268: Ads on Netflix Revisited, Hyperscalers vs Independent Infrastructure SaaS, US Immigration Stalling, Tinder for Investors, SpaceX, and Lightfall

"Shareholder letters are like online dating profiles"

Those who lower standards are thieves of potential.

It is challenge that reveals the shape of our talents.

The sparring partner that hits back. The teacher with the red pen.

Resistance builds strength.

Skill comes to the player of the unrigged game.

-Stoic Emperor

🚗💨 I wrote about how much I dislike unnecessary vehicle idling in edition #267.

Friend-of-the-show and supporter (💚 🥃) Jimmy Soni shared this article about New York City allowing citizens to report (with video proof) commercial trucks that idle more than the legal limit to get a cut of the fines that are collected (incentives 101).

A small group of people apparently generate 85% of the reports and make tens of thousands of dollars per year doing this.

On one hand, I don’t think it’s ideal to have citizens getting assaulted by angry drivers, but on the other, before they did this the laws on the books were simply not being enforced, making them pointless.

Large diesel trucks idling unnecessarily in densely populated areas are particularly bad — not only the pointless carbon emissions, but also the smog-forming particulate matter emissions linked with lung cancer and asthma, the noise, the smell. It just makes the city more unpleasant and less healthy for everyone. While it’s hard to quantify, quality-of-life is a worthy goal, so figuring out incentives to bring this under control has pretty big leverage.

I suspect that once trucking companies know that there’s enforcement and they run a decent chance of getting caught, we’ll see a lot more self-policing, driver training, and maybe even the use of technology to try to reduce unnecessary idling as much as possible.

You get more of what you reward, and vice-versa.

