482: AMETEK Deep Dive, Ozempic GDP Impact, Perplexity AI, Stripe, Anthropic's Claude 3, Amazon AWS' Nuclear DC, and Dune 2

"Simple things that make a big difference"

It may be that when we no longer know what to do,

we have come to our real work.

And when we no longer know which way to go,

we have begun our real journey.

—Wendell Berry

🗓️⏳🕰️🛠️ I often feel like I should have done more in the past year. Then I read books where they spend 2, 3, 4, 5, 6… years chipping away at a single project.

It’s easy to miss. In a book, years can fly by in just a few pages. Or even a few lines.

I make a conscious effort to try to feel how long the amounts of time mentioned in biographies are to better calibrate myself.

Not as an excuse to slow down, but to remember that hard things take time and think long-term.

👩🏻🍳🍳🥘 I love high-leverage cooking tips.

Simple things that make a big difference, like getting a cast iron skillet or a decent chef’s knife.

The tips above are perfect examples of this.

They don’t take longer or require more effort than doing things the wrong way yet they have a big impact either on how long a recipe takes or on how delicious it is.

They’re purely about having the right information (knowledge is power!). 💡

If I had to choose just two, I would go patting meat dry with a paper towel before grilling it and pressing it properly in the skillet so that the whole surface makes contact, avoiding pockets of steam bubbling under the meat, steaming it instead of browning it.

📚🏆🚨 YOU GET A BOOK! YOU GET A BOOK!

This rarely happens, but today everyone’s a winner! 🥇🥇🥇🥇🥇

Thanks to Jimmy Soni’s generosity, EVERYONE who participated in the signed Founders giveaway will get a book! This is multiples of the originally planned 10 copies, but Jimmy’s just that cool.

If you participated, I will email you soon to ask for your mailing address 📫

A Word from our Sponsor: 💰Watchlist Investing 💰

Investors face two main problems:

Identifying good businesses 🕵️♂️

Keeping track of them over time 👀

Watchlist Investing is a monthly newsletter devoted to studying great businesses and helping readers be ready to pounce when Mr. Market gets irrational (🤪).

Independent Research: Benefit from 40-50+ hours of primary research on each Deep Dive

Regular updates on Watchlist companies: Don’t miss opportunities by staying on top of important business and industry changes!

Other Benefits: Private Google Meetups, Detailed sum-of-the-parts Berkshire Hathaway valuation, Private Discord server, Subscriber introductions

Watchlist Investing founder Adam Mead spent over a decade in commercial credit, has skin in the game as a value investor, and is the author of ‘The Complete Financial History of Berkshire Hathaway’. 📕

⭐️ Sign up here and get 20% off your first year with the coupon code “Liberty20” ⭐️

Here’s a free taste from the back catalog:

🏦 💰 Liberty Capital 💳 💴

📡 🛰️ 🛠️ AMETEK Deep Dive ⚙️🔬

If you were intrigued by what I wrote about Ametek in Edition #475 and want to dig deeper, check out the deep dive on the company that my friend David Kim (🕵️♂️) wrote over at Scuttleblurb.

Some highlights (shared with permission):

Most of the AMETEK’s acquisitions over the last 2 decades have landed in Process and Analytical Measurement and Analysis […] hardware and algorithms that measure and test with meticulous accuracy very small and close things and very big and faraway things.

For instance, Secondary Ion Mass Spectrometers (SIMS), which AMETEK acquired through CAMECA is 2007, are microscopes on steroids… They are used by chip manufacturers to detect impurities in silicon wafers, by geologists to date rock samples, by research labs to measure the hydrogen content in meteors, by drug researchers to identify the presence of drugs in biological samples, by material scientists to map the 3D structure of PV cells and metal alloys. AMETEK claims that just about every major research lab in the world has CAMECA SIMs.

If you think that’s cool, check this out: ⚛️ 🛰️

AMETEK made the laser-grade optics that Lawrence Livermore National labs used to achieve nuclear fusion ignition and helped design the 18 hexagonal-shaped mirrors in the James Webb Space Telescope.

Their mirrors are found in Extreme Ultraviolet equipment that semi fabs use to manufacture bleeding edge chips. Their optics systems are embedded in non-contact metrology instruments that take precise measurements of an object at the nano-scale level without making contact with it, especially critical for complexly shaped products with tight tolerances, where direct physical contact may cause material distortions.

Aerospace engine manufacturers use them to design turbine blades, semi fabs to measure the thickness of silicon wafers before packaging

Is there a moat?

AMETEK’s business units, while cyclical, are structurally sound. They sell highly-engineered products with high switching costs and typically command 30%-40% share as the #1 or #2 player in $200mn-$500mn niches.

