112: Complexity Investing, Instagram Extortion?, 16 Greatest Investments Ever, Stripe, Walk it Off, Voxels, Survival Curves, Lost Art of Thinking, and Retro-Futuristic Hamlet

"some ideas were four-pebble problems"

The great advances in science usually result from new tools rather than from new doctrines.

—Freeman Dyson

🚶🏻♂️I’m a big fan of walks.

They’re fun, they’re good for the body (and that includes the brain — too many of us assume that our brains are somehow separate from the rest), and they’re good for thinking through things.

Looks like Charles Darwin was also a fan:

The "sandwalk" was a gravel track near Down House, his home in Kent – he called it his "thinking path". Every day, once in the morning and again in the afternoon, Darwin strolled and reflected amongst the privet and hazel, often alongside his fox terrier. Darwin had a little pile of stones on the path, and he kicked one with each turn: some ideas were four-pebble problems.

I love this. I’m definitely going to start thinking of problems as N-pebble problems from now on.

🏭 👩🏻🏭 ⏱ One concept I’ve tried to integrate in my life is the idea of the natural ebbs and flows of productivity (in the broad sense of the word — not just “work” work, but doing things, learning, and having ideas generally).

The industrial age has tried to convince us that humans are cogs in a machine, and that they should wake up at the same time every weekday, spend the same amount of time working at the same pace to produce the same amount of whatever it is they do.

This makes some sense in a factory where it’s all a big coordination problem, but outside of it — either in more natural settings, like for farmers or hunters or gatherers, or in modern “knowledge work” settings — it doesn’t really work.

There are seasons to everything.

There are weeks where I learn more than in the preceding months, there are periods when it’s clearly time to slow down and relax, and times when those yummy flow states are easy to fall into and should be maximized.

In the early days of the newsletter, I think I was better at varying between longer and shorter editions.

Lately, I’ve had a lot to say, so they’ve mostly been long. But I want you to expect that there will be days or week when things slow down, and others when we push that hyperspace thrust-lever all the way forward.

It’s only natural.

🤔 I know the theory of why large numbers of anything tend to have fairly predictable behaviors as a group. A gazillion atoms bouncing around randomly in a gas produce a pretty predictable behavior, the random movements in every direction largely cancel each other out, etc.

But it still feels weird to me that certain things should be so smooth and predictable, even with relatively small numbers.

Like when I look at total subs here:

It seems like way more of a straight line than I would’ve predicted if I had never seen the graph.

This is a relatively small number of people in the grand scheme of things. There are big events in the world, the market is sometimes very volatile, taking a lot of mindspace for people in finance (which is most of us here), there are pandemic developments, some days are extra quiet and boring and people are looking for things to read, etc.

I’d expect more spikes and plateaus and basically a much more wavy line.

Yet about the same number of people end up signing up every day, +/- a few, and it keeps chugging along; or at least I hope it will and we won’t hit the dreaded flatline too soon! — the jumps that you see can usually be traced to a specific external factor, like someone recommending the club on Twitter or their website, not just a randomly high day because more people felt like it that day. If I took out the top 5 jumps because someone with a following said “hey go subscribe over there”, the line would be freakishly smooth.

I understand it, but it still feels counter-intuitive to me. ¯\_(ツ)_/¯

🎞 I wonder what movies would be like if the concept of “visual effects” — both computer-generated and practical effects — didn't exist and you could only film things you did in front of the camera for real.

I think we forget how many of the things we see are effects… You’d see a lot fewer guns being shot or car chases! Even fights are basically perspective and editing tricks, so we’d probably see a lot fewer of those.

🛀 Sometimes I wonder if I'll ever feel like an adult. I don't feel like a kid or immature, just not particularly adult either.

