83: My Thoughts on Investing, Twitter vs Substack, WSB Sentiment Dashboard, MSFT Q4, Automakers Beg TSMC, Nvidia, EVs, and Mechanized Nuclear Pulse Propulsion

"a sand-polishing company"

Anyone who isn’t confused doesn’t understand the situation.

—Edward R. Murrow

Why am I interested in investing?

The first thing that comes to mind about the field to most outside observers is money. Oh, you must be really into money. I guess it’s the visible brand of “finance”.

But the way the world works, to do a lot of the interesting stuff, people have to band together and organize as groups. Companies are a common way that this happens when you want to do something really complex and difficult. And these companies, when they are publicly traded, reveal a lot about themselves, their products, their technologies, and their inner workings.

So it’s an endless playground for someone who’s curious and likes to learn about how things work. That you can make money doing it, that makes it practical. But the money is not the reason why it’s interesting.

I can’t spend my days thinking about money and how it’ll be when I sell that stock for a higher price than you bought it at some point in the future. That’s boring. Thats’ just the mechanics of paying the bills, and keeping playing the infinite game.

What’s interesting is the people and technologies and systems and patterns and relationships and puzzles and constant change and trends and counter-trends and dynasties and disruptions and breakthroughs and fallen angels and risen phoenixes…

Sometimes I wish that people outside of finance knew about all that, because when I mention what I do — which is rarely — they probably think I’m a lot closer to an accountant than I actually am (don’t get me wrong, I wish I had better accounting skills).

▹ My new fave way to describe Intel: "a sand-polishing company" (credit goes to John Gruber). Of course, it also applies to others, like TSMC… (and to be clear, this isn’t meant to imply anything negative about Intel, though I have separate opinions on that. I like it because it’s a funny euphemistic way to describe a really really complicated thing. It’s like saying that investing is “guessing which lines will go up”).

🤔 Maybe Michael Lewis' next book should be about WallStreetBets… Shouldn’t be hard to find some colorful characters and anecdotes to anchor the story.

Speaking of Lewis, he should probably get more credit for ‘The Fifth Risk’ and seeing a lot of things coming. It’s no the most cinematic of his books, but it’s an important one.

Investing & Business

Twitter Acquires Revue (aka “it’s kinda like Substack”)

Twitter writes in a blog post:

Twitter has acquired Revue, a service that makes it free and easy for anyone to start and publish editorial newsletters. [...]

Twitter is uniquely positioned to help organizations and writers grow their readership faster and at a much larger scale than anywhere else. Many established writers and publishers have built their brand on Twitter, amassing an audience that’s hungry for the next article or perspective they Tweet. Our goal is to make it easy for them to connect with their subscribers, while also helping readers better discover writers and their content. [...]

Finally starting to try to do something about the fact that they’re at the top of the funnel for so many, and that so far, they all had to go off-platform to create things that don’t fit into tweets and/or try to pay their bills.

Starting today, we’re making Revue’s Pro features free for all accounts and lowering the paid newsletter fee to 5% [from 6%], a competitive rate that lets writers keep more of the revenue generated from subscriptions.

This will no doubt put some pressure on Substack to take a long hard look at its 10% fee.

I think they could probably have something that scales with revenue, like, 10% may not be so bad for smaller creators, especially if Substack keeps improving the platform fast and helps more with discovery.

Then when you get above a certain size, Substack could lower its fee to reduce some of the incentive for its stars to move off-platform (f.ex. 10% of revenue up to $200k, 7.5% up to $500k, 5% up to $1 million, and over that, call us and we’ll figure it out.. here, have some massage vouchers and an Aeron Chair).

The question always is: Can Twitter get out of its own way and stop snatching defeat from the jaws of victory.

Substack’s best hope is to just be so much better, and improve at such a faster rate than Twitter’s offering, so that it remains the first choice of many. But it’ll be tough to overcome Twitter’s distribution advantage…

Ben Thompson also covered the acquisition (sub required), with an interesting angle on Substack’s wholesale transfer pricing challenge.