It wouldn’t make much sense for a new entrant to commit the R&D resources required to surmount AMETEK’s technical entry barriers given the modest TAMs. That so many of AMTEK’s acquisitions have origins going back 35+ years… hints at modest disruption risk and solution stickiness.

As you’d expect from a provider of performant technology with high switching costs geared to mission critical use cases, AMETEK enjoys some pricing power.

I thought this was a clever metric:

management assiduously tracks its “vitality index”, the percentage of revenue coming from products introduced in the last 3 years, a metric has gradually progressed from ~18% in 2008 to a record 29% over the last decade.

The M&A engine:

In the 20 years since 2004, AMTEK spent $12.6bn on acquisitions, $2bn on buybacks, and $1.6bn on dividends. Nearly all of this has been funded with $12.2bn of free cash flow, with most of the balance coming from debt. [...]

AMETEK and Teledyne have much higher-tech, harder to replicate technology than Constellation, but so do their acquisition targets. The differentiated technology they boast reflects the same scarcity that drives lower returns on the companies they purchase.

I’ll stop here, there’s a lot more. The Scuttleblurb subscription is WAY worth it, you’ll learn so much about so many industries and about *how to learn* about new companies.

See also:

🏦🍕🍟🥤🤔 GDP Impact of Ozempic (and other GLP-1 drugs)

This feels a lot like made-up numbers, but even if we don’t trust the exact figures, it’s still an interesting signal that these drugs are getting to a point where we’re starting to consider the macro-economic effects of all this weight loss:

The US GDP could grow by an extra 1% if 60 million Americans took GLP-1 drugs by 2028, Jan Hatzius, the chief economist at Goldman Sachs, wrote.

"Combining current losses in hours worked and labor force participation from sickness and disability, early deaths, and informal caregiving, we estimate that GDP would potentially be over 10% higher if poor health outcomes did not limit labor supply in the US," Hatzius said.

Have you had a look at Eli Lilly’s market cap lately?

10 years ago it was $64bn. Not exactly small…

Today it’s $713bn!

Sales of the drugs have exploded, with some users seeing drastic weight loss of up to 20%. A study released in August found that patients who took Wegovy for weight loss reduced their risk of heart attacks, strokes, and cardiovascular death by 20%.

And with the US obesity rate hovering at around 40%, tens of millions of Americans could be prescribed GLP-1 drugs over the next few years

I still wonder about hard-to-identify side effects like loss of motivation or competitive drive in people who have an addictive personality that pushes them in pro-social directions (ie. addicted to practicing guitar or coding or building businesses or getting better at a sport).

To be clear, I haven’t seen much evidence of that. However, reported side effects on compulsive shopping and gambling make me think that the blast radius of the drug could be wider than we think.

Could this be the inverse TRT? Instead of older men becoming more risk-seeking when they boost their testosterone, could we see some people losing weight and becoming less motivated in beneficial areas of their lives? ¯\_(ツ)_/¯

🔍🤖 Perplexity AI Raising Money at $1bn Valuation

My fave new app/research tool seems to be doing well:

[Perplexity] is finalizing a new funding deal at around a $1 billion valuation, roughly doubling since its most recent financing a few months ago. [...]

The current Perplexity financing is being led by Daniel Gross, a former partner at the venture firm Y Combinator who now runs his own investment fund, the people familiar with the deal said. Gross was an early adviser to Srinivas when he launched Perplexity.

It comes just two months after Perplexity said it had raised $74 million in a deal valuing the startup at $520 million. That round, which was the largest sum raised by an internet-search startup in recent years, drew backing from Amazon.com former CEO Jeff Bezos and the venture firm Institutional Venture Partners.

Interestingly, Bezos was an early investor in Google — he invested $250k in 1998 — it’s not known how long he kept the stock, but knowing his long-term orientation, it’s possible that he could be a billionaire today from just that investment, even if Amazon had failed and he had no other assets.

See also:

I really enjoyed this interview with Aravind Srinivas, the CEO and founder of Perplexity. I’m running out of time and space in this Edition, but I’ll share highlights and thoughts in the next one:

💳 Stripe valuation over time 📈📉

These are of course from private funding rounds.