Not that it's a problem or anything ¯\_(ツ)_/¯

Investing & Business

‘Complexity Investing’, Reader’s Digest Version

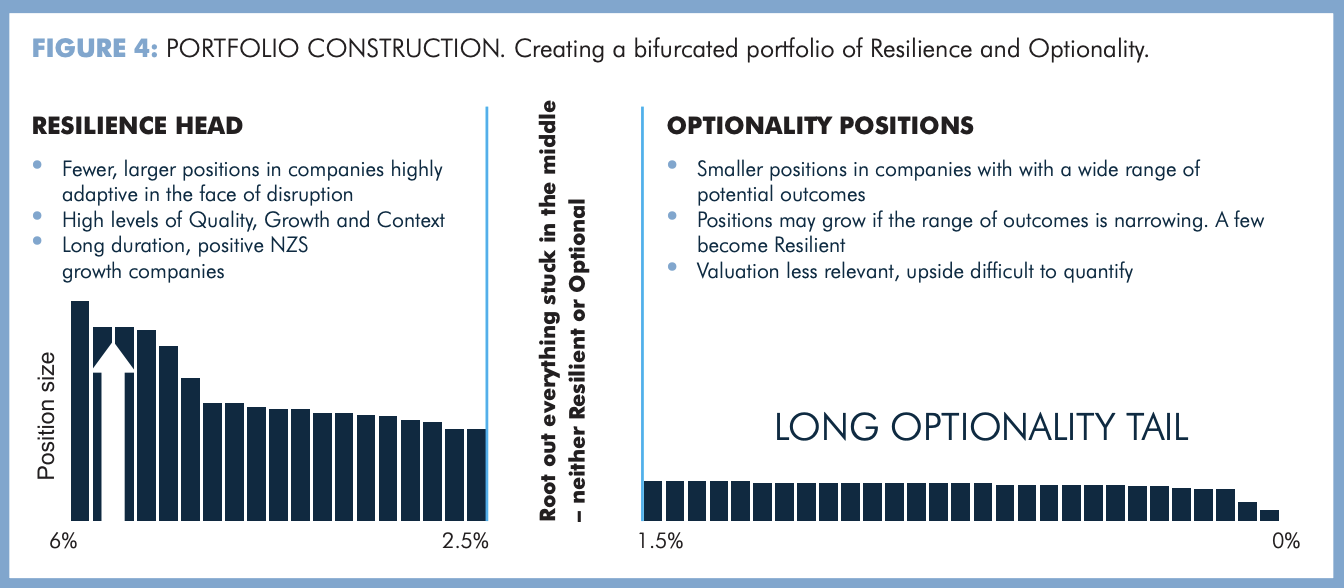

If the 45-page paper on ‘Complexity Investing’ by the NZS folks is a bit too intimidating for you, they released a condensed version recently:

Or maybe you’ve read the original, but could use a memory-refresh…

We embrace volatility and focus on allocating capital to companies that can thrive in a complex environment. To do so they require two characteristics which we describe as Resilience and Optionality

Balancing Resilience and Optionality allows us to remain agnostic about the

various paths that the future might take. [...]The relentless pursuit of productivity at the expense of resilience has been the dominant business philosophy for decades. Consider “Just In Time” inventory when shocks disrupt the supply chain. [...]

resilient companies are those that are less optimised on maximising short-term returns and more focused on their ability to adapt and evolve to changing conditions, surviving and even capitalising upon extreme events [...]

Optionality refers to a large potential payoff resulting from a relatively small investment – it’s how the power laws mentioned earlier can work in our favour. Power laws are no secret to venture capitalists, they know that many of their investments will amount to nothing and they only need a small number of winners to make the portfolio successful. [...]

We like finding businesses that combine Resilience and Optionality. They will likely have certain products or services that can be optimised for Resilience, and these recurring revenue, high cash generative business units should be used to fund a series of Optionality investments around the business’s core or adjacent competencies. [...]

A portfolio that balances Resilience and Optionality is a barbell, with the majority of weight in companies that combine both Resilience and Optionality, and the remainder in a diversified selection of small investments that maximise Optionality.

In any case, I think there’s a lot to learn from this approach, and thinking about how it may influence your portfolio construction, or how you think about companies in qualitative ways. Good stuff.

Instagram Extortion… by Facebook Employees?!

Seyi Taylor has an interesting post about extortion claims by the owner of an erotic online media company (“Playboy’s hotter sister”).