Interview: Elliot Turner on Twitter (and Dropbox, a bit)

Speaking of Twitter, here’s a good interview that is largely about it, with Elliot Turner and Andrew Walker (that pandemic beard is coming along nicely).

I like what Elliot says about how, for a long time, Twitter didn't even know what it was, compared itself to Facebook for a while, then tried to focus on “live”… But now seems to finally understand that it’s all about people’s interests.

When the Revue acquisition was announced (after the recording of the podcast), Elliot shared his thoughts about it here.

Microsoft Q4 Highlights

Yea yea, fiscal year Q2, whatever, can we abolish those offset fiscal years already? But daylight saving time first, please.

What was most impressive to me was probably Azure’s acceleration to 50% growth (48% ex-FX) and commercial cloud overall being +34%. Pretty amazing at that scale.

GitHub is used by more than 56 million developers, as well as 3 million organizations

Power Platform is the clear leader in low code/no code development, with more than 11 million monthly active users, up 95 percent year over year.'

LinkedIn’s nearly 740 million members

How many billions of annoying automated notification emails that come back even after you unsubscribe is that?

Teams has nearly 60 million daily active users on mobile alone.

Security: our operational security posture and threat intelligence, which analyzes 8 trillion signals each day, help customers defend themselves.

Crowdstrike mentioned analyzing 4 trillion signals/week, though who knows what each counts as a "signal" and if it's comparable. Microsoft’s 8 trillion per day would be 56 trillion per week, for those who don’t remember 8 x 7 (it’s a hard one).

Over the past 12 months, our security business revenue has surpassed $10 billion, up more than 40 percent.

In identity, Azure AD has more than 425 million monthly active users.

In security, Microsoft Defender blocked nearly 6 billion threats last year alone.

Gaming: “We surpassed $5 billion in revenue for the first time this quarter”… Xbox Series X and Series S was the most successful in our history, with the most devices ever sold in a launch month... exceeded $2bn in revenue from third-party titles this quarter

Xbox Live has more than 100 million monthly active users, while Game Pass now has 18 million subscribers

Automakers Starved for Polished Sand

"[TSMC] will prioritise production of auto chips if it is able to further increase capacity [...]

Germany has asked Taiwan to persuade Taiwanese manufacturers to help ease a shortage of semiconductor chips in the auto sector [...]

Automakers around the world are shutting assembly lines due to problems in the delivery of semiconductors, which in some cases have been exacerbated by the former Trump administration’s actions against key Chinese chip factories. [...]

The shortage has affected VW, Ford, Subaru, Toyota, Nissan, Fiat Chrysler and others." [...]

In 2020, auto chips accounted only for 3% of TSMC’s sales, lagging smartphones’ 48% and 33% for high performance chips.

In the fourth quarter, sales for TSMC’s auto chips jumped 27% from the previous quarter, but still only accounted for 3% of overall sales in the quarter. (Source)

‘Move to EU to avoid Brexit costs, firms told’

In an extraordinary twist to the Brexit saga, UK small businesses are being told by advisers working for the Department for International Trade (DIT) that the best way to circumvent border issues and VAT problems that have been piling up since 1 January is to register new firms within the EU single market, from where they can distribute their goods far more freely. (Source)

🤦♀️

MasterCard:

Mastercard will increase fees more than fivefold when a British shopper uses a debit or credit card to buy from an EU-based company, sparking alarm among companies that rely on online payments and concern among MPs over higher consumer prices.

Mastercard and Visa levy an “interchange” fee on behalf of banks for every debit or credit card payment that uses their networks. The EU introduced a cap in 2015 after concerns the hidden fees were leading to hundreds of millions of euros in costs for companies and higher prices for consumers.

But Mastercard has told merchants that the cap no longer applies to some transactions post-Brexit, because payments between the UK and European Economic Area are now deemed “inter-regional”. [...]

From October 15, Mastercard will charge 1.5 per cent of the transaction value for every online credit card payment from the UK to the EU, up from 0.3 per cent at the moment. For debit card payments, the fee will jump from 0.2 per cent to 1.15 per cent. (Source)

Good job, Brexiters.

