91: Constellation Software Q4, Qualcomm vs Nvidia, SolarWinds, SPAKKS, Gavin Baker on Disney IP vs Video Games Franchises, Solar PV, Twitter, and Averaging Up

"I wasn’t angry when I started typing this."

Winning a bad game is no victory.

—Stoic Emperor

It's not because something keeps the same name that it is the same thing.

The Dow Jones goes up and down in an unbroken line, but underneath the surface, it’s like the ship of Theseus that had had every plank replaced over time, or the grandfather's ax that over time had both the head and handle replaced multiple times.

It's the same for institutions, like the U.S. Government, the New York Times, Microsoft, or even Berkshire Hathaway. It’s not necessarily bad, it’s sometimes good, but either way, it’s something to be aware of.

(I want to write something longer on this someday, but planting the seed will have to do for today 🌱)

🛀 Some pattern-matching I've noticed again and again over my life... Every time I've encountered something where the real value being "mysterious" and "opaque" was claimed as a feature, there usually wasn't much "there" there.

If there was something really cool there, it’d be front-and-center and shouted from the rooftops. If instead you get “this is really amazing, but I can’t just tell you why, you have to figure it out by yourself, study it a lot, only a few people really get it, etc”, maybe that should be a red flag… (inspired by this)

💸 I had a DM conversation with a friend, and he said something very insightful (hey A!):

"democratize investing" will be the new banner for this era's frauds.This was in the general context of the whole Reddit investors, WSB, Robinhood, Chamath’s pitch these days, etc.

I think that may be true.

Investing is already very democratic, very accessible. It's not like there's huge barriers to entry anymore, like 40 years ago. You have low-cost or no-cost brokerage, more financial information at your fingertips than you could possible consume in a lifetime, and improving tools to make sense of it all (*cough* Koyfin *cough*).

The problem isn't getting in. It's doing something smart once you're in. Reducing entry friction further, or convincing more people to join manias isn’t going to help with that.

The vast majority of people who aren’t freaks like us Fintwitters, people who won’t spend 20-40 hours a week on this, reading what, to most normal people, are the most boring documents about the most boring companies, until your eyes bleed… These people should index or, if they can somehow find a good money manager that they trust and that will have them, let someone else handle it.

Convincing millions of people that they should invest material amounts of their money in ‘ticker XYZ’ because they spent a couple hours thinking about investing and peer pressure is ramming FOMO down their throat (NYT headline: “Everyone Is Getting Hilariously Rich and You’re Not”) is just speculation and gambling and likely to finish badly for the virgins sitting at the table with the card sharks.

That’s not democratizing investing, that’s recruiting greater fools for your schemes.

Lots of people have something to sell that isn't always aligned with the best interests of who they're selling to… There’s a huge difference between getting someone involved in investing in a way that will benefit them in the long run, and just revving them up for a Hangover-style night in Las Vegas.

Shit, I wasn’t angry when I started typing this.

🛀 I'll take true clichés over false novelties any day of the week.

(I don’t care if that ↑ is a cliché)

Investing & Business

Constellation Software Q4

Just a few highlights (you can see the whole report and press release for more):

Q4:

Revenue grew 14% (1% organic growth, negative 1% after adjusting for changes in FX)

A number of acquisitions were completed for aggregate cash consideration of $179 million (which includes acquired cash). Deferred payments associated with these acquisitions have an estimated value of $60 million resulting in total consideration of $239 million.

Free cash flow available to shareholders (“FCFA2S”) increased $113 million to $307 million compared to $193 million for the same period in 2019 representing an increase of 59%.

On January 5, 2021, the Company completed its purchase of 100% of the shares of Topicus.com B.V.

