwit starter pack curated by Terminal Value.

📕💭💭🎁 Don’t forget to pre-order your copy of Jim’s new book!

It’s a fun read and a beautiful artifact to hold 💚 🥃

I’m involved in the creation of this book, but I wouldn’t recommend it to you if I didn’t genuinely believe that you’ll enjoy it and that it makes for a great gift to give to your loved ones. I wouldn’t burn your trust on anything that I don’t 💯 believe in.

🏦 💰 Liberty Capital 💳 💴

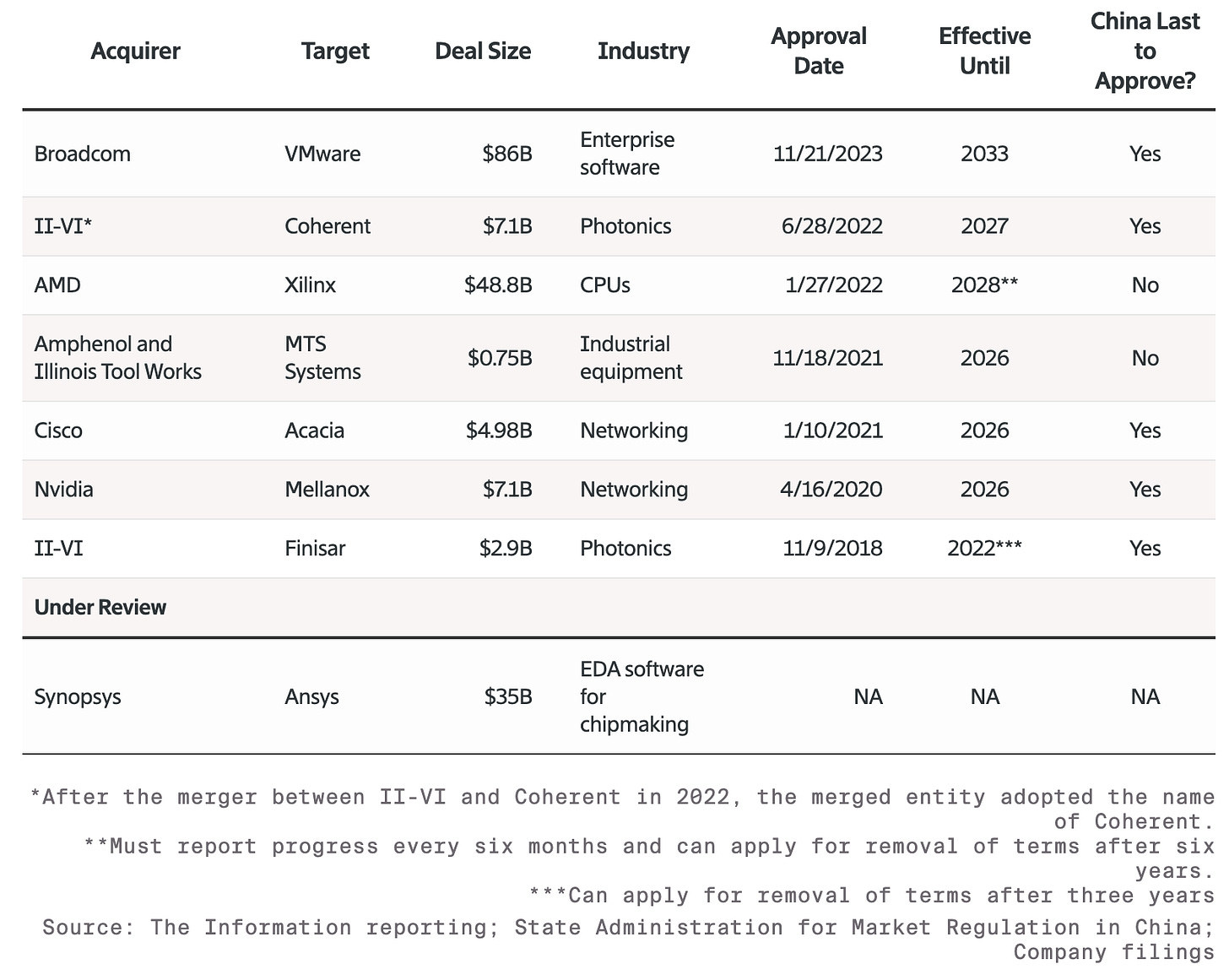

🇨🇳📃📃✋📃📃🇺🇸 China vs USA: New Salvo in Regulatory Warfare (Nvidia in the crosshairs, who’s next?)