While I don’t know if the claims are true or not, if they are, there’s something seriously rotten inside of Facebook’s Instagram division and they need to get to the bottom of this and seriously clean house.

It’s also possible that someone outside of FB is running a scam and claiming to be able to do things they can’t, but then, scammers don’t usually draft contracts for equity in a company (not exactly an untraceable briefcase of cash) and it sounds like these are known Instagram contacts to creators in the space.

Check out Seyi’s post:

Warning: Seyi’s post is safe-for-work (whatever that means in this work-from-home world — I guess your kids could be around), but if you then follow the Twitter thread by Julia Rose that he links to, there are some lightly-censored ˜nude pics showing what her company posted on Instagram vs what some of her competitors post.

The TL;DR is that Instagram took down her personal (5.2M) and business (700k) accounts for breaking their guidelines around nudity. She’s alleging that they give larger brand names a pass even though they often post pictures that are “more nude” than hers (she specifically calls out Playboy). [...]

She then alleges that a supervisor at Facebook offered to restore her accounts in exchange for a $62,500 one-time payment, as well as 2.5% of her company. She also alleges that someone at Facebook was paid to take her account down. [...]

Preventing the abuse of access for personal profit is a problem both governments and corporations have to solve for. For many people, the person that can de-monetize or suspend your account has more impact in your life than any government official, as it seems to be case for Ms. Rose.

‘Unofficial list of the 16 greatest investments ever’

Trung Phan has a list of what he considers to be some of the greatest investments ever.

Of course, such a list can never be exhaustive, and I don’t think they all still own their stakes, but it’s interesting to think about the commonalities:

Unofficial list of the 16 greatest investments ever

(Minimum gain of $1B)

1/ The best of the best

Naspers - Tencent (2001): $32m -> $250B (7800x)

Softbank - Alibaba (2000): $20m -> $100B (5000x)2/ The Facebook winners

Saverin - FB (2004): $15k --> $14B (866,666x)

Peter Thiel - FB (2004): $500k --> $1B (2000x)3/ The Google winners

Sequoia/Kleiner - GOOGL (1999): $13m --> $20B (1500x)

Jeff Bezos - Google (1998): $250k --> $5B (20,000x)

Andy Bechrolsheim - Google (1998): $100k --> $1.5B (15,000x)4/ The "Friends & Family" winners

Jackie & Mike Bezos - Amazon (1995): $250k --> $20B - $60B (80,000x to 240,000x)

Bruce McKean (Tobi's father-in-law) - Shopify (2007): ~$200k --> $7B (35,000x)

John & Cathy Phillips - Shopify (2007-09): $750k --> $4.4B (6000x)5/ Other bangers

SIG-Bytedance (2012): $5m --> $15B (3000x)

Steve Jobs - Pixar (1986): $5m --> $7.4B (1480x)

Ruby Lu - Kuaishou: $40m --> $12B (300x)

FB - IG (2012): $1B -> $250B (250x)

GOOGL - YT: $1.6B --> $300B (200x)

eBay - Paypal (2002): $1.5B --> $100B (70x) [...]10/ Elon’s bets on himself

White medium squareTesla: $70m --> $120B (1714x)

White medium squareSpaceX: $100m --> $40B (400x)

‘the bear case is “competition” but not a specific competitor’

Byrne Hobart (I’m featuring him a lot lately, but he’s writing a lot of good stuff, so on a Byrne-adjusted basis, it’s not too much):

A good sentiment-based passive strategy would be to go long companies where the bear case is “competition” but not a specific competitor.

CS Report on Stripe

Learning a bit more about Stripe, thanks to The Dentist:

Non-Ergodic Systems, Simple Explanation Edition

Good post by Leon Lin at Avoid Boring People:

It’s one of those non-intuitive terms that I have to relearn every few years because the details kind of fall out of my head if I don’t think about it for too long. This was a nice refresh:

We see one lucky outlier who got to $1k in wealth, and also see that the average wealth (dashed red line) is continuously increasing. However, notice that the majority of these people lost money! In this simulation, 94 out of the 100 people who played ended up with less than the $1 they started with. [...]