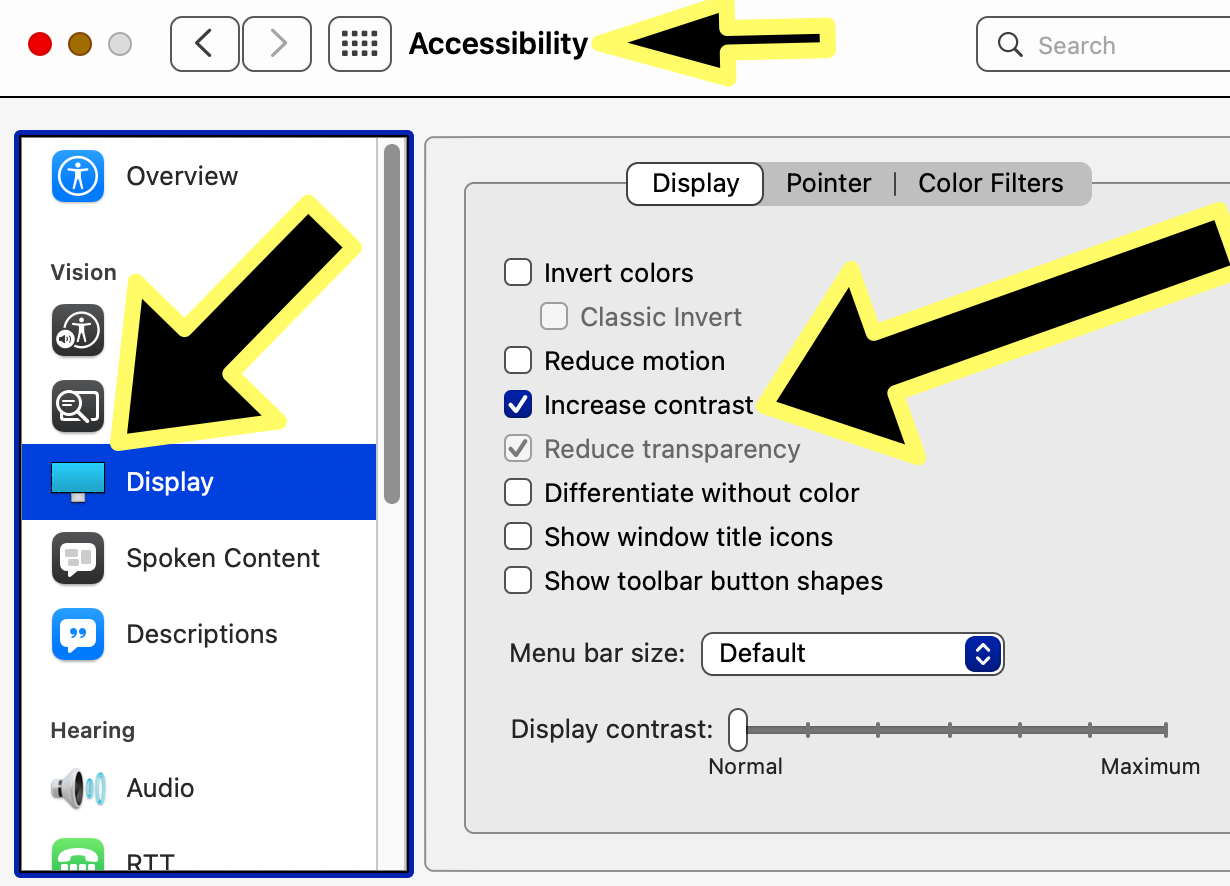

💻 If you’re using a Mac, here’s something to try.

Maybe you’ll like it, maybe you won’t, but it takes just a moment and I find that it makes the UI better (if you try it, give it a day or two before you decide either way — it takes our brains time to get used to changes, and at first it’s easy to confuse this process with not liking something):

In Systems Preferences, you go into Accessibility → Display → check ‘Increase Contrast’.

It’s basically the difference between a drawing that has a solid black ink line around shapes, or doesn’t.

Personally, I prefer the solid lines. Maybe you do too..?

💚 🥃 I like you just the way you are 🧡

A Word From Our Sponsor: 📈 Revealera 📊

Revealera provides data and insights for investors into hiring trends for 3,500+ public/private companies + technology popularity trends for 500+ SaaS/Cloud Products.

We give investors insights into:

Job Openings trends: Insights into a company’s growth prospects.

Technology Popularity Trends: Insights into how widely products like Datadog, AWS, Splunk, etc, are gaining adoption.

Vendor Sign-ups (Currently Alpha) tracks the # of companies, as well as the specific companies, that have signed up for SaaS products such as Zoom in near real-time.

Visit Revealera.com for a ✨free✨ trial/demo.

Investing & Business

Part 2: 📺 📢 Should Netflix sell ads? 🤔 (the other side)

Back in edition #263, I wrote about the idea of Netflix selling ads (which had been brought back to the spotlight by Ben Thompson (💚 🥃 🎩), and before had been raised over the years by Jeff Green, the founder of The Trade Desk…).

I leaned in a positive direction on it, mostly for pretty ‘tangible’1 reasons having to do with how it would help the company better compete and fund more content.

I ended on this note:

I understand the psychological aspects of such a change, and it’s the most credible argument against that I’ve seen, but despite that, it may still be worth the trade-off.To better flesh out what I meant here, allow me to quote John Gruber (🍎), who has the best articulation of it that I’ve seen:

When you keep that point in mind, as a business case, it makes a lot of sense for Netflix to expand this way. My argument against Netflix doing this is about brand, though. Netflix has built an incredibly valuable brand, and part of that brand’s foundation is that Netflix is a premium service that doesn’t do rinky-dink sht like force you to watch unskippable ads. When you’re a Netflix customer, Netflix is always on your side. Unskippable ads are not on your side. Ergo Netflix should never create a lower-priced-with-ads subscription tier. Yes, they’d add more subscribers that way, and goose revenue growth for a few more years, but I think the revenue they’d gain would be outweighed, significantly, by the brand equity they’d lose in doing so. Netflix isn’t just like Hulu or Peacock or any of the also-ran services with ads. Netflix is [expletive] Netflix, the leading streaming service.

There’s no way to account for brand value on a balance sheet, but great CEOs know what it’s worth in their guts, and savvy investors should too.

If they don’t do it, I think it’ll probably be for something like this line of reasoning.

Coopetition: Hyperscalers vs Independent Infrastructure SaaS ☁️🌪

Friend-of-the-show Peter Offringa (💿) has a good piece on something that I wrote about a few times (f.ex. in edition #217), the strange relationship between the hyperscalers (AWS, Azure, GCP) and the independent saas companies that offer competing infrastructure services.

Some highlights:

In defense of the cloud vendors, it quickly became unrealistic for them to field best-of-breed solutions in the hundreds of emerging categories. Too much VC money was funding competitive offerings in niches. [...] The hyperscalers had to start narrowing their field of bets. While they might keep products alive in every category, many of those MVP’s transitioned to life support as independent offerings clearly outperformed them. [...]