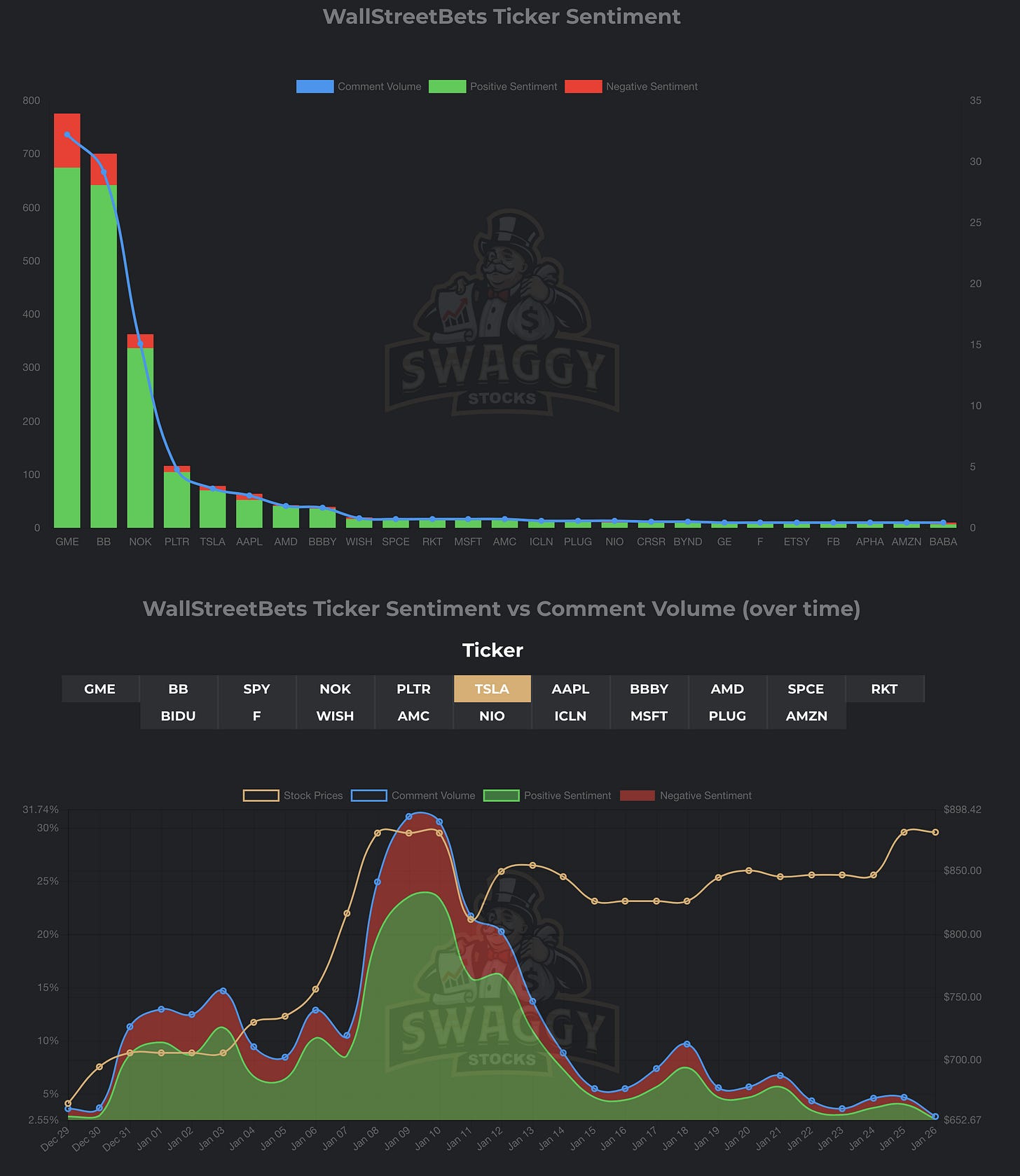

WSB Sentiment Dashboard

You know your little Reddit community is influential when people create visualization dashboard to track which stocks are mentioned on it and sentiment. You can see ticker sentiment here, and real-time overall sentiment here. What a world we live in.