Wealth in this scenario is non-ergodic, since the wealth in the future depends on the wealth of the past (path dependence). The ensemble average does not equal the time average.

Wealth in general is also non-ergodic, since your investment portfolio's return tomorrow is dependent on the current size and allocation of the portfolio today. [...]

What can seem attractive at first is often terrible, as a small number of outlier values skew the average upwards

Interview: Byrne Hobart

Ok, the double-Byrne today. It may seem like I’m just stanning him, but… well — I guess I am stanning him1 ¯\_(ツ)_/¯

Good, wide-ranging interview of Byrne by Misha Saul:

All things finance with Byrne Hobart (audio & transcript)

I gotta admit I wasn’t expecting the crack den anecdotes. I liked this:

I always hesitate to attribute success to things being overdetermined. This is just me riffing on Peter Thiel line, that failure is generally overdetermined because you can make several different fatal mistakes. Only one of which is the one that you see as the proximate cause.

If you think that you learned the one thing you did wrong and you probably did many things wrong, but with success, usually it means that everything went right, which means that every decision is very informative.

Science & Technology

‘Comanche’ (1992)

Oh wow, I used to love this game so much on my 486 with 8 megs of RAM.

The terrain graphics were mind-blowing at the time, years ahead of the competition (similarly to how ‘Doom’ was years ahead of everyone when it came out).

Now you can render it in-browser with a few lines of code:

The link above also has a great explanation of how the rendering engine works and how it could be so efficient with the limited resources of the time. Very clever way to have all the height and texture information baked in the map (including static shadows).

Pfizer Vaccine Kicking Ass

-Analysis of 927 confirmed symptomatic cases of COVID-19 demonstrates BNT162b2 is highly effective with 91.3% vaccine efficacy observed against COVID-19, measured seven days through up to six months after the second dose

-Vaccine was 100% effective in preventing severe disease as defined by the U.S. Centers for Disease Control and Prevention and 95.3% effective in preventing severe disease as defined by the U.S. Food and Drug Administration

-Vaccine was 100% effective in preventing COVID-19 cases in South Africa, where the B.1.351 lineage is prevalent

-Vaccine safety now evaluated in more than 44,000 participants 16 years of age and older, with more than 12,000 vaccinated participants having at least six months follow-up after their second dose (Source)

UV Lights in Every HVAC

You want a no-brainer idea to spend some of that infrastructure bill money?

UV lights everywhere! For a long time, our species did not separate drinking water from sewer water. That's like our air today! Every HVAC should have one.

Kills *all* airborne infection (virus bacteria parasite), not just covid!

This is by Paul Sztorc, who also links to this post from last Spring:

Also related:

the virus was inactivated as much as eight times faster in experiments than the most recent theoretical model predicted. [...]

This study found the SARS-CoV-2 virus was three times more sensitive to the UV in sunlight than influenza A, with 90 percent of the coronavirus's particles being inactivated after just half an hour of exposure to midday sunlight in summer.

By comparison, in winter light infectious particles could remain intact for days.

The Lost Art of Thinking

I recently came across a Hemingway quote that caught my attention:

“My working habits are simple: long periods of thinking, short periods of writing.”

[...]

the reality that we’ve lost our familiarity with the concept of “thinking” as a concrete and isolatable activity; something that can be prioritized, and trained, and even cherished as a valuable pursuit in its own right.

In the Nichomachean Ethics, Aristotle identified rational contemplation as the highest and best of all human activities. In The Intellectual Life, Thomastic scholar Antonin-Gilbert Sertillanges spends over 200 pages detailing how the serious thinker should organize their process of thinking.

Today, we’re not nearly as comfortable with this most fundamental of activities. We talk a lot more about information — how we can get more of it, how we can spread it faster — than we do its processing.

We see this in education systems built more around content than training the meta-activity of making sense of content. [...]

We cannot make sense of ourselves or the world around us without putting in the mental cycles necessary to wrestle this frenetic information into useful forms.

So true.

