196: Me on Infinite Loops, Facebook goes Meta, Cloud Software Growth Durability, Supply Issues, Learning to Invest, Recycled EV Batteries, VR for 2D, and Bluegrass

"the virtual scotch-buying button"

Curiosity killed the cat. —Various

Ignorance killed the cat; curiosity was framed! ― C.J. Cherryh

🐈

🗣 A few days ago, I did a two-hour video call with friend-of-the-show and OG supporter (💚 🥃 🎩) John Huber.

It was the first time we spoke, but out of curiosity, I looked at our DM history on Twitter — the first time we messaged was in 2016, but I’m pretty sure we must’ve interacted on the timeline way before that.

Funny to think we’ve known each other for over half a decade, but had never met or spoken.

John was one of the very first supporters of this steamboat, writing a very nice tweet merely two weeks into the project (linking to edition #10), creating one of the early spikes in subs that helped get this show on the road.

Thanks again, John!

🍖🥩 Got a new digital thermometer with probes that go in the oven.

That felt like a hole in my cooking arsenal…

Related: I wrote about digital thermometers in the intro of edition #163 (yea, I’ve got all kinds of stuff in the archives…).

🛀 I think it’s kind of weird that in financial circles, the word “cannibal” has stuck for companies that buy back shares. I get it, it’s a striking word, a very strong image, it stands out in the bland financial lingo (are customers “fully penetrated” yet?).

But cannibals don’t eat themselves, they eat others. The term would make more sense for a company doing a rollup via M&A than some Malone company doing leveraged buybacks…

👶 In the Good News Corner™ this week, Extra-Deluxe supporter (💚💚💚💚💚 🥃 ) David Mark arrived on Earth! The news reached me via his dad, friend-of-the-show Daniel Harriman.

It’s reminding me of the birth of my two sons.

What a special time. It’s also a reminder of how fast they grow up — before I had kids, I kind of *felt* (not that I thought of it explicitly) like the ‘baby’ phase lasted a while.

But a short, sleepless year later and they’re walking around and talking.

Cherish your time with your small human, Daniel, and take plenty of photos and videos, because the sleep deprivation tends to mess with memory consolidation… Happy for you!

💚 🥃 I'm thinking of it kind of like we're sitting in a pub somewhere, and I'm talking about various things that interest me or that I've learned about recently.

If you like it, once in a while, you send me a scotch to keep me talking and show appreciation. All very casual & civilized. And a jolly g'day to you too, sir. 🎩

This button is the virtual scotch-buying button 🥃:

Investing & Business

Interview: Me 🤪 on ♾ 🔁

Well, as per Jim’s habit, it’s more a conversation than an interview.

I’ve been invited on some podcasts where the format is basically “pick a company you want to talk about for 45 minutes”, and that’s fine, but my scattered brain tends to prefer to just pull on various threads and see where they lead.

I didn’t even know what we would talk about before we hit “record”, so whatever came out was just as off-the-cuff as if we had been talking over a nice Ardbeg Uigeadail 🥃 at the pub, and you were sitting at our table.

I hope you enjoy it:

Btw, at one point I mention a friend of mine who writes novels, and how we enjoy discussing the craft of writing. If you want to follow along his journey, he writes a newsletter called Delusional Writer.

(Don’t worry, he doesn’t post as often as I do, so you can safely subscribe)

Facebook goes Meta

Back in edition #192, I guessed that Facebook would change its name to “Meta”, and, uh, they did.

What’s my prize? Do I get a golden ticket to visit the metaverse factory, or at least some Libra? ¯\_(ツ)_/¯

I suppose Matt Ball’s ETF ticker just got a lot more valuable. Maybe he’ll get the Zoom Tech effect (during the pandemic, people mistook it for the video-conferencing company and the stock went up 1,000% over a couple weeks…).