Nvidia’s Gaming Installed Base

installed base of 200 million GeForce users, still 70% of that installed base is on Pascal or prior generation platforms [...] only 10% of that installed base is on RTX-based platforms

Replacement cycles, etcetera.

Interesting, though, that even this long after the launch they still haven’t caught up:

seasonality is probably not a big factor this year as we are supply-constrained

‘The reflexivity shows up in the LinkedIn graph for the company, not on their 10k.’

Science & Technology

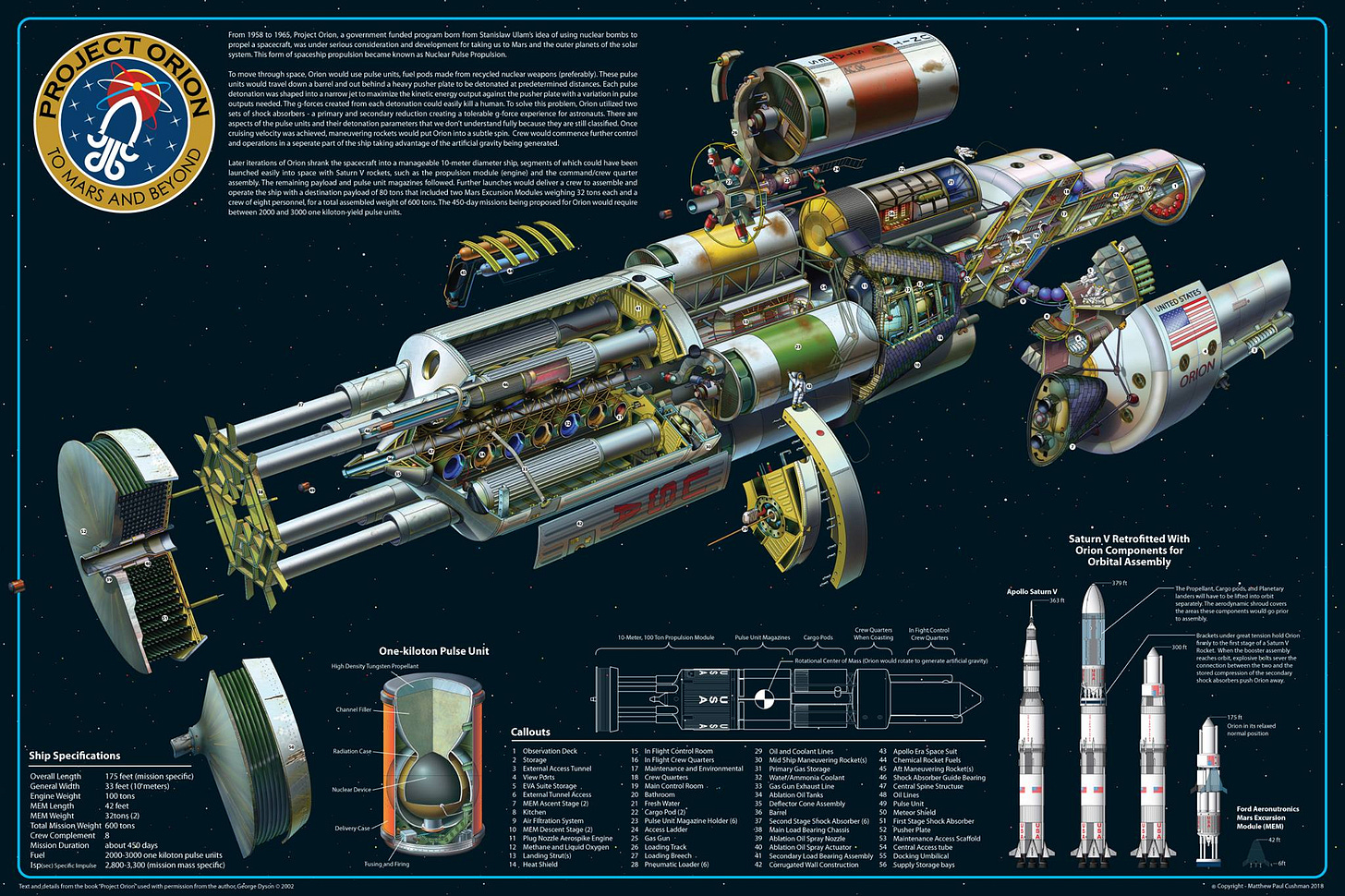

‘Moto-Orion: Mechanized Nuclear Pulse Propulsion’

Ok, this is cool.

The Orion nuclear pulse propulsion concept has been around for over six decades [...]

Project Orion’s design for a nuclear pulsed propulsion system was pretty simple. A physical plate of steel, protected with a thin layer of oil, faced a plasma jet from a nuclear shaped charge. The force of that blast was translated into useful thrust for the Orion spaceship.

In this manner, a propulsion system could tap into the immense power of a nuclear detonation while sidestepping the heat management issues that would normally come from handling such an output. Its thrust was huge, enough to lift thousands of tons into orbit, and