190: Apple Chip Shortage, TSMC & Sony, Ben Thompson 2.0, Michael Mauboussin, Cloudflare's Share, Microsoft + Nvidia's 530bn Parameters AI Model, and Let it Be

"most people kind of lie to themselves about why"

Everyone thinks of changing the world, but no one thinks of changing himself.

—Leo Tolstoy

🎮 This is a follow-up on what I wrote in edition #189 about being a non-practising gamer. Reader and supporter (💚 🥃) Michael Tang emailed me this:

I feel the same on videogames. Hard to get immersed when the rewards seem so pointless. But gamifying real life is tough. Wicked learning environments, lower correlation between results and input, and most important things not quantifiable. Sometimes I just crave the certainty of progress.

All very true.

But since it’s how real life is, I can imagine there can be a perverse effect to spending lots of time in these seductive virtual environments where everything is very neat and satisfying, unlike real life.

There’s a similar problem with school: Kids are basically taught that in life, problems are well-defined, there’s a clear answer, you’ll get very precise feedback on how you’re doing at regular intervals, that someone else will provide you with questions and what matters most is answers, that you can’t decide what you work on, or when, or who you’re surrounded with (training for low agency?), etc.

Thriving under the real world’s uncertainty and fuzzy feedback loops is a skill like any other, and it can atrophy from lack of practice.

There’s a lot of good to be had from games, and I feel like I benefited tremendously, but I want to look at the downsides too, and if I was a huge gamer, I’d be a little worried about that aspect.

🎧📚 I was catching up with my friend and Extra-Deluxe supporter (💚💚💚💚💚 🥃) MBI (💎🐕), and we got to talking about the rate of diffusion of information these days, at least in our circles.

I was telling him how I try to pick quotes for the top of the newsletters that aren’t things that I’ve seen a thousand times before. No “price is what you pay and value is what you get” or “in the short term, the market is a voting machine, but in the long term, it’s a weighing machine”…

Well, this made me think about how these seem obvious to me now, but at some point in my life, they were quite novel to me and helped crystallize important knowledge (I wrote before in edition #74 about compression algorithms for concepts — JPEG your ideas — and some of these phrases are exactly that).

It’s easy to think that everybody else knows what you know, but everybody is at different points in their journey, and some people are just coming across a bunch of “cliché” Ben Graham and Warren Buffett quotes for the first time.

Hence the balancing act.

I think that a lot of the most important things in life are simple and obvious, they’re just very hard to apply and keep in mind consistently. So we have to re-learn them periodically…

That’s why I try to cover a lot of stuff that may seem obvious, but hopefully from a slightly different angle, so that it doesn’t get too boring, and keeps my basics well-oiled.

Back to information diffusion: MBI was telling me how fast things have gotten, and how certain concepts like ‘reflexivity’ are now likely known by a much higher percentage of people on fintwit than they would’ve been a few years ago. (whether people actually *understand* the concepts and really *think about them and apply them*, or just mention them in conversation as “cached thoughts” is another question…)

My first thought when he mentioned this was that podcasts were probably responsible for part of this acceleration in diffusion. Obviously, tools like Twitter are playing a big role, but I think that the rise of audio shouldn’t be underestimated.

People used to get most of the big ideas in books, and while everybody loves to talk about books, and some people read a lot, I think most people don’t read that much.

Podcasts are much easier to consume, and we now have many great podcasts where you can listen to the person who wrote the book, or some expert who’s actually doing the thing and/or has read the books talk about it and give you a pretty condensed version of a lot of it.

So getting to a bunch of the big ideas of the field just became a lot easier, and as we know, reducing friction is powerful.

🛀 The only way to never make mistakes is to do nothing, and that itself is a mistake, so just gotta roll with the punches ¯\_(ツ)_/¯

🙊 It’s very possible to fail by applying great advice from someone really smart, but just at the wrong time, or on the wrong thing. Or just by being unlucky. And also the reverse.