In the world's most expensive chess match, the pieces aren't carved from ivory but etched in silicon. The newest front in the US-China rivalry isn't fought with soldiers or destroyers but with export control footnotes and filing deadlines.

The [Chinese] State Administration for Market Regulation, which oversees antitrust and other issues, alleged that Nvidia had breached the conditions laid out for acquiring Mellanox Technologies, without elaborating. The U.S. chip designer bought Mellanox, an Israeli company that develops computer networking technology, for $7billion in April 2020.

As diplomats trade pleasantries across mahogany tables, a different kind of warfare unfolds in gray nondescript government offices with neon lighting and bad carpeting. Washington moved first with its chip ban gambit, and Beijing is countering with an antitrust knight's fork against Nvidia.

Bureaucrats and lawyers on both sides of the Pacific are fondling their finest fountain pens and transforming regulatory paperwork into Weapons of Mass Regulation, with America's semiconductor sanctions clashing with China's antitrust artillery.

Was this too maximalist? I thought it was kind of fun, though I won’t do that too often… ¯\_(ツ)_/¯

Looking ahead, here are potential targets for China’s antitrust column:

Intel may already have been a casualty of this weapon, with the blocking of the Tower Semiconductor acquisition for no apparent reason other than tit-for-tat retaliation.

They may still have failed with Tower, but they would’ve had stronger prospects in their transition to becoming a Foundry and, well, we’ll never know the counter-factual…

How much damage could China’s regulators do with this approach, and will the US find a way to remove China’s veto power over the M&A of its companies? Further economic decoupling might be the only solution, but it carries risks of backfiring —potentially accelerating China's development of homegrown capabilities.

But it’s probably too late on that front anyway — even without separation, China will keep going full steam ahead on that parallel track. Perhaps now is the moment to do it, when the impact will be felt most.

A similar dynamic plays out with the EU (🇪🇺). Their regulatory approach is a kind of de facto veto on many activities by US global companies (ie. especially Big Tech M&A). Since tech companies prefer to maintain unified products to preserve economies of scale, the world ends up inheriting EU regulations by default (infuriating cookie popups and Privacy Policy Notifications everywhere!).

I wonder if there will come a breaking point for certain Big Tech companies when it comes to the EU, where the calculus of staying in the EU vs the red tape that hampers their global operations and recurring billion-dollar fines outweighs the benefits of staying in the European market. 🤔

🎌 🚗🤝🚙 Honda and Nissan Consider Merging 🤔

Hissan? Nonda? HoNi? NiHon?

Hondassan!

That’s the one 🥋

Transitions lead to consolidations:

Honda and Nissan are considering operating under a holding company, and soon will sign a memorandum of understanding, according to [Nikkei]. They also look to eventually bring Mitsubishi Motors, in which Nissan is the top shareholder with a 24% stake, under the holding company. [...]

The merger report follows the two Japanese automakers entering into a strategic partnership in August on shared automotive components and software.

Such a tie-up would be the largest automotive industry merger since Fiat Chrysler joined with France-based PSA Groupe to form Stellantis in January 2021.

Legacy automakers are being hit from all sides:

Self-driving technology

Software becoming the heart of the modern vehicle

Big Tech inserting itself between them and their customers via Android Auto and Apple CarPlay

Electric vehicle transition disrupting ICE supply chain advantages

Aggressive new entrants from China's hyper-competitive ecosystem which breeds fast innovation and lean super-predators

I would not be surprised to see this merger happen, and more coming.

But I doubt it’ll be enough.

How can these industrial companies become good at software? At AI? At rapid innovation? At doing less, but better? They don’t need 37 different “blah” models — they need to focus on a few highly differentiated and desirable “wow” vehicles.

The harsh reality is that these companies have evolved to operate more like Procter & Gamble than SpaceX.