so was its efficiency, with an effective Isp of 2,000 to 12,000s. That’s five to thirty times the specific impulse of a chemical rocket, with thrust and efficiency that only gets better as you scale it up.

There’s plenty of extra context before it goes into the update to the design, the Moto-Orion, which are a safer and more flexible design. You can read about it here.

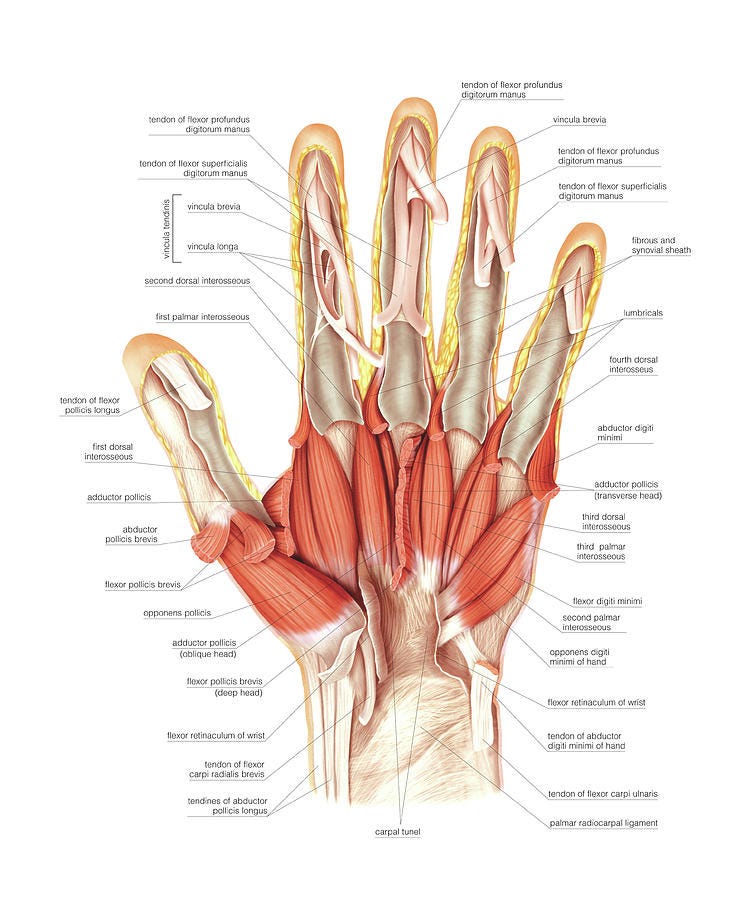

‘Fingers do not contain muscles’

Fingers do not contain muscles (other than arrector pili [also known as ‘hair erector muscles’]). The muscles that move the finger joints are in the palm and forearm. The long tendons that deliver motion from the forearm muscles may be observed to move under the skin at the wrist and on the back of the hand. (Source)

‘Biden vows to replace U.S. government fleet [650k] with electric vehicles’

If you’re going to try to incentivize EVs, using the purchasing power of the federal government isn’t the worst way to do it. Ideally you’d be able to go back in time and retroactively remove the hundreds of billions in subsidies, direct and indirect, for oil, but that’s not possible, so trying to level the playing field a bit in favor of what is clearly going to be the dominant technology in the future makes sense.