Dat 28.1% FCF margin. Though expenses were depressed because of the pandemic and some gov’t grants helped. But still, it’s better than the alternative of seeing margins fall during tough times…

FY2020:

Revenue grew 14% (negative 3% organic growth, negative 3% after adjusting for changes in FX)

A number of acquisitions were completed for aggregate cash consideration of $477 million (which includes acquired cash). Deferred payments associated with these acquisitions have an estimated value of $151 million resulting in total consideration of $628 million.

Free cash flow available to shareholders (“FCFA2S”) increased $399 million to $989 million compared to $590 million for the same period in 2019 representing an increase of 68%.

Reminder that Topicus wasn't a full-spin:

Constellation’s equity interest in TSS prior to the Spin-Out Transactions was 66.7%. Constellation’s equity interest in Topicus.com after completion of the Spin-Out Transactions on a fully diluted basis is approximately 30.4%. In addition, Constellation as the holder of a super voting share is entitled to that number of votes that equals 50.1% of the aggregate number of votes

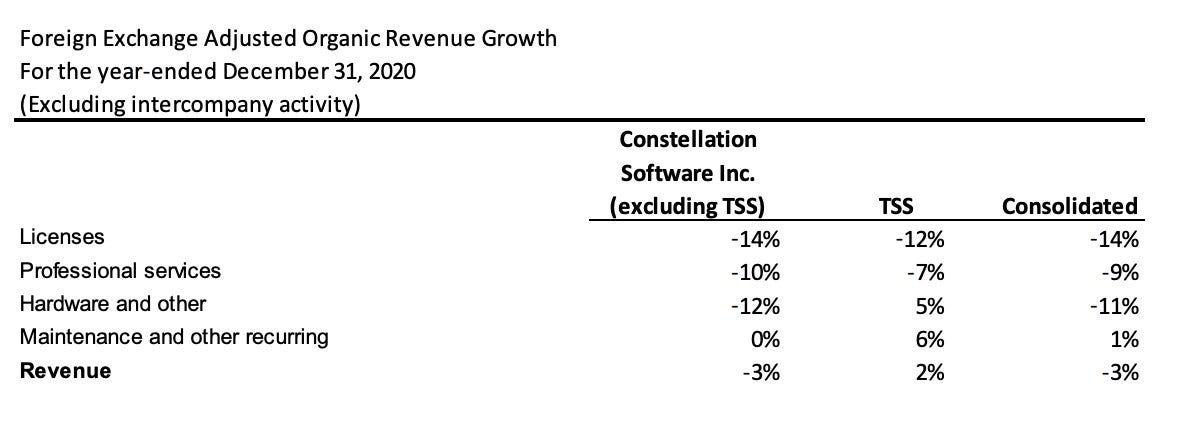

That FX-adjusted table I always like to look at (especially that line, where most of the value is):

The above is particularly interesting because not all revenue is created equal. So if you just look at the aggregated organic revenue growth number, you can easily mis what is going on under the surface.

For example, if organic growth is flat, but hardware is tanking and licenses & maintenance/recurring are doing great, I don’t really care. But if it’s the reverse, I may start to become worried…

Cash is piling up. Even excluding TSS, they have $690m with $160m of bank debt.

It’ll be interesting what they will decide to do with it if it keeps increasing and larger deals don’t materialize for a bit.

I wouldn’t be surprised to see another special dividend (Mark sounded like he was warming up a little to the idea of buybacks in recent AGMs, but I’d guess he probably likes special divs better because he’s very sensitive to the idea that management with inside information is buying back shares from shareholders who are less sophisticated and informed).

They broke out organic growth by segment and ex-TSS, which shows how good TSS has been doing lately (and that’s without Topicus, which historically has had even higher organic growth):

If you want even more, you can see the income statement ex-TSS here.

Qualcomm Spits in Nvidia’s Corn Flakes

Qualcomm has opposed the Nvidia takeover because it thinks there’s a very high risk that Nvidia could become a gatekeeper of Arm’s technology and prevent other chipmakers from using Arm’s intellectual property, according to sources. It doesn’t think Nvidia will be able to fully capitalize on the acquisition without crossing certain lines that people are worried about, they said. (Source)

“Psychological projection is a defense mechanism in which the ego defends itself against unconscious impulses or qualities (both positive and negative) by denying their existence in themselves by attributing them to others.”