🏪📈 The Private Billions Club: Public Investors Can Only Watch 👀 — Databricks, Stripe, SpaceX, Anduril, OpenAI, Anthropic, Perplexity, etc 😕

Databricks just announced that it’s raising $10bn at a $62 billion valuation.

Stripe was valued at $70bn last summer, OpenAI at almost $160bn in October, Anthropic in the $30-35bn range, Anduril raised at $14bn in August, Perplexity at $9bn last month.

SpaceX was valued at $350bn (🤯) in a secondary round this month!

I have no idea what these companies would be worth on the public market — more or less — but I’m kind of sad that so many interesting and innovative companies are staying private for a looooong time leaving public market investors (like me) unable to participate in that phase of growth.

I know it was a very different time, but Apple IPO’ed in 1980 at a $1.2bn market cap (by the end of the first trading day it was $1.8bn…) and Microsoft IPO’ed in 1986 at a $519 market cap (rising to $777m at the end of the first trading day!).

While that was a lot of money then, even when adjusted for inflation and the size of those markets, it was much earlier in the lifecycle of those companies.

It’s almost comical that Stripe and SpaceX are still sometimes labeled “startups” when processing over a TRILLION DOLLARS in payment volume and launching MORE ROCKETS THAN THE REST OF THE WORLD COMBINED and operating a constellation of THOUSANDS OF LEO SATELLITES.

My wish for Xmas this year is that the market gods will reform some of the regulations that make it so onerous to go public, allowing public market investors to have more variety in their buffet of choices and not let all the high-growth to private investors and VCs.

When something is trading for tens of billions, there’s no need for “venture” capital anymore…

To be clear, not all of these companies would be good investments — there are many factors, even for businesses that do well and grow fast — but it would be nice if this highly dynamic part of the economy wasn’t off-limits to most investors.

🇳🇴✂️🔌🇩🇪 Norway considers cutting energy links to Europe because of volatility caused by German wind & solar

Norway’s two governing parties want to scrap an electricity interconnector to Denmark, with the junior coalition partner also calling for a renegotiation of power links to the UK and Germany, as sky-high prices trigger panic in the rich Nordic country.

A lack of wind in Germany and the North Sea will push electricity prices in southern Norway to NKr13.16 ($1.18) per kilowatt hour on Thursday afternoon, their highest level since 2009 and almost 20 times their level just last week.

“It’s an absolutely shit situation,” said Norway’s energy minister Terje Aasland.

Germany is the big domino affecting the smaller ones.

When there’s seasonally little wind and sun, it needs to find megawatts somewhere, so it burns more coal and gas, and imports more power from neighboring countries.

It can’t let the lights go off at home, so it will bid up the price of electricity to the sky if need be — what seems like a modest power purchase for an economic giant like Germany can create massive ripples in smaller markets — after all, when demand is inflexible, even small changes in supply can cause price explosions.

The interconnectors are taking the blame for the current high Norwegian prices, with critics arguing Norway should only send electricity from its abundant hydropower abroad after it has ensured low prices at home, as was the case for decades previously. [...]

The right-wing Progress party, which is leading the polls, also wants to scrap the connection with Denmark and to reform the deals with the UK and Germany to reduce “the price infection” to Norway from the continent.

Norway isn't without bargaining power, though. As western Europe's largest petroleum producer, it has become the crucial gas supplier to many EU countries, effectively stepping into Russia's former role.

🔍🤖 Perplexity’s Financials (take with some 🧂)

Some of the company’s financials have been reported publicly, and I found them interesting, but it's worth remembering that — like all fundraising projections — they should be taken with a full 🥨:

Perplexity AI recently projected it will more than double its annualized revenue in 2025 to $127 million, implying it would be generating $10.5 million per month, according to three people who have seen the projections. Perplexity also projected it would quintuple annualized revenue to $656 million by the end of the following year

Nice growth, if they achieve it!

But I’m biased, I like the product…

Perplexity plans to end this year with 240,000 subscribers to its premium service, according to one of the prospective investors. But it isn’t clear how many of the subscribers are paying for the service, which typically costs $20 per month. The company projected it would have 550,000 subscribers in 2025 and 2.9 million subscribers in 2026, this investor said. Perplexity says companies including Stripe and Zoom have signed up for enterprise plans, costing $40 per month per person, for their employees.