As an aside, a lot of people don’t realize how much government money has been poured into protecting oil in indirect ways, on top of all the direct ones. When you have large military deployments around the world to protect oil routes and permanent military bases in countries where your main strategic goal is to protect the flow of oil (often by cozying up to dictators), that’s a real cost.

If you hadn’t done these things, the price of oil would’ve likely been higher and more volatile, encouraging alternatives to be developed earlier, on top of a much higher rate of fuel efficiency improvements. Would it have cost more at the pump? Probably, though efficiency improvements mitigate some of that; but it’s not like the military is free either, and it ultimately all comes out of the same pockets.

Anyway, the US has something like 250 million vehicles (maybe around 180m light-duty), so 650k isn’t that much when compared to the installed base.

But when you compare it to how many EVs are currently being sold in the US, it’s a significant amount, enough to help manufacturers reach scale faster and better amortize their R&D costs.

So it could be a nice boost to EV adoption, when combined with other measures like removing all kinds of other unnecessary subsidies and regulatory favors to the oil industry — I’d also like to see a revenue-neutral carbon tax, where you reduce the stupidest taxes by the same amount that you raise there, as we should focus on taxing “bads” that we want less of instead of taxing “goods” that we want more of (incentives 101). f.ex. cut payroll taxes.

Is a carbon tax unfair? I don’t know, is it fair for society as a whole to bear the costs of pollution and global warming and the geopolitical and humanitarian costs of being dependent on petro-dictators?

‘Police ping Apple Watch to find kidnapped woman’

A man is facing charges after he allegedly kidnapped a woman who used her watch to call for help, terrorizing her as he drove with her in the bed of a truck. [...]

officers spoke to a girl who told them her mother had been kidnapped. She said her mother and Adalberto Longoria were outside of an apartment arguing when the girl heard her mother scream. The girl told police she heard the screaming from the parking lot, but did not know where she was taken.

Around 10 to 15 minutes later, the woman called the girl through her mobile watch, telling her Longoria had kidnapped her and wanted to hurt her. As she was speaking to her mom, the mobile watch was suddenly disconnected.

Officers used an emergency cellular ping to track the woman. The watch showed the victim's location on East Sonterra Blvd at the Hyatt Place Hotel. When police arrived, they found the woman in a vehicle in the parking lot. Longoria had unfortunately already fled the scene on foot, police said. (Source)

The Arts & History

‘My girlfriend and the only fully black church in Iceland’s Westman Islands’

Source. Here’s another photo that I also like by the same photographer. Another one.

The Wire (S2 Mild Spoiler + Book Rec)

For some reason, I was randomly reminded of a scene in season 2 of ‘The Wire’ (HBO, you know) where two crime bosses are chatting about how they’ll have to disappear because the police are starting to know too much about their organization:

Spiros: He knows my name... but my name is not my name.

And you... to them you're only "The Greek."

The Greek: And, of course, I'm not even Greek.If you love the show as I do, I highly recommend this book about it. I devoured it quickly a few years ago, and really enjoyed it. It’s mostly interviews with almost everyone involved in the creation of the show, from the actors to the writers and directors and some of the crew:

"And these companies, when they are publicly traded, reveal a lot about themselves, their products, their technologies, and their inner workings. So it’s an endless playground for someone who’s curious and likes to learn about how things work."

This perfectly captures it for me. I remember around the time I found out what a 10-K was. And that companies like Nike and McDonald's actually put all that info out there for random people like me to read. It blew my mind that all that info was even meticulously tracked and collected in one place, never mind that I had access to it. Felt like a kid on Christmas.