Cloud Software Growth Durability

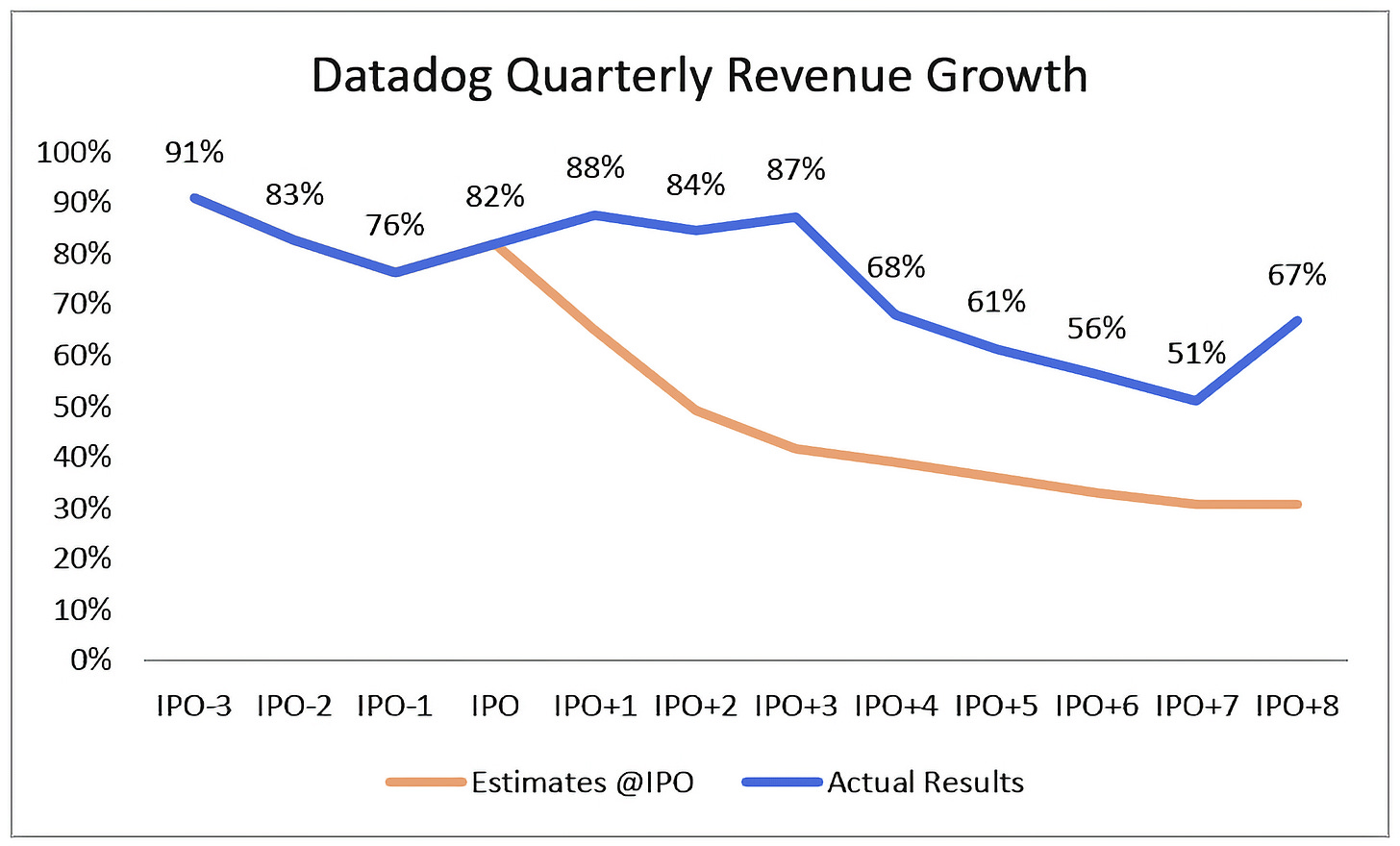

This thread by Jamin Ball (is he related to Matthew Ball? 🤔) has graphs showing the expected growth decel at IPO vs what actually happened for Datadog and Crowdstrike (which stand for a lot of others that were similarly under-estimated ).

At IPO (Sept '19) Datadog was projected to do ~$610M of revenue in 2021. Current projections? $1.3B! In just 2 years expectations have doubled 🤯

Crowdstrike is another example below. At the time of their IPO (June '19) they were projected to do $756M of revenue in 2021. Current estimate? $1.4B. Just staggering overperformance in 2 short years [...]

If history repeats itself, there are companies who will do more than 2x the revenue in 2023 than what they're projected to do currently

I've clearly cherry picked 2 amazing businesses. But there will certainly be more in the future

Of course, the way to read this isn’t “all these companies are going to be similarly under-estimated and have more growth duration than expected”…

But it does show how the very best companies can keep the magic going for longer than most analysts can predict with a straight face.

The rate-limiter on forecasts appears to be being embarrassed and your boss thinking you may not know what you’re doing (good ol’ career risk — better to be wrong in the crowd than wrong on your own).