Margins:

Perplexity said its gross profit margin, or revenue after the cost of goods sold—including cloud fees, customer service and payment processing—would be around 75% by the end of the year, up from roughly 30% in January, said the person who saw the figures. Perplexity expects to eventually increase its gross margin to 85% after 2026. [...]

Perplexity’s projected gross margins are far higher than those of the major AI developers upon which its search service relies. OpenAI, for instance, projected a 41% gross margin this year, possibly because of the high costs of running the free version of ChatGPT, which has more than 300 million weekly users. (However, OpenAI is growing faster than Perplexity despite being 80 times bigger in terms of revenue.)

That’s higher than I expected, but there's an important context here: this business has a higher share of variable costs (ie. inference) than typical software services.

BUT

It has been a huge tailwind for them that smaller models have gotten a lot better, even if we haven’t made a quantum leap over GPT-4 yet. The cost per token has fallen pretty dramatically in the past couple years.

If Perplexity can serve most of its free users with a small but very high-performance and finely-tuned model (they call it Sonar, it’s based on Meta’s Llama 🦙), its inference cost can be kept reasonable.

🧪🔬 Liberty Labs 🧬 🔭

🎮 Unreal Engine 5.5 Highlights 🧱

It’s been a while since we looked at how the Unreal Engine has been progressing. I thought it would be cool to have a look at the latest update.

I’m particularly impressed by the ray-traced light and volumetric shadow improvements and the virtual production tools.

If you want more, also check out the highlights from the 5.4 update.

🇺🇸🕸️☎️ Bell Freaking Labs! 👨🔬🔬🧫🧪 💾 📡🛰️📺💻💿📻

Friend-of-the-show and OSV Fellow Jason Carman, alongside his S3 team, produced this great short video about Bell Labs.

That’s like catnip to me, and I suspect you’ll like it too. 🐈

🔮🤔 More Sober Perspectives on Google’s Willow Quantum Computing Results

I’m not a quantum computing nerd, but I follow the field as an interested tourist. But most of it is firmly outside of my area of competence. That’s why in the previous Edition I found it easier to identify what the Willow announcement wasn’t rather than what it was.

But Scott Aaronson has spent his career thinking about this, so I value his sober take. I encourage you to check it out.

Aaronson also points to this post by Sabine Hossenfelder, a German physicist and well-known science communicator.

He gives this context “I don’t think she and I disagree about any of the actual facts; she just decided to frame things much more negatively. Ironically, I guess 20 years of covering hyped, dishonestly-presented non-milestones in quantum computing has inclined me to be pretty positive when a group puts in this much work, demonstrates a real milestone, and talks about it without obvious falsehoods!”

🛞 Tire Technology is Underrated! 🛞

I love this kind of comparison testing!

Pitting a newer car equipped with older tires (new tires, but older tech) against an older car running newer-generation tires.

Great way to show just how much of the performance gains that most people likely attribute to engines actually come from advances in tire technology.

🎨 🎭 Liberty Studio 👩🎨 🎥

💝 Nirvana’s Heart-Shaped Box Reworked and Rearranged in Real-Time by a Jazz Band 🎺🎶

Here's something you don't hear every day!

I love watching musicians create, observing the gears turn in their minds as they discover/distill the essence of a song and mold it into something new.

It’s often the sign of a great song when you can turn it into something completely different yet it remains compelling and recognizable.

If you like this concept — getting a band in the studio, making them listen to something very different from what they usually play, and watching them create their own version of it — I also recommend this folk/pop duo covering a System of a Down song:

"My wish for Xmas this year is that the market gods will reform some of the regulations that make it so onerous to go public, allowing public market investors to have more variety in their buffet of choices and not let all the high-growth to private investors and VCs."

🙏

I'd be interested in hearing your opinions on "Accredited" investor rules. I understand that it is meant to protect less "sophisticated" investors, but at the same time, it also looks like a gate that privileges wealthier individuals. The income/wealth requirements haven't changed for as long as I've known of them, making it seem even more arbitrary.

Been surprised there isn't more pushback against them with the general sentiment these days against those sorts of gates.

Love and very much agree on the point about using AI as a checker for academic papers. It would be great to see this particularly on the open source archives that don't yet have peer review but feel pretty much all papers would benefit.