Who knows when they’ll finally IPO… but the way the market is going, it could be sooner than later — I’ll be curious to see the impact on Adyen’s valuation 🤔

Via Chartr

🧪🔬 Liberty Labs 🧬 🔭

🤖 Claude 3 (Haiku, Sonnet, and Opus sized) 🎻

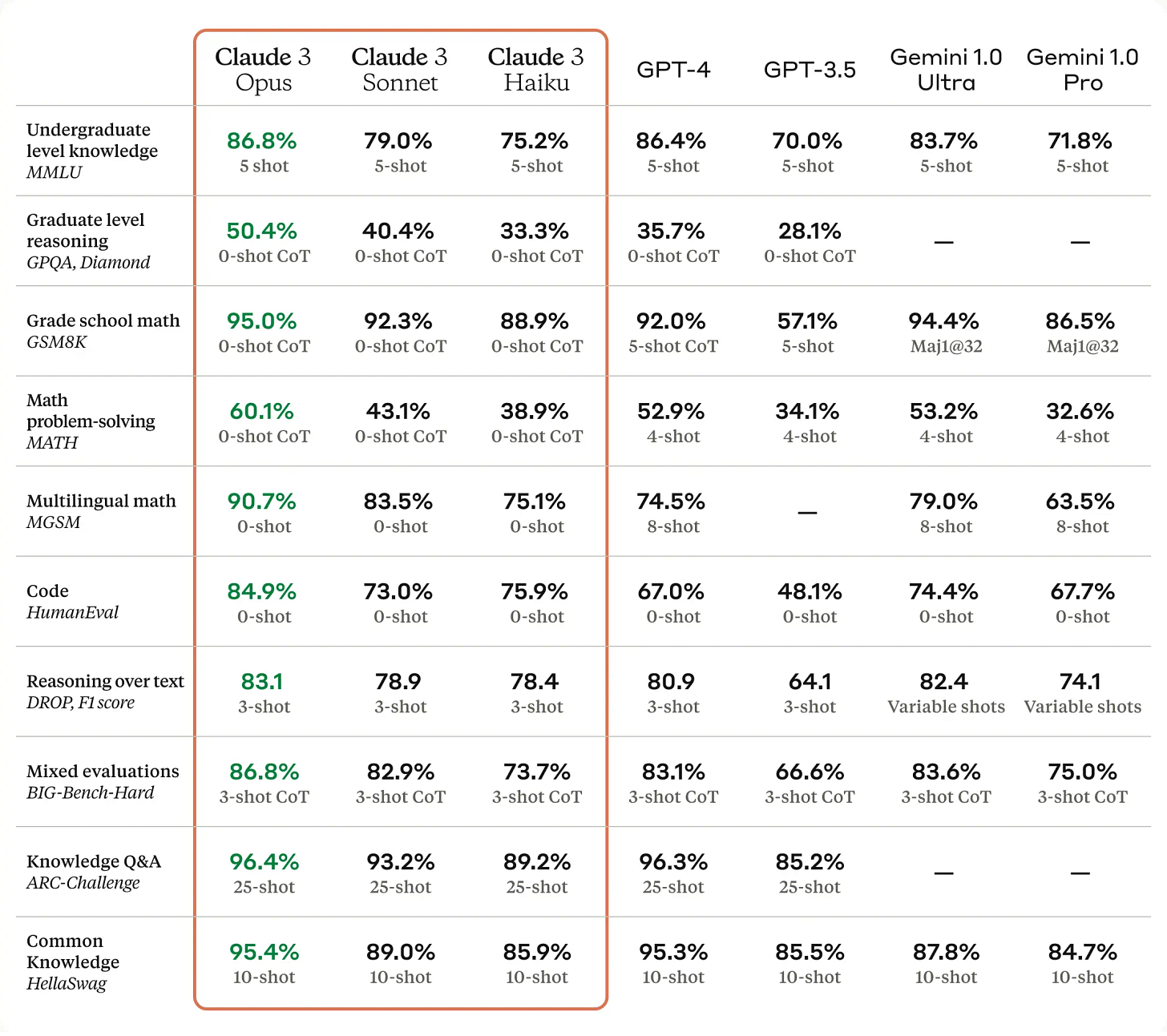

Benchmarks like the above tell you something about the performance of models, but not everything. I’ll be curious to see how real-world use in the coming weeks and months creates a gestalt consensus about the quality of this model and how it compares to others.

The best benchmark is still the reaction of the hive mind online.

Interestingly, GPT-4 is still the one to beat despite coming out almost exactly one year ago (which is about 15 years in AI development time these days — it’s like we’re on the water planet near the supermassive black hole in Interstellar…).

Also note that Anthropic is comparing C3 to the original GPT-4 test scores, *not* the latest ones that take into account improvements made since.

I would have liked to see Gemini 1.5 included.

But Gemini is a great example of how benchmarks don’t tell you everything you need to know. Its benchmark numbers are impressive, but the model became a laughingstock for other reasons…

Claude 3 is the first Anthropic model to be multi-modal — it’s increasingly becoming table stakes for foundational models.