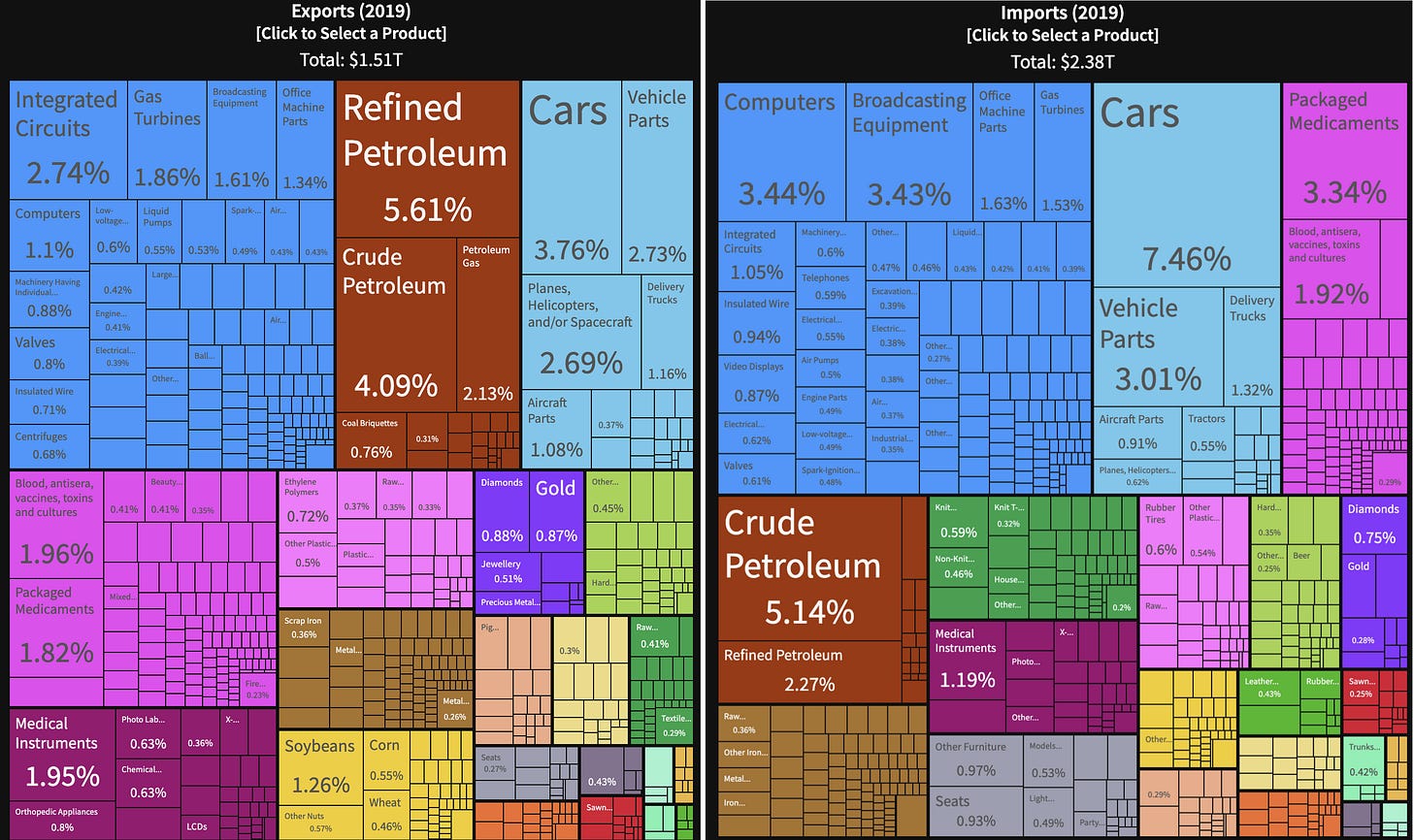

U.S. Exports and Imports (2019)

I just thought this was cool. You can click on the image to see a larger version, or go straight to the source here.

h/t Zach Weinersmith

Supply Issues

Are sales "lost" to "supply issues", or are they just delayed? 🤔

Learn to Investing While Your Capital Base is Small…

Nick Maggiulli made a good point here:

Those who are entirely focused on investing prowess should zoom out and spend some of that time and energy to focus on earning power & saving rate, because in the end, your eventual wealth will come from:

Earning power x saving rate x investing prowess x timeBut I wanted to add to what he said, zooming out again:

It takes a while to learn how to invest properly, and to know yourself and how you react to various situations and what works for you, so the experience you gain when you are young and have little $ is extremely valuable later.

That's how it was for me, anyway.

I think if I had waited to have lots of capital to start caring about investing, and I had made the mistakes that I made in my first few years but on a much larger capital base, it would've been much worse for my situation...

Ideally, you learn as much as possible from *other people's mistakes* and avoid making your own.

But it seems like there always remains a certain amount that you have to experience yourself for it to really stick.

Science & Technology

♻️🔋 Recycled EV Batteries as Good, Potentially *Better* than New Batteries… 🔋♻️

One of the benefits of the move to EV is that the biggest piece of the puzzle — the batteries — doesn’t get destroyed by use, unlike the millions of gasoline and diesel barrels burned daily.