While some independents started with software packages that customers could install into their data centers, almost all of them eventually transitioned to a cloud-hosted version of their software. And for that cloud version, they didn’t stand up their own data centers in most cases. Rather, they made the unusual choice of hosting on infrastructure provided by the hyperscalers. This seemed counter-intuitive at the time, as the hyperscalers were also competitors.

However, this choice turned out to be prescient, providing the main catalyst for a new symbiotic relationship with the hyperscalers. As the independents sold more cloud-based software services, the hyperscalers generated revenue from the underlying storage and compute. While this growth threatened the hyperscaler look-alike products on the surface, the hyperscalers acknowledged that those dedicated product teams also incurred high cost. Their operating margin from some software services might be higher by co-selling an independent’s service than supporting an internal competing team.

Basically setting things up so that heads you win, and tails you win too.

Much better to offer both and win in a bake-off against another hyperscaler than to try to only win with home-grown solutions and lose to another hyperscaler that pushes and integrates the independent best-of-breed too.

The impact of this trade-off is mitigated further by the fact that most independent providers consume compute and storage resources from the hyperscalers. Even if the independent provider is selected for data warehousing, data streaming or observability, the hyperscaler still generates some easy revenue from the utilization of their platform. And they avoid the cost of managing that particular service.

Because of these factors, we now see the hyperscalers completely reversing their strategy of even a couple years ago. They have created marketplaces that make third party services available to developers on top of their infrastructure. Almost every cloud-hosted independent provider is included in these. In some cases, the hyperscalers take the relationship to the next level and engage in active co-selling with sales teams from the independents. These choices are more strategic in nature, used as a competitive strategy against another hyperscaler or a way to attract customers with a preference for a popular independent solution. [...]

We’re seeing this more and more, with examples like Snowflake, Crowdstrike, Datadog, etc.

Of the $1.2B in new contract sales in Q4 for Snowflake, over half, or $700M, was co-sold with the hyperscalers. That amount is up 40% sequentially from the $500M in co-selling accumulated over the prior three quarters of the year. That represents an enormous acceleration. The CFO further clarified that the majority was co-sold with AWS, $0 with GCP and the balance with Azure.

If this piqued your curiosity, Peter goes into much, much more detail in his post.

Just write, just write ✍️

Friend-of-the-show and day 1 supporter (💚 🥃 🎩) Andrew Walker has a good riff (🎸🎶) on the asymmetry and optionality of public writing for those aiming to work in finance and/or start their own thing:

It works for finance, but it applies more broadly for sure — writing is thinking, and proof-of-work/thought is worth a lot in a world where many people are great at getting in the door but can’t do good work or stick with it past the early burst of enthusiasm/novelty.

Diplomas only *imply* competence, but a high-quality body of work proves it.Some highlights:

My friend Byrne from the Diff had an analogue that stuck with me a few months ago: your life is a call option. He was using it in a different context than I am here, but I think it’s particularly apt here. If you’re looking for a career in investing, I’d suggest that starting a Substack is the best call option you can “buy”. The possibilities are endless, but they’re almost literally all good. [...]

First, you’ll probably start to form a community and meet some new friends, and who knows where that can take you!

Second, you might just get a job offer out of the whole thing! [...]

maybe you’ll find you love writing and investing and turn it into a career. [...]

Or the following you build on Substack might just help you launch a fund and skip the traditional job entirely. [...]

So there are lots of different paths and upside a blog / substack can take, but (again) it’s all pure upside.

Bottom line: if you asked me for one piece of advice for someone looking to “break into” finance, it would be starting a Substack. Again, it costs you nothing but a little bit of time investment, and the upside is enormous.