Qualcomm’s been pretty good at using IP it controls to try to squeeze and hamper suppliers and competitors…

Interview: Andrew Walker on SPACSPACPSAPSÇ

(I thought going nuts on the word got the current sentiment across, somehow)

Another good interview by Billy Booster, having a chat with Andrew Walker about the current SPAC mania, and even touching the SPAC third rail a bit (Chamath):

It’s always fun to hear two interviewers talk, because there’s a tendency for each to try to interview the other without really meaning to.

Good stuff.

Gavin Baker’s Napkin Math on Disney IP vs Video Games Franchises

Cool thought experiment to compare why franchise is more recurring and durable:

Have been thinking about @JerryCap question on whether $DIS IP is more recurring than $ATVI $EA $ATVI IP. I think a reasonable way to measure the “franchise value” of IP is to look at the peak to trough variance within franchises.

i.e. More durable/recurring franchises should be less sensitive to the quality of individual releases and therefore have less variance within the franchise. On this metric Call of Duty is a more durable franchise than Star Wars over the last 10 years.

The highest variance within the CoD franchise over the last 10 years was between Modern Warfare 3 at 30.7m units relative to WW2 at 12.2m units; 2.51x. [...]

The highest variance within the Star Wars franchise over the last 10 years was between The Force Awakens at $2,068,223m relative to Solo at $392,924m; 5.26x. [...]

This makes logical sense to me. Games like Call of Duty are social networks and more important to the identity of their hard core “fans” than any movie/TV IP.

Videogames have secular tailwinds that other entertainment modalities do not have which makes the comparison more difficult. Perhaps a reasonable adjustment to the above analysis would make the franchise value closer to being equivalent

i.e. Videogame sales in 2018 were significantly higher than in 2011 when MW3 came out which effectively increases the variance within CoD.

You can read the rest of the thread here (it includes references to The Godfather 2 and The Deer Hunter — how’s that for a teaser?). DIS 0.00%↑

Cloud Computing’s Built-In Price Discrimination

Good writing (again again again) by Byrne Hobart (this one from last July, sub required):

cloud products have a wonderful sort of lock-in: the cost is roughly zero at first, and as the cost rises, switching providers gets more and more expensive. It’s perfect price discrimination: you charge $0 for developers who are just messing around, and charge a painful amount for customers who are deathly afraid of switching.

Who Wouldn’t Want to Invest in This?

Mira this press release by United Rail (URAL on the OTC market):

An era has now ended. URAL is no longer a rail business. [...]

No more choo choo, chuckled Mr Chan. Now it seems we are wizz-bang, swoosh, buzz, zing, ka-ching as we turn URAL into the future with high technology projects and innovation in various industries be it logistics, real estate, construction, agri-business or some of the other projects we are looking at.

Via Dave Waters

Interview: Jen Ross, Short-Selling, Cool Space Stuff, and Market Weirdness

I enjoyed this. I don’t short, and wouldn’t want to deal with the stresses of the short-seller life, but it’s fun once in a while to dip your toes in the mind of a short (a bit like in Being John Malkovich when you go through the portal and see through someone’s eyes for a while — but wouldn’t want to be stuck in there).

The extended section about the space industry may have been my favorite part, though I wish Jen was at liberty to talk more about all the cool stuff she’s involved with…

But I have to admit, what intrigues me the most is the all-female short-seller hedge fund where two analysts are ex-sniper instructors.

I need someone like HBO or AMC to make a mini-series about this hedge fund and all the diligence adventures and tense late-night conference room meetings (with empty pizza boxes, of course) about whether to pull the trigger on an idea or how some scumbag CEO is attempting to outplay them and raise capital before the fraud is revealed… I’d definitely watch that.