Batteries may degrade over time, but all the atoms that you started with when the pack was brand new are still there, and with the proper techniques, they can be recycled into brand new batteries.

And unlike recycled paper, which is downcycled because the fibers get shorter and you can’t get back to the level of quality you had with virgin paper, recycled batteries seem to be ‘good as new’, and potentially better, according to a new study:

Cells using recycled cathodes were then put through an array of tests, where they performed almost identically to cells using fresh cathode materials. There was only one notable exception: The cells using recycled cathode materials lasted up to 53 percent longer.

“The control cells degraded to 80 percent of their original capacity after 3,150 cycles and to 70 percent capacity after 7,600 cycles. At this point, they were done. Meanwhile, the recycled material cells could go through 4,200 cycles before they had degraded to only 80 percent state of charge. They reached an "astonishing" 11,600 cycles before 70 percent was the best they could do.”

When the researchers looked at the recycled cathode powder using a scanning electron microscope, they discovered that the particles were quite similar, but the recycled particles had larger pores in their centers compared to control particles. Additionally, recycled powders were a bit less brittle. The more porous structure makes it easier for lithium ions to diffuse through, and because it's more flexible, it's more resistant to cracking after repeated charging and discharging. (Source)

Well, waddayaknow.

Right now EVs are in the part of the cycle where they are ramping up and replacing internal combustion engines (ICE).

But once the installed base is at a more mature state, the industry will have a steady flow of vehicles reaching end-of-life and donating their batteries so that the circle-of-life ♻️ may continue.

Not hard to imagine a point in the future when a very large fraction of “new” batteries use recycled materials.

Using VR to access 2D content (I have questions)

Saw this tweet fly by:

FACEBOOK TO LAUNCH WAY FOR QUEST VR USERS TO ACCESS 2D APPS LIKE SLACK, DROPBOX AND INSTAGRAM(yeah, it’s all caps, so you know it’s Bloomberg)

It raises the question — and I don’t know how common this is, but I’ve got some anecdotal corroboration — if the same phenomenon happens as with 3D films.

Let me back up: After the big hype around 3D films a few years ago, after having seen a few, I noticed that I had more trouble remembering films I had seen in 3D than 2D.

Somehow the experience was processed differently in my brain, and it was harder to recall and consolidate memories about it, just a hazier feeling afterwards.

I wonder if consuming 2D stuff like text and images in a 3D world has some of the same drawbacks, at least to those who are like me 🤔

The Arts & History

🪕 Béla Fleck: My Bluegrass Heart (2021) 🪕

Well, have I got some good music for you today!

I don’t care if all that comes to mind when you think of Bluegrass is this:

This album is still is worth a spin. It’s playful and the musicianship is 🤯:

🎶 I’ve listened to it while writing the majority of this edition 🎶

Given his instrument's strong associations with bluegrass, banjo hero Béla Fleck has spent much of his career moving away from the music that inspired him back in the 1970s. His unbridled virtuosity, prolific output, and hunger for innovation have made him the instrument's foremost ambassador, and he has the eclectic catalog to prove it. The past two decades have seen Fleck exploring jazz fusion, classical, African music, and everything in between, but on My Bluegrass Heart, he makes a grand return to the kind of progressive power picking that characterized his mid-'80s work as part of the pioneering New Grass Revival. [...]

At 19 original tracks spread over two discs, My Bluegrass Heart is a feast of instrumental wizardry that runs the gamut from more traditionally minded cuts like "Our Little Secret" and the "Hug Point" medley to wonkier fare like the avant farmyard vamp "Us Chickens" and the speedy "Charm School."

"Company Commander": Lessons from WW2

File under ‘history’: here’s a great podcast where ex-Navy Seal Jocko Willink goes through the war memoirs Charles B. MacDonald.

The book ‘Company Commander’ was written in 1947, so everything was quite fresh, and it’s an incredible time capsule of what it must’ve been during that crazy period:

Just got around to reading this edition, Bela Fleck is so good. Have you ever watched a video of their drummer performing? He plays the drums with a guitar, as impossible as that sounds. I encourage you to check out this video of it if you haven't seen before: https://www.youtube.com/watch?v=eqGEc8vnMbk&ab_channel=nevesh

Hi Liberty,

The podcast with Jim was interesting and fun. There was a brief discussion on how learning for kids could be much better in today’s world. Can you please drill down on this topic? I have read about Ad Astra School (Elon Musk) - https://markattrack.com/ad-astra-school/#Ad-Astra-School …but trying to figure out more on how to practically implement a better encourage kids to learn to learn on interesting and impactful topics.