💚 🥃 The price of a couple coffees or one alcoholic drink isn't a bad trade for 12 emails per month (plus 𝕤𝕡𝕖𝕔𝕚𝕒𝕝 𝕖𝕕𝕚𝕥𝕚𝕠𝕟𝕤) full of eclectic ideas and investing/tech analysis. That’s 77¢ per edition.

If you make just one good investment decision per year because of something you learn here (or avoid one bad decision — don’t forget preventing negatives!), it'll pay for multiple years of subscriptions (or multiple lifetimes).

As Bezos would say of Prime, you’d be downright irresponsible not to be a member, it takes 19 seconds (3 secs on mobile with Apple/Google Pay — if you don’t see paid options, it’s because you’re not logged into your Substack account):

Investing & Business

Chip Shortage Apparently Hitting Apple’s iPhone

With the caveat that this isn’t official info from the company and could be wrong or change:

Apple Inc. is likely to slash its projected iPhone 13 production targets for 2021 by as many as 10 million units as prolonged chip shortages hit its flagship product, according to people with knowledge of the matter.

The company had expected to produce 90 million new iPhone models in the last three months of the year, but it’s now telling manufacturing partners that the total will be lower because Broadcom Inc. and Texas Instruments Inc. are struggling to deliver enough components [...]

Apple gets display parts from Texas Instruments, while Broadcom is its longtime supplier of wireless components. One TI chip in short supply for the latest iPhones is related to powering the OLED display. Apple also is facing component shortages from other suppliers. (Source)

TI is usually more conservative than others in keeping plenty of inventory, and has more control because it owns its own fabs. The fact that even they are having problems keeping up shows just how severe the weirdness in the semi supply chain has to be right now.

‘Sony to join TSMC on new $7bn chip plant in Japan’

Speaking of semiconductors… The belle of the ball is now TSMC, and everybody w̶a̶n̶t̶s̶ ̶t̶o̶ ̶g̶o̶ ̶t̶o̶ ̶p̶r̶o̶m̶ ̶w̶i̶t̶h̶ ̶h̶e̶r̶…. wants them to build a fab in their country:

Taiwan Semiconductor Manufacturing Co., the world's largest contract chipmaker, and Sony Group are considering joint construction of a semiconductor factory in western Japan amid a global chip shortage

The total investment in the project is estimated at 800 billion yen ($7 billion), with the Japanese government expected to provide up to half the amount.

Japan's top auto parts maker Denso is also looking to participate through such steps as setting up equipment at the site. The Toyota Motor group member seeks stable supplies of chips used in its auto parts.

Sony may also take a minority stake in a new company that will manage the factory, which will be located in Kumamoto Prefecture, on land owned by Sony and in an area adjacent to the latter's image sensor factory, according to multiple people familiar with the matter. The factory will make semiconductors used in camera image sensors, as well as chips for automobiles and other products, and is slated to go into operation by 2024, the people said. (Source)

Apparently, this will be a 22-28nm node fab, so *not* leading edge, which is fine for all kinds of chips (like for automotive and all kinds of less-sexy stuff that isn’t a CPU/GPU/etc).

Ben Thompson & Stratechery, Changes are Afoot Edition

This is kind of a big deal in my world:

For the Big 5 that increasingly means regulation, and frankly, I don’t have much interest in covering the ins-and-outs of politics day-in-and-day-out. At the same time, exploring the future means more uncertainty, more to learn, and more iterations to figure out the truth.

I don’t think the current format of Stratechery supports that exploration [...]

going forward I am effectively cutting the Stratechery schedule in half (kind of): my goal will be a Weekly Article every two weeks, along with three Daily Updates over the same period; that’s the “2”, because I’ll publish on Tuesdays and Thursdays. At the same time, I still want to do follow-up, incorporate more of your feedback (like the above email), and do interviews [...]