I think it’s one more example of what is visible and quantifiable being valued a lot more than what is invisible and hard to quantify.

For example, if you were to ask me how long it takes me to write this newsletter every week, my answer would depend. Are you asking me how long my fingers are dancing over the keyboard, or are you asking me how long it takes to do the whole thing?

Because most of it isn’t the mechanical act of writing, it’s reading a lot of stuff, discarding most of it as not interesting enough, thinking about the rest, figuring out what I think about it and how I want to express it, going through notes and trying to see if there’s anything there, etc.

That’s the hard part, not what I’m doing right NOW . .. …

The Arts & History

Very Hamlet, Retro-Futuristic Edition

Just a digital painting I like. Artist: Odubenus.

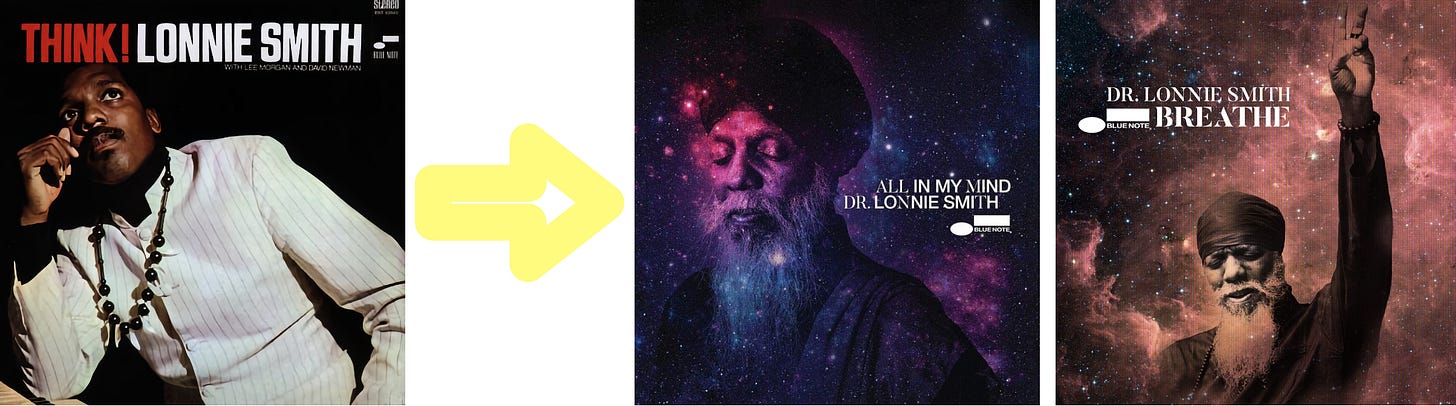

Dr. Lonnie Smith

You gotta enjoy the small things in life.

For example, I enjoy looking at Lonnie Smith album covers and seeing his evolution over the years, from a pretty down-to-Earth dude to a real groovy galactic shaman.

His music is great. He recently did a couple tracks with Iggy Pop, I like this one:

Apple Music | Spotify (it’s mellow, don’t be a in hurry when listening)

There’s even a documentary in the works on Smith and his amazing B3 organ playing (“Dr. Lonnie is the Coltrane of the B3” — the trailer is here, it’s a good and probably tells you most of what you need to know about the character).

Trivia: “Smith is referred to as ‘Dr.’ by fellow musicians because he likes to ‘doctor’ up the tunes with his unique improvisational stylings”

If I was half as smart as Byrne, I could take a few days off each week and you probably would say “wow, you’ve been working harder lately, and don’t sound nearly as dumb — did you get one of those fluke reverse-brain-injuries?”.

The Complexity Investing Paper is really good; I also enjoy Brad's weekly newsletter SITAL. An oft cited book in his paper is The Origin of Wealth by Eric Beinhocker. I picked it up and plan to dive into it and I also believe Eugene Wei mentioned he was reading it and enjoying it too.

Given your Liberty name, seems you should have at least added amention of Liberty Media's loan to Sirius that arguably has an infinite rate of return givne how it was paid back in six months IIRC and turned into 40% of SIRI equity.