Anyway, another hit by Billy Booster. I’ve mentioned him soon enough lately, I’ll have to ask for a volume discount or something. You can follow Jen on Twitter here.

Update: If you want more Jen, she also did The Roth Effect podcast where she talked about her career and the recent GameStop and WSB/Reddit craycrayziness:

Averaging Up is an Uphill Battle1

One thing I often find myself thinking when I feel like “I missed it”, especially for something that I know lots of investors I admire own:

“Well, would they keep holding it here if they didn’t expect it to still do pretty well over the coming years?”

It’s not enough to make an investment, that’s not my point; I just find the framing helpful to try to re-anchor on the present rather than on some much lower price in the past.

On a similar theme, this thread from April 2, 2020, by Long Hill Road is good:

Imagine you've been following a company for years, but its stock always seemed too expensive for you to buy. A time traveler visits you from the future and claims, "Let's say there's a situation where that company's revenues plummet due to a temporary crisis.

The business loses a lot of money, but easily survives due to a strong financial position, cost cutting, and access to capital. Over time, it makes a full recovery and continues to grow, and the stock soars over the next several years.

But during the shut down period the stock is down 50%. Would that be an attractive enough price for you to finally make your long-term investment?" You say, "Of course. If only I could be so lucky."

He says, "Well, this actually happens. But you never buy it because you keep staring at your screen, speculating that it might trade even lower. You miss the whole opportunity."

While on this, here’s another good thread that is kinda, somewhat, a-little-related to this, by Mario Cibelli:

An incomplete list of things that one may encounter along the way if one plans on owning a great consumer company over the long-term - 5 to 10+ years

Spiking CAC that makes near term unit economics/transactions appear far less attractive

Rapidly decelerating growth rates that make high market penetrations appear near impossible

Perception of a soon to be high market penetration due to high trial usage/churn despite a current low # of users/customers

A completely unjustifiable equity price based on traditional and non-traditional valuation techniques that will challenge the notion of holding for the long term

A CFO and/or other executive changes leading to the notion of ‘why would so and so depart if the upside was still so attractive’

A quarterly miss that produces a peak to trough correction in the share price of 40%+

Your original financial model breaking/losing relevance as the business evolves to something else

Insiders selling in size at prices that are attractive to you as a buyer

Data/credit card panels capturing a definite slowdown in the business ahead of earnings

An attractive, highly justifiable valuation that will be terribly difficult to pull the trigger on due to a chorus of doubts from the sell side and fear of being able to acquire the shares at an even lower price tomorrow

Science & Technology

‘grid-tied solar photovoltaic (PV) owners are actually subsidizing their non-PV neighbors [& utilities]’

For years some utility companies have worried that solar panels drive up electric costs for people without panels. Joshua Pearce, Richard Witte Endowed Professor of Materials Science and Engineering and professor of electrical and computer engineering at Michigan Technological University, has shown the opposite is true -- grid-tied solar photovoltaic (PV) owners are actually subsidizing their non-PV neighbors. [...]

"Anyone who puts up solar is being a great citizen for their neighbors and for their local utility," Pearce said, noting that when someone puts up grid-tied solar panels, they are essentially investing in the grid itself. "Customers with solar distributed generation are making it so utility companies don't have to make as many infrastructure investments, while at the same time solar shaves down peak demands when electricity is the most expensive." [...]

Michigan Tech Open Sustainability Technology (MOST) Lab, found that grid-tied PV-owning utility customers are undercompensated in most of the U.S., as the "value of solar" eclipses both the net metering and two-tiered rates that utilities pay for solar electricity. [...]

The overall value of solar equation has numerous components:

Avoided operation and maintenance costs (fixed and variable)

Avoided fuel.

Avoided generations capacity.

Avoided reserve capacity (plants on standby that turn on if you have, for example, a large air conditioning load on hot day).

Avoided transmission capacity (lines).