I do think the content will shift over time, but I’m not making any promises; I’m not going to abandon the Big 5, but perhaps reduce their concentration, particularly in terms of politics and regulation. What I am excited about is producing what I think will be better content that meets this new moment, to be “wrong” more often, incorporate your feedback, and iterate. I’ve always said that Stratechery is my journal of figuring out how the world works, and I want to get back to that exploration, not being the establishment in my own right.

This matches a theory I’ve had on Ben and Stratechery, and this type of content more generally (like my newsletter and others). It may be completely wrong, it’s just a theory (Ben if you’re reading this and disagree, please let me know!), but here it goes:

There’s a spectrum of reasons why people read the things they read. On one hand, there’s the things that are more purely “utility”, and on the other, there’s the more “entertainment/personality driven” side.

I think most people kind of lie to themselves about why they do things.

Stratechery, for example, looks like the kind of thing you read because you want to learn about big tech strategy, which sounds pretty utilitarian (for investors and entrepreneurs and such).

But I think most people found and followed Ben because what he writes about is very interesting and entertaining, and they like his personality (his writing voice, but he also did lots of podcasts, which is how I first found him in 2013).

So his readership probably tilts towards the “personality” side of things, with the ever-present *optionality* of utility (ie. better understanding Amazon when Ben wrote about the AWS IPO or whatever).

I feel like in recent times, Ben has been writing a lot about anti-trust, regulation, political issues, etc.

It’s probably the best thing he could’ve written about because he now has the reach and influence to help shape this conversation in beneficial ways, but I also think that if he had mostly been writing about regulation and such from 2013 onward, he wouldn’t have built the audience he has, because while this stuff is important, it’s mostly not very entertaining.

This recent change makes it sound like maybe Ben agrees, and that while it was something important to do, he himself wasn’t having as much fun with it and wants to get back to more of the original spirit of Stratechery (sometimes you need a change to recapture that same thing you had).

As a long-time reader (paying since 2015, but listening to podcasts and reading since 2013), I think it’s great.

We should periodically make sure we’re driving the car in the direction of where we want to go, even if that means going offroad for a bit when there’s no clearly marked paved road. Otherwise, it’s too easy to let inertia streer us, like water flowing downhill, taking the path of least resistance, flowing to a mosquito-infested swamp rather than the open sea…. (wow, didn’t expect that water metaphor to go there ¯\_(ツ)_/¯ )

In short: I’m excited to see what Ben does with the new format. Happy trails!

Interview: Michael Mauboussin

Friends-of-the-show Ben & David (💚 🥃) did a great interview with Michael Mauboussin (📚🐐):

It’s just goodness. As I often say, all the most important things are simple, just not easy, and because they’re often counter to human-nature, or go against what we would do unthinkingly, it’s very useful to periodically refresh our memory.

This interview does exactly that with many of the most important concepts that every investor should know about, in a non-boring way.

☁️ 🔥 Cloudflare’s Stock since IPO

This is kind of bonkers. Cloudflare IPO’ed just 2 years ago and it’s already up 818%.

That’s a CAGR of 189.34%

🤭

Science & Technology

This is How much of the Internet Goes Through Cloudflare

Friend-of-the-show Peter Offringa (💿) had this to say in a recent email:

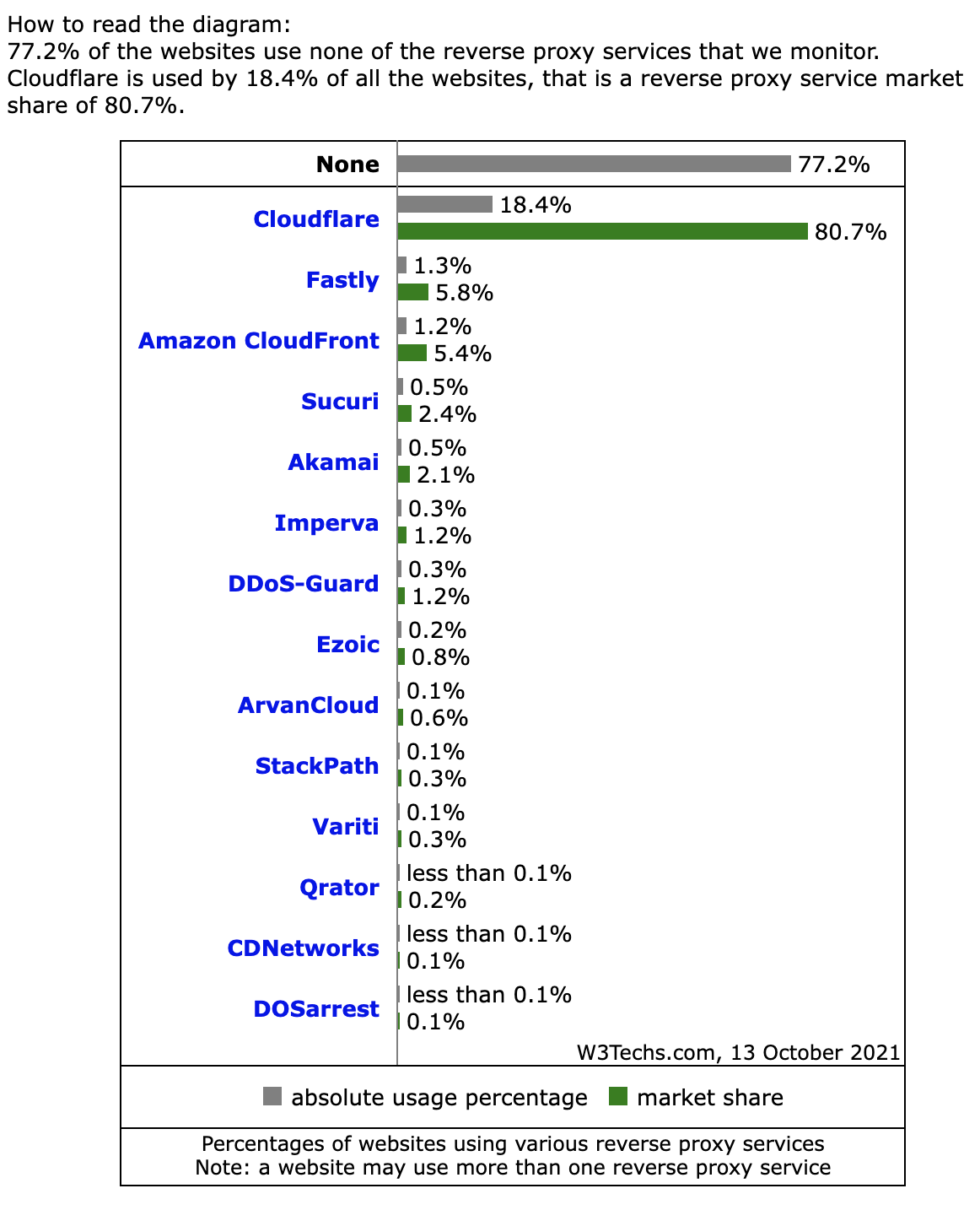

To further highlight Cloudflare's lead here, the CEO continues to post updates on Cloudflare's usage as a reverse proxy across the whole Internet. This penetration is now up to 18.4%, leading all providers by a large margin. Fastly is second at 1.3% and AWS CloudFront is third at 1.2%. Akamai is at 0.5%. This penetration is important because we would expect the same leadership to apply to solutions that leverage truly distributed compute and storage at the edge.

A reverse proxy is basically something that sits between the rest of the internet and a web server. So that when you want to get data from that server, you first go through the reverse proxy, which can provide security and performance improvements by caching data and filtering out DDoS attackers or whatever.

At this point, Cloudflare is in front of close to 20% of the internet.

BUT wait a minute.