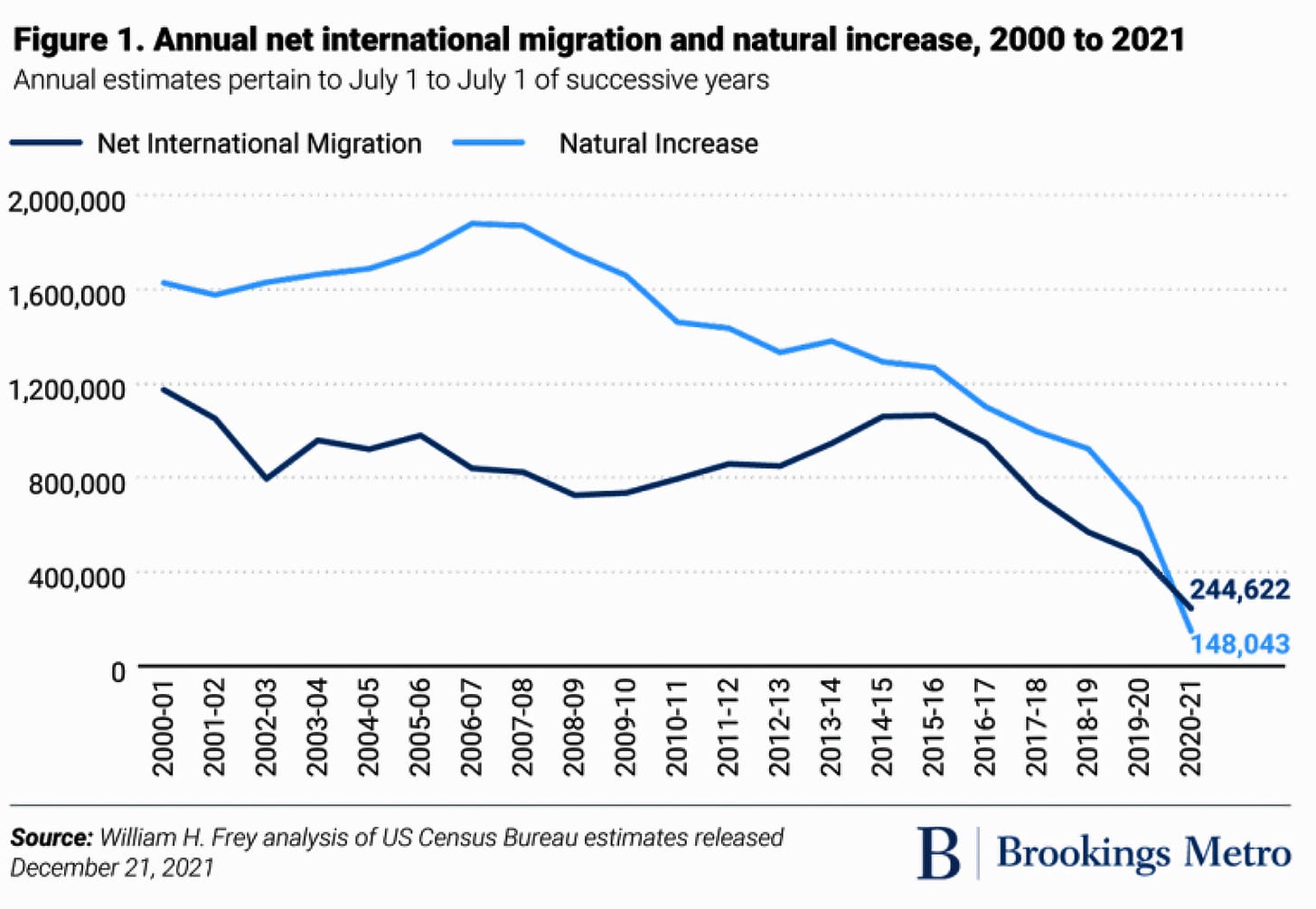

US Immigration Stalling 🇺🇸

Attracting a lot of motivated, skilled, ambitious people from around the globe has been one of the main competitive advantages of the US since its founding.

I know there’s a litany of reasons to explain this, but I’m more curious about the list of things that *should be done* to make sure it rebounds going forward.

Source. h/t No Sunk Costs (🔐)