The Claude 3 family of models will initially offer a 200K context window upon launch. However, all three models are capable of accepting inputs exceeding 1 million tokens

‘Context window’ is the new ‘parameters’…

Remember when everyone was obsessed with how many parameters models had?

It reminds me a bit of the megahertz race with CPUs back in the day.

Anthropic claims that Claude 3 will refuse to answer questions more rarely because it has better contextual understanding and won’t mistake harmless questions for things prohibited by its guardrails. We’ll see 🧐

I’m looking forward to playing with it to find out if I like the “flavor” of this model.

I can’t wait for Perplexity to get access to it. Right now, I’ve got mine set to use GPT-4 as default, but I think I’ll set it to Claude 3 for a while to kick the tires on it.

⚛️🔌☁️ Amazon buys nuclear-powered data-center for AWS

The Susquehanna Steam Electric Station in Pennsylvania is one of the largest nuclear power plants in the US (2.5GW), generating electricity since 1983.

A new data-center built next to it will use a lot of that clean power:

First announced by DCD in July 2021, the 1,200-acre campus draws power from Talen Energy’s neighboring 2.5GW nuclear power station […]

Talen said AWS aims to develop a 960MW data center campus. The cloud company has minimum contractual power commitments that ramp up in 120MW increments over several years; AWS has a one-time option to cap commitments at 480MW. The cloud provider also has two 10-year extension options, tied to nuclear license renewals

According to the investor presentation, Talen sold the site and assets for $650 million.

Microsoft also has already made some nuclear power deals and investments… We just need Google and Meta to join the part!

It may take a while, but eventually, smart people run the numbers, look at the facts, and realize that nuclear is one of the only workable paths forward.

🎨 🎭 Liberty Studio 👩🎨 🎥

🎥🪱 Dune: Part 2 🔥🏅

🚨 The ‘making of’ video above has BIG spoilers for the film, and my review below has *some* spoilers 🚨

🌵

🙈

🌵

Denis did it. Bigger, better, and more badass!

My subjective experience of watching this on a big IMAX screen was *extremely* positive and fun. It was a ride, an experience. The film leaned into what movies do best, which is to *immerse* you in interesting worlds, make you *feel* like you’re there as extraordinary things take place, to forever burn scenes in your memory.

TV shows are better suited for character development and dialogue and books can go deeper into inner worlds and complex plots.

This was a visual and auditory feast like I’ve rarely seen before. I feel like I’ve been to Arrakis!

The number of unique visuals was impressive. The costumes and sets were striking and the characters were vivid and magnetic.

I didn’t expect Javier Bardem to be the comedic relief, but it worked. Unlike the jokes in a Marvel film, his moments didn’t wink at the fourth wall and weren’t poisoned by too much irony.

Austin Butler was *excellent* and stole every scene he was in.

The difficulty level of what this film does is much higher than in Part 1, and that film did much harder things than 99% of films out there.

Everything is larger scale, more detailed. They had to walk a fine line — it would’ve been very easy for the rise-of-the-Messiah part to not work, but they pulled it off as well as could be expected.

They also had a lot of complex plot to go through, and it could easily have turned into a series of disconnected vignettes. Instead, they took their time in human-scale moments between characters so that we don’t feel too much at a distance from everything that takes place.

They still had to rush through some things. Some characters didn’t get fully fleshed out (f.ex. Baron Harkonen) but that’s a limitation of doing a 900-page book adaptation.

When you have a universe this rich and a cast this stacked, you unfortunately can’t spend 30 minutes at every location and with every character. It would make for a great 12-episode mini-series with a billion-dollar budget, but that wasn’t in the cards here.

It’s already pretty cool that we’ll likely get Dune Messiah too, bringing the total run time of the trilogy to around 8 hours. If Messiah has the same budget as Part 2, the Trilogy’s budget will be close to $550m.

The films that we enjoy most are not always the “best” films and vice versa. There are many films where I recognize the artistry and see why others may like them, but they don’t do it for me.

Dune 2 was the whole package: great *and* very enjoyable.

Not that they’re competing with each other, but I liked it better than Nolan’s ‘Oppenheimer’, which I also saw in IMAX when it came out.

I’m already looking forward to seeing it again. I’ll try to rewatch it on the big screen, and I know someday I’ll watch Part 1 & 2 back to back to get the full experience.

I'd been holding off talking to you about Dune 2 until I had managed to get my thoughts in writing! I am so jealous of you seeing it in IMAX, I imagine that made a huge difference. The Javier Bardem stuff was funny, the "he's so humble - he must be the Maud'Dib" line got a big laugh in my screening. Looking forward to discussing this in much more detail...