Even that can be misleading, because a lot of the internet uses no reverse proxy…

Cloudflare’s actual market share is much much higher if you only look at sites and services that use one:

80.7%! That’s what I call a pretty healthy market share…

Now of course, not all of this is generating revenue for Cloudflare, but it’s part of the machine that allows them to have such a great vantage point on what is going on across the whole internet at any time, gather lots and lots of data for their machine learning tools, and this is the top of the funnel for selling services and products, since once you’re on Cloudflare, it’s easier to add more services than if you weren’t on it at all to begin with.

Microsoft and Nvidia team up to train ‘Megatron-Turing’ 530 billion-parameter language model

That’s cool:

We are excited to introduce the DeepSpeed- and Megatron-powered Megatron-Turing Natural Language Generation model (MT-NLG), the largest and the most powerful monolithic transformer language model trained to date, with 530 billion parameters. It is the result of a joint effort between Microsoft and NVIDIA [...]

Note that OpenAI’s GPT-3 has 175 billion parameters.

Have a look at the growth in size of these models (note that the Y axis is log — just bonkers):

Interesting conclusion here, about the demand for compute from these massive models outpacing what Moore’s Law can provide:

We live in a time where AI advancements are far outpacing Moore’s law. We continue to see more computation power being made available with newer generations of GPUs, interconnected at lightning speeds. At the same time, we continue to see hyperscaling of AI models leading to better performance, with seemingly no end in sight.

My Wishlist for Apple’s Event Next Week (Oct 18)

Every rumor is about Macbook Pros, and that’s all everybody seems to be able to talk about…

But what about the big iMac Pro? (or whatever they call the big-screen ARM iMacs)

That’s the one I’ve been waiting for…

I don’t really need one (my 2019 27” 5K iMac is fine), but once in a while, there’s a big enough leap forward in tech that it makes me seriously consider upgrading out of my usual cycle. This looks like it’ll be the case.

I’m pretty frugal about almost everything, but with computing devices, I find them so undervalued vs the value they provide in my life that paying up for good models is still a bargain.

I mean, if a computer cost a minimum of $50k and I had the money, I’d pay that rather than not have a computer, right?

So if I can have a great computer for $3k, that doesn’t feel too bad to me.

I spend all day on these machines. Any improvement to the screen alone would make it worth it to upgrade, but I know that the M1X is going to be vastly better than the Intel 6-core CPU that I’m currently rocking.

The Arts & History

‘The Beatles: Get Back’ (new Peter Jackson documentary on ‘Let it Be’ studio sessions)

My friend JPV (he’s a novelist — go check out his Substack about his writing journey) sent me this trailer from a new Peter Jackson documentary on the Beatles.

It’s based on 57 hours of backstage studio footage from the Let It Be sessions that have been in a vault since that era, so it isn’t just a rehashing of something every Beatles fan has seen a thousand times.

The trailer makes it seem really interesting. I’m looking forward to it — I’ve always been interested in both the end product and how the art is made, the craft, the iteration and experimentation part.

Looks like it’ll come out on Disney+ on November 25th, in three parts, for a total of about 6 hours. More details here.

Regarding Texas Instruments, are you aware if the bottleneck is due to a process input from a 3rd party supplier, or are the fabs running at 100% capacity and that just isn't enough to satisfy demand?

There's no lack of headlines in the media about the shortage, but specific details are hard to come by.

There was a famous economist who used to be known for talking about how important games are - I can't remember the name or find the quote, but I think he passed away recently.

Video games are useful because you can get thousands of reps in on a simulation to understand how something works. A game that features an auction mechanic will teach you a lot more than a textbook on auction theory alone. Same goes for a game with a good stock market simulation or economic simulation or historical simulation.

A football player recently explained that players today conceptually understand strategy much earlier and faster because they grew up playing Madden, and also you see much more optimal strategy today at the end of games because players have played every scenario thousands of times in a video game whereas before people made dumb mistakes because they would so rarely encounter it real life (a specific example would be today players often down on purpose near the goal line to run out the clock, instead of scoring a touchdown and giving the ball back to the other team which would be a mistake).

They are also useful to study. You can't easily measure labor output in most environments but you can in some sports, and you can see how well theory matches high stakes real life outcomes.