💏 Tinder for Investors 😘

Science & Technology

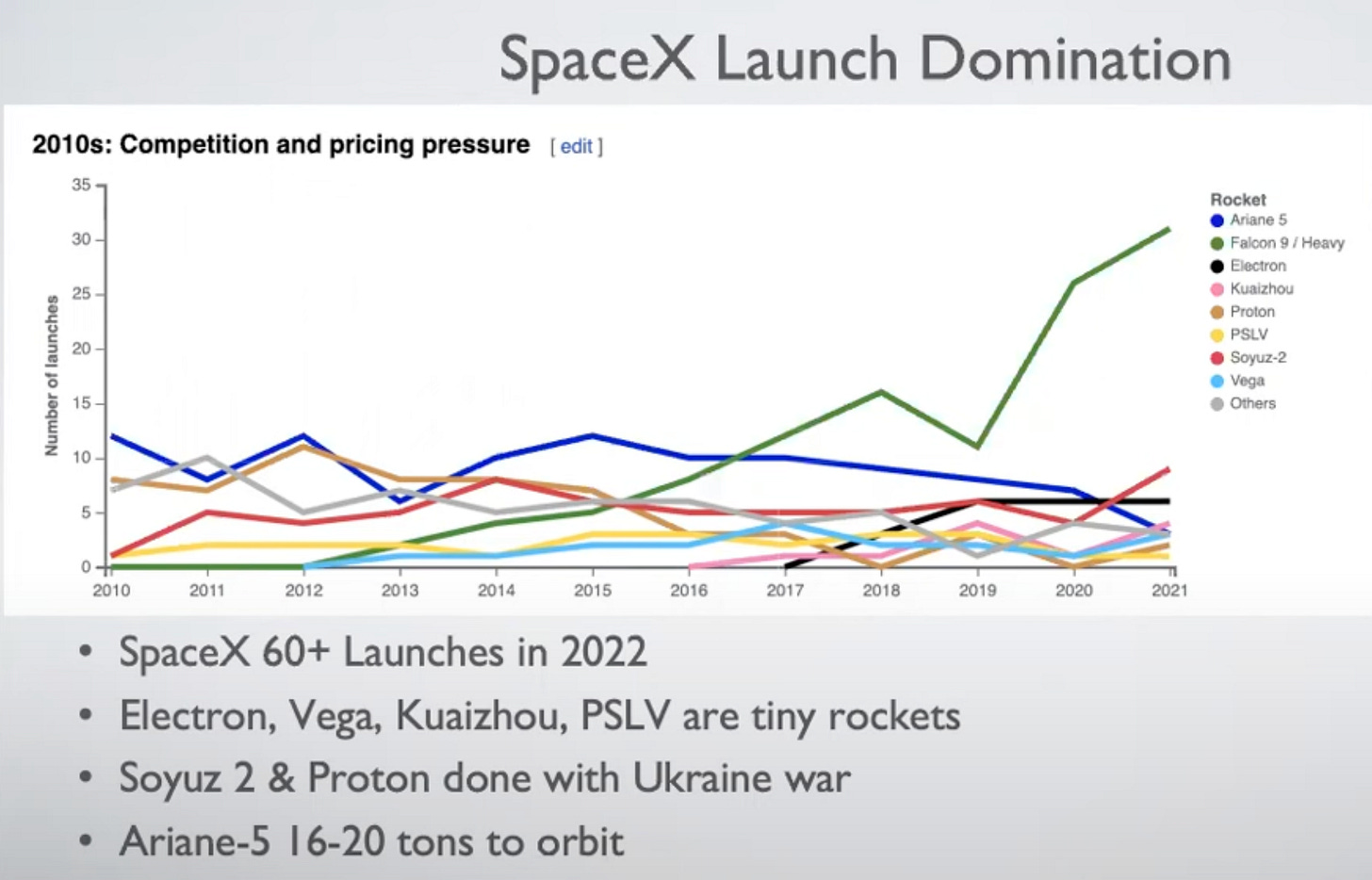

🚀 SpaceX vs Everyone Else 🛰

Saw this slide in a presentation by Brian Wang. Thought it was quite striking.