Environmental and health liability costs associated with forms of electric generation that are polluting. [...]

"It can be concluded that substantial future regulatory reform is needed to ensure that grid-tied solar PV owners are not unjustly subsidizing U.S. electric utilities"

Well well well. How do you like them apples now?

Microsoft President Brad Smith: SolarWinds hack was 'largest and most sophisticated attack' ever

“When we analyzed everything that we saw at Microsoft, we asked ourselves how many engineers have probably worked on these attacks. And the answer we came to was, well, certainly more than 1,000,” Smith said. (Source)

The damage that Russia has done to the US in the past 4-5 years is probably higher than for almost any 4-5 year stretch during the Cold War.

Masterclass in Reading Between the Lines

Ok, if you want to be fancy, call it metaepistemology:

Critical Thinking isn't Just a Process by Zeynep Tufekci

$1 Billion to Train a Single AI Language Model?

Bryan Catanzaro, VP of Applied Deep Learning Research at NVIDIA put this into staggering context when he told us that he thinks it is entirely possible that in five years a company could invest one billion dollars in compute time to train a single language model.

“With models like GPT-3 we are starting to see models that can go beyond, that can actually become more general purpose tools for solving real-world problems. It’s a step toward a more general form of artificial intelligence and that justifies the investment in training these enormous language models on clusters like Selene.” [...]

“We’re going to see these models push the economic limit. Technology has always been constrained by economics, even Moore’s Law is an economic law as much as a physics law. These models are so adaptable and flexible and their capabilities have been so correlated with scale we may actually see them providing several billions of dollars worth of value from a single model, so in the next five years, spending a billion in compute to train those could make sense,” Catanzaro says. (Source)

GPT-7 is going to be 🔥

Twitter Feature Suggestion, Easier Onboarding/Discovery

Was chatting with a few people on Twitter, and we were discussing the challenge of onboarding new users on the platform, and how until you know how things work and who to follow, things can be really rough, and probably turn off a lot of people who never get to the good stuff. I wrote:

This is twitter's onboarding/discovery problem.

Someone who just wants to "check it out" may end up in some horrible corner of twitter and run away in horror. You don't know what you don't know, so how are you supposed to know who to follow at first? Tough problem ¯\_(ツ)_/¯

Twitter has a higher floor, but a higher ceiling too

If you want more images, you can also say that the learning curve is steeper than most other social networks (Snap is also pretty steep)

Derek William Vallès had a good idea:

This thread sparked some thoughts:

What if Twitter had a feature where you could see other timelines in “View as...” mode?

This could inspire new users by showing what’s possible, but would it make you uncomfortable?

Is network curation a kind of intellectual property?

Which made me think:

Never thought of that one. Makes sense, since the list of follows is public... Could just add a button in there that says basically "live view of this list" with option to "follow this as a list"

I think this could help new users get up to speed faster. Just jump in and out of timelines of people you have affinity for, or that are interested in the same kind of things you are. Follow some timelines as lists, over time build up your own by following the people you like from these…

Curious what Elliot Turner thinks of this idea 🤔

‘Israeli study finds 94% drop in symptomatic COVID-19 cases with Pfizer vaccine’

Israel’s largest healthcare provider on Sunday reported a 94% drop in symptomatic COVID-19 infections among 600,000 people who received two doses of the Pfizer’s vaccine in the country’s biggest study to date. (Source)

The Arts & History

Well, Hello There

I just like this bird. First time I saw it and it was love at first sight.

It even has a cool name: White-throated kingfisher

widely distributed in Asia from the Sinai east through the Indian subcontinent to the Philippines. This kingfisher is a resident over much of its range [...] It can often be found well away from water where it feeds on a wide range of prey that includes small reptiles, amphibians, crabs, small rodents and even birds.

This photo is really good too. I also like this one of the Ruddy Kingfisher with a tiny fish on its beak.

I’m kind of proud of that title, for once.