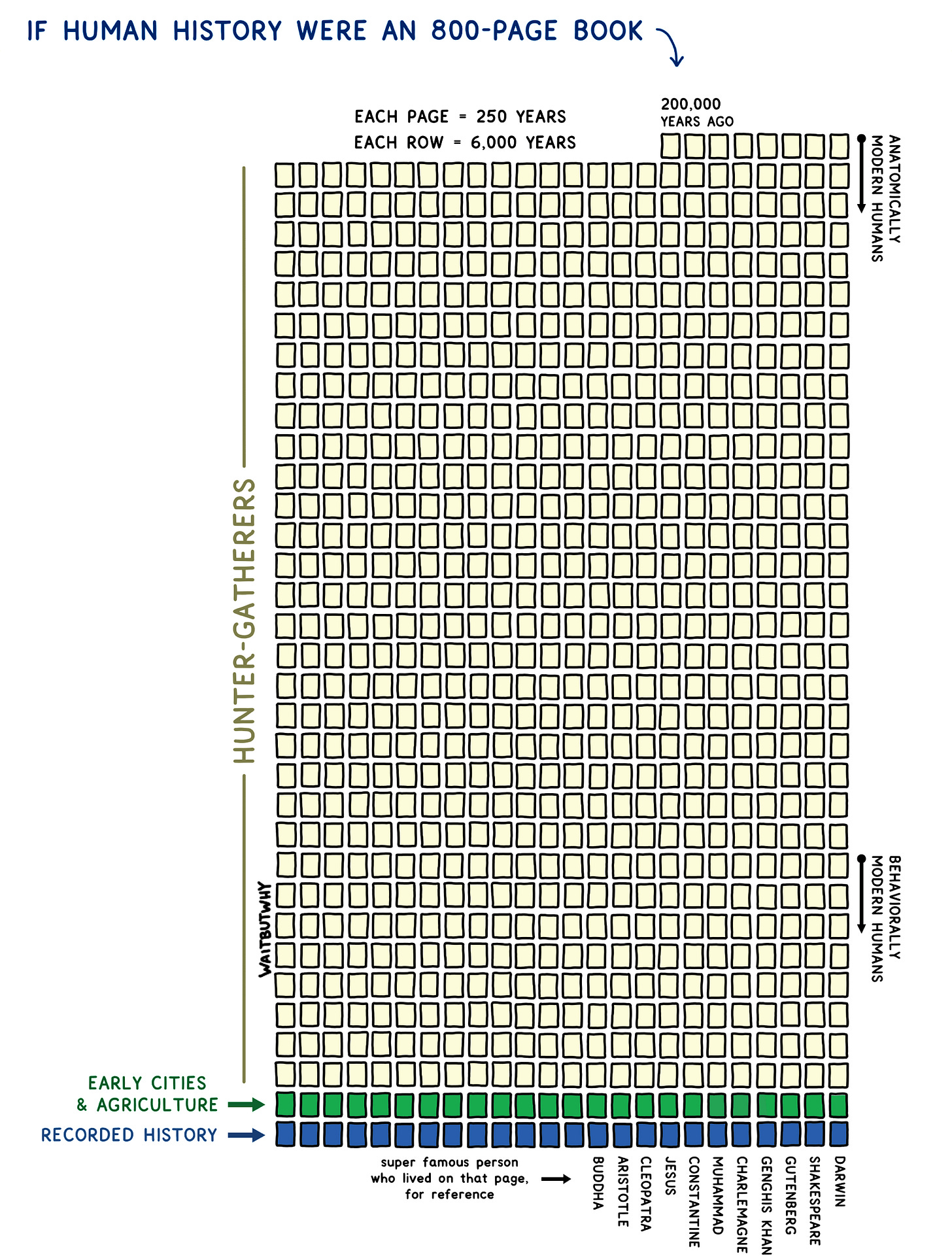

‘How recent "ancient history" actually is’ 📜

Tim Urban: “I made this to try to illustrate how recent ‘ancient history’ actually is. Human history as an 800-page book, with each page covering 250 years. Recorded history is just the last row!”

The Arts & History

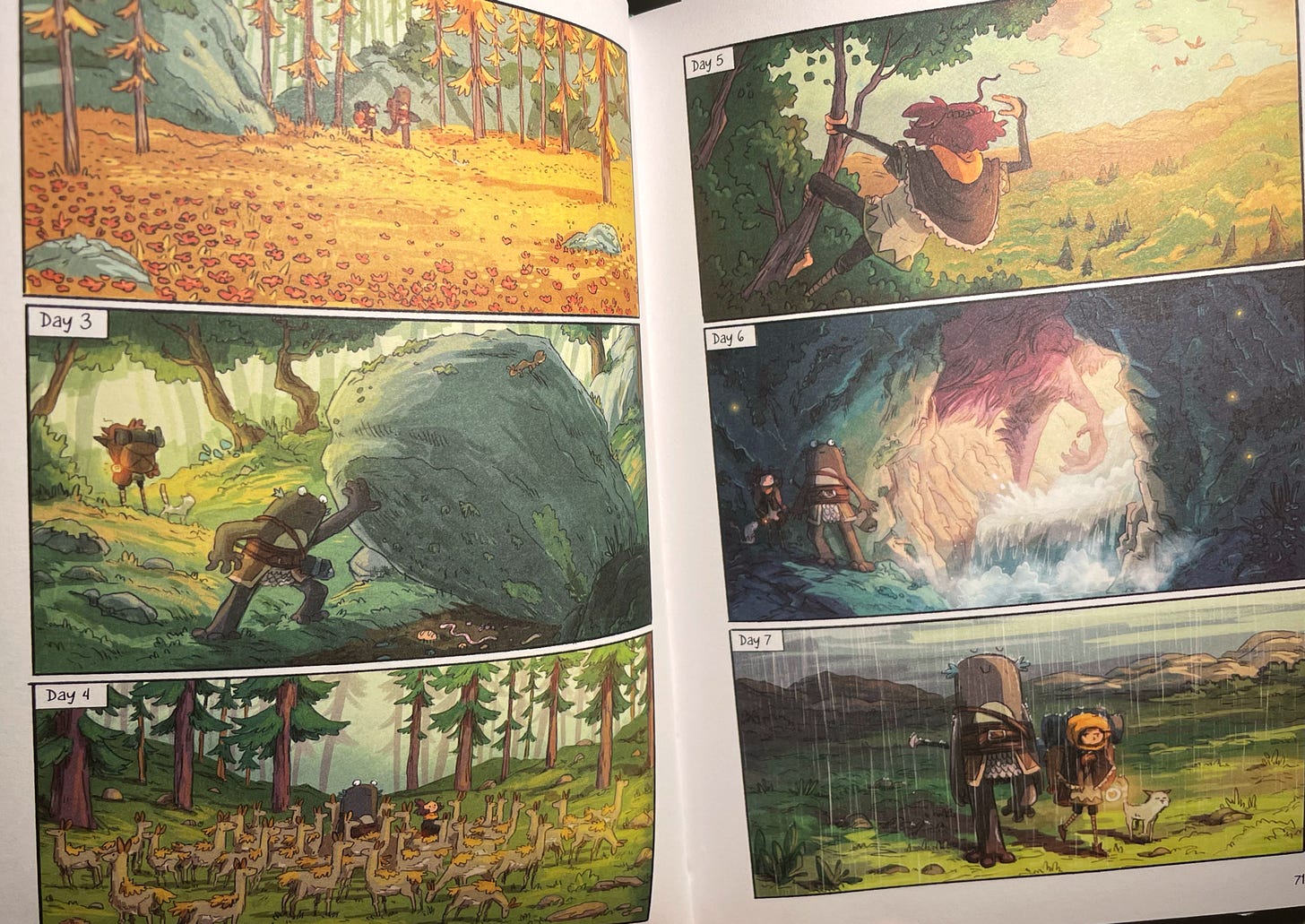

Lightfall: The Girl & the Galdurian (Book 1, 2020) 📖

I started a new book with my 8yo. It’s a 250-page graphic novel, which is a first for him.

So far he really loves it (💙💙💙), but we’re only about 1/3 of the way through. I’ll probably review it when we’re done, but it’s a good sign that I’ve pre-ordered book 2 (which comes out on April 26).

The art style is really good, the writing is crisp, and I made up a voice for the Galdurian character that makes my boy crack up, so that’s a bonus.

I’m noticing that part of my personality really enjoys the quiet parts in these adventure books, when the heroes are just quietly traveling through the land, without anything specific happening. Walking through fields, sleeping by a fire at night, etc.

In a film, it would probably be a montage without dialogue.

I know some people can’t wait to get to the big action moments, the scary monsters and epic battles. I like that stuff too, but I kind of like it when things are just “okay” too, the moments in-between...

Are you like that too, or are always impatient to get to the action?

I’m trying not to say ‘rational’, because rationality doesn’t only includes cold hard facts and numbers. It’s also rational to take into account feelings and emotions and intangible/hard-to-quantify things.

The “Spock” myth of rationality needs to be updated. In fact, it’s usually irrational *not* to take fuzzy human characteristics and cognitive biases into account…

US Immigration Stalling -- One of the larger mistakes is the "us vs. them" mindset that rules immigration policy. So many talented people out there who the US should be trying to add to our economic/cultural engine (as should other countries). Growth vs. fixed mindset error. Should add that there were a lot of travel related issues in the last two years, but the trend was going the wrong